- The Bitcoin market showed a little improvement recently on BlackRock’s ETF entry.

- The current discount, or negative “premium,” used to describe GBTC share prices is -36.6%.

The “OG” institutional Bitcoin investment vehicle seems to have gained value as a result of BlackRock’s Bitcoin aspirations. According to data compiled by tracking platform CoinGlass, the Grayscale Bitcoin Trust (GBTC) came dangerously close to new all-time highs on June 17.

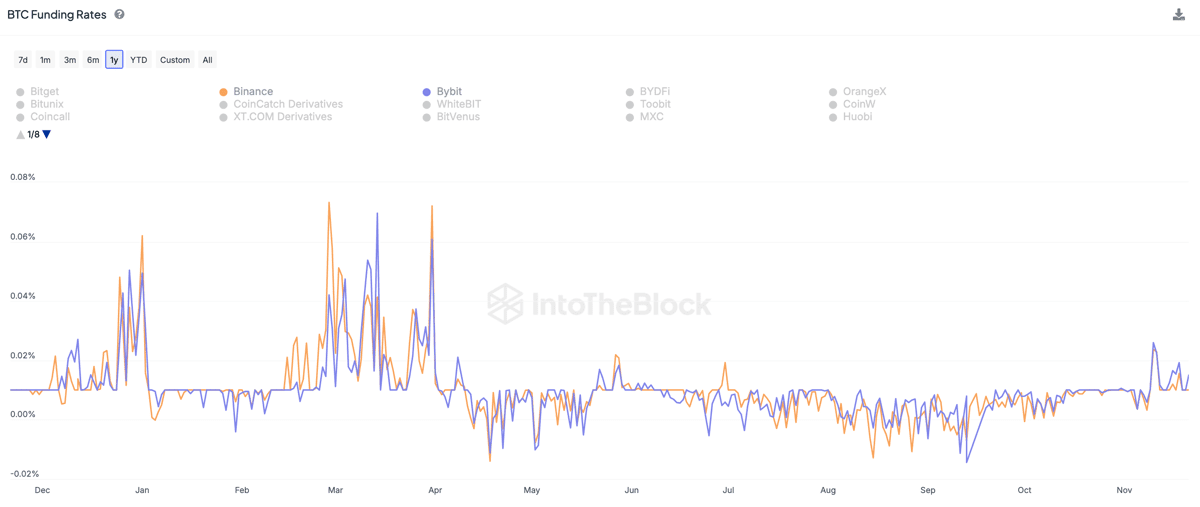

Late last week, when word spread that the biggest asset manager in the world, BlackRock, had filed to start a Bitcoin spot price exchange-traded fund (ETF), the mood in the Bitcoin market showed a little improvement.

Can BlackRock Bring a Change?

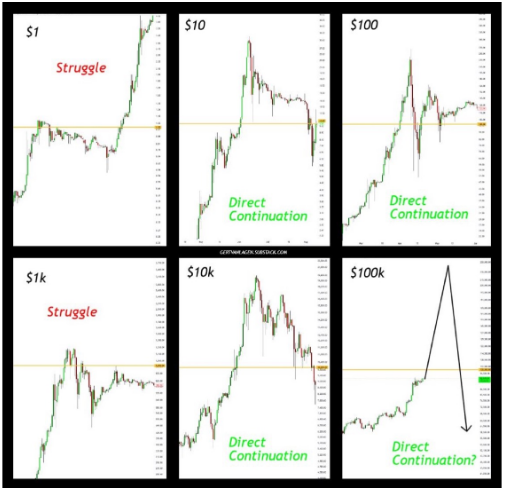

Spot ETFs are not yet authorized in the United States, but some believe that a strong player like BlackRock’s may change that. There are, however, indications of hope beyond emotion, with GBTC long selling at a significant discount to the BTC spot, which is rising.

The current discount, or negative “premium,” used to describe GBTC share prices is -36.6%, as reported by CoinGlass. GBTC is trading closer to zero than at nearly any point this year, despite the fact that it is still deeply undervalued. On June 13th, for instance, the price drop was closer to -44%.

Market analysts are already debating whether or not BlackRock’s new initiative counts as an exchange-traded fund (ETF). While some contend that it will only be another GBTC-like Trust, others take a more nuanced stance. Despite this caveat, there has been a rise in GBTC’s popularity among investors.

Meanwhile, ARK Invest is one large holding that hasn’t increased its position yet, since it still has around 5.37 million GBTC shares. Cathie’s ARK, a website devoted to monitoring the investments of ARK Invest CEO Cathie Wood, shows a steady decline in those holdings until 2023.