- The ex-CEO of Celsius had his lawyers contend that there is insufficient evidence.

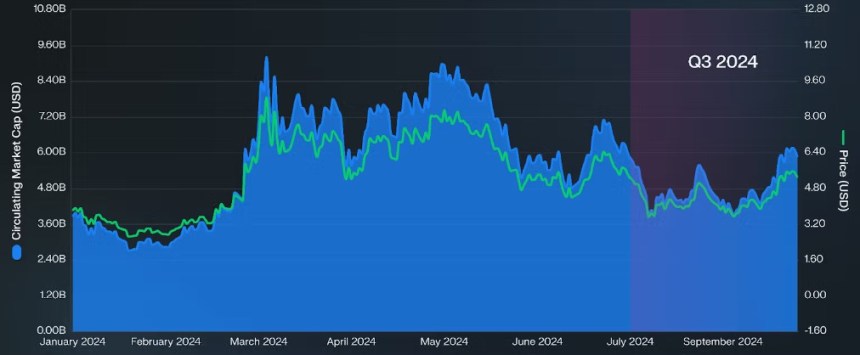

- In July, the FTC fined defunct cryptocurrency lender Celsius Network $4.7 billion.

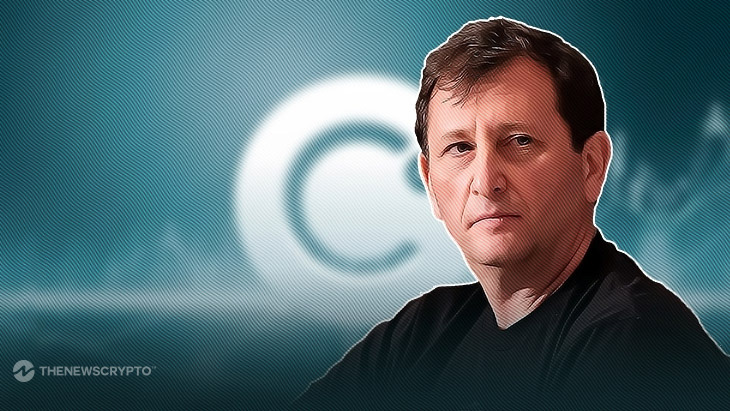

The founder and ex-CEO of defunct cryptocurrency lender Celsius, Alex Mashinsky, has filed a fresh application in court asking for the U.S Federal Trade Commission (FTC) action against him to be dismissed “in its entirety.”

The ex-CEO of Celsius had his lawyers contend that there is insufficient evidence to prove that he had intentionally lied to “fraudulently obtain customer information from a financial institution.”

Moreover, a claim under the Gramm-Leach-Bliley Act cannot be made based on these allegations, the attorneys say. Also, to illegally obtain financial institution client information by making false claims is a crime under this statute, which dates back to 1999 law.

The attorneys also argued that the case lacks merit since it is impossible to show that Mashinsky “is violating” or “is about to violate” the law given that he resigned as CEO of Celsius on September 27 last year.

Struggle Continues

Furthermore, in July, the FTC fined defunct cryptocurrency lender Celsius Network $4.7 billion and launched a lawsuit against the founder along with co-founders Shlomi Daniel Leon, and Hanoch “Nuke” Goldstein.

Lawyers for Goldstein argued that the FTC is only using Goldstein’s retweet of a blog post by Celsius as evidence in the lawsuit against him. Also, Goldstein claims that this action is being taken much too seriously as evidence of involvement in the alleged misbehavior.

The founder stepped down as CEO in September of last year, and by the end of 2022, he had been charged on many counts of criminal fraud by the U.S DOJ. Mashinsky was released on a $40 million bond after pleading not guilty to various counts.

Highlighted Crypto News Today:

Franklin Templeton Applies for a Spot Bitcoin ETF With the U.S. SEC