- HBAR’s price rose 43%, with a market cap reaching $4.49 billion.

- Speculation grows about Brian Brooks becoming the next SEC chairman.

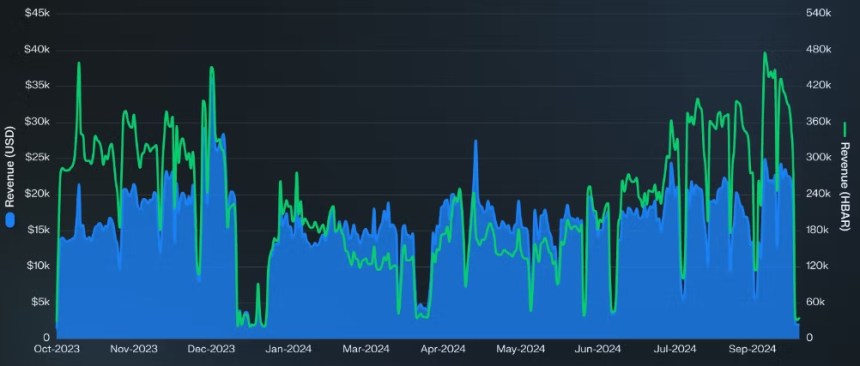

Hedera ($HBAR) has seen a remarkable price surge, climbing by 43% in one day. Its current price stands at $0.1191, with a 37.84% increase in market capitalization, now at $4.49 billion. The trading volume surged by 29.33% to $1.21 billion, showing strong investor activity. The market cap ratio of 26.05% highlights the high trading momentum.

This growth comes alongside key developments that have caught the market’s attention. Notably, speculation is rising about HBAR board member Brian Brooks potentially becoming the next chairman of the U.S. Securities and Exchange Commission (SEC).

BREAKING: $HBAR Board Member @BrianBrooksUS potentially the next chairman of the SEC

Brooks was nominated twice by President Donald Trump for a five-year term as Comptroller of the Currency, once during the 116th Congress, and once in the 117th Congress.

The former CEO of… pic.twitter.com/jiRyQoYsCW

— Shawn (@oroogle) November 18, 2024

Brooks, a former CEO of Binance US and previously nominated by President Donald Trump for Comptroller of the Currency, is considered a top candidate for this influential role. If appointed, Brooks’ familiarity with blockchain and cryptocurrencies could create a more crypto-friendly regulatory environment, boosting investor confidence in assets like HBAR.

In parallel, Canary Capital filed with the SEC to list a Hedera-focused exchange-traded fund (ETF), proposing broader accessibility to U.S. investors. This ETF filing, combined with the possibility of a crypto-savvy SEC chair, further strengthens the bullish sentiment around Hedera.

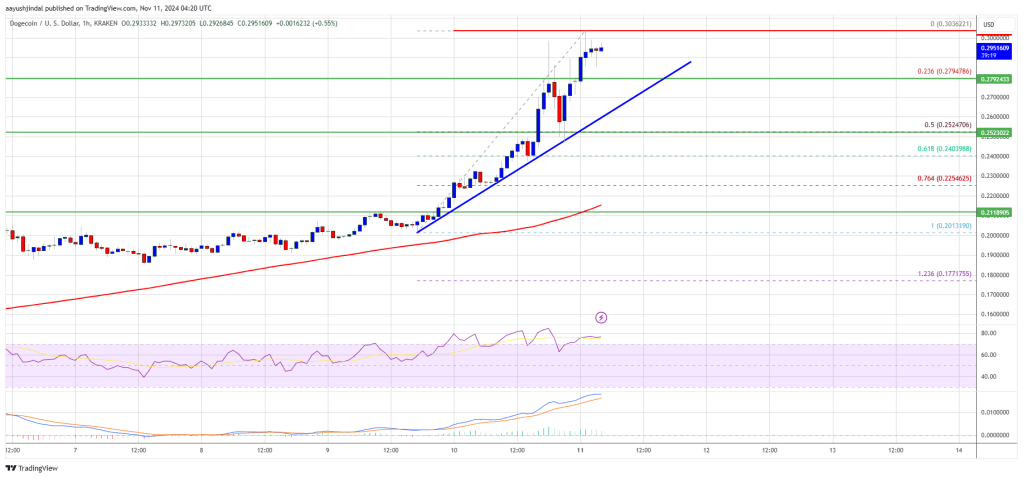

Technical Levels for $HBAR

HBAR’s technical indicators reveal strong bullish momentum. The price is breaking out of a symmetrical triangle on the weekly chart, supported by increasing trading volume. Consecutive large green candles indicate strong buying pressure. This suggests a continuation of the upward trend in the short term.

Key resistance levels for HBAR are at $0.1331 and $0.1372. If these levels are breached, the next target is $0.1562, with no significant resistance beyond that. To maintain its upward trajectory, these resistance levels must transform into support.

The Relative Strength Index (RSI) for HBAR stands at 89.20, indicating overbought conditions as it crosses the typical overbought threshold of 70. This suggests strong buying momentum, but a potential cooldown or correction could follow if the RSI remains elevated for too long.

The RSI average, calculated over a 14-day period, is currently 65.98. This value shows a steady upward trend in momentum, reflecting a gradual increase in buying interest over time.

The Moving Averages (MA) provide further bullish signals. The 9-day MA is at $0.07461, and the 21-day MA is at $0.05911, with the shorter-term MA positioned significantly above the longer-term one. This bullish crossover is a strong indicator of an upward trend, signalling the potential for continued price growth.

Highlighted Crypto News Today

Will XRP Reach $1.50 as Price Rallies 7% Continuing Bull Run?