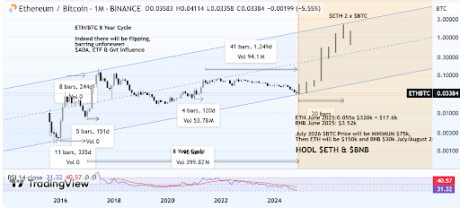

Ethereum’s price seems to have been following Bitcoin’s, but recent large transactions suggest it may soon move independently.

Whale Alert reported a sum of 25,264 ETH, roughly valued at around $48 million, was moved from an unidentified wallet to the leading cryptocurrency exchange, Coinbase.

While these large transfers can, on occasion, herald an upcoming uptrend, they can also imply a short-term surge in volatility. Particularly, such movements can be used to discern possible price sentiment changes.

In addition to the 25,264 ETH transferred, another substantial transaction of 30,000 ETH was also noted. This amount was relocated from an anonymous wallet to OKEX, another prominent crypto exchange.

Notably, as with any financial market, the crypto industry is impacted by many factors, with ‘whale’ movements being just one of them. While they can potentially influence price sentiment, other elements, such as broader market trends, global economic indicators, and investor sentiment, should also be considered for a holistic market understanding.

Thiese Ethereum transactions come at a time when ETH has been trading between an intra-day high of $1,957.35 and an intra-day low of $1,872.94. At the time of writing, Ethereum has only seen a slight decline of 1.4% in the past day, with a market price of $1,884.

This modest plunge indicates whales might not have moved or sold just a small amount of the ETH deposited. Notably, a ‘whale’ in cryptocurrency refers to an individual or entity holding a large amount of a cryptocurrency.

This individual or entity has the potential to influence the market due to the sizeable volume of its holdings. When such transfers occur, they can create waves in the market and often signal potential price shifts.

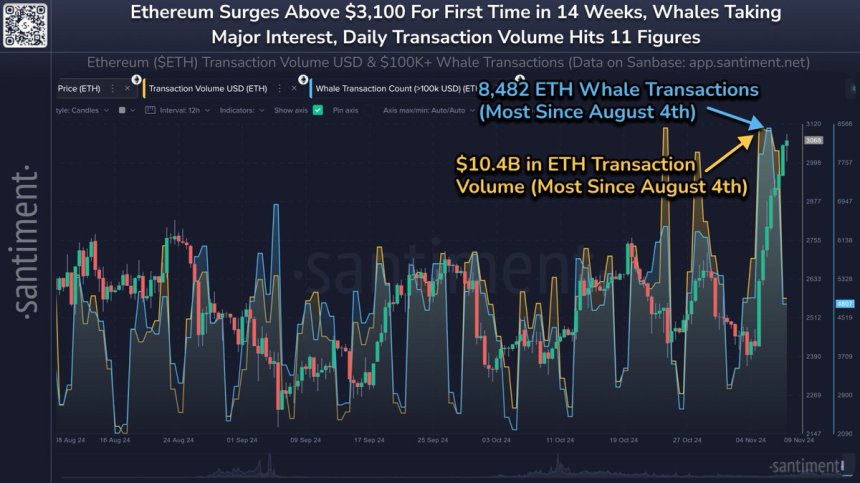

Over the past week, Ethereum has seen more than a $3 billion surge in its market capitalization. The second largest asset by market cap has surged from the $223 billion seen last Thursday to $226 billion. ETH’s daily trading volume has also surged significantly in the same period.

Ethereum’s daily trading volume has soared from $6 billion last week to above $12 billion over the past 24 hours.

Featured image from Shutterstock, Chart from TradingView

Whale Alert reported a sum of 25,264 ETH, roughly valued at around $48 million, was moved from an unidentified wallet to the leading cryptocurrency exchange, Coinbase.

25,264 #ETH (48,302,924 USD) transferred from unknown wallet to #Coinbasehttps://t.co/ViF7z23ixe

25,264 #ETH (48,302,924 USD) transferred from unknown wallet to #Coinbasehttps://t.co/ViF7z23ixe

— Whale Alert (@whale_alert) July 6, 2023

Analyzing The Potential Impact

While these large transfers can, on occasion, herald an upcoming uptrend, they can also imply a short-term surge in volatility. Particularly, such movements can be used to discern possible price sentiment changes.

In addition to the 25,264 ETH transferred, another substantial transaction of 30,000 ETH was also noted. This amount was relocated from an anonymous wallet to OKEX, another prominent crypto exchange.

30,000 #ETH (57,687,950 USD) transferred from unknown wallet to #OKExhttps://t.co/ENxRwsJMLh

30,000 #ETH (57,687,950 USD) transferred from unknown wallet to #OKExhttps://t.co/ENxRwsJMLh

— Whale Alert (@whale_alert) July 6, 2023

Notably, as with any financial market, the crypto industry is impacted by many factors, with ‘whale’ movements being just one of them. While they can potentially influence price sentiment, other elements, such as broader market trends, global economic indicators, and investor sentiment, should also be considered for a holistic market understanding.

Ethereum Latest Price Action

Thiese Ethereum transactions come at a time when ETH has been trading between an intra-day high of $1,957.35 and an intra-day low of $1,872.94. At the time of writing, Ethereum has only seen a slight decline of 1.4% in the past day, with a market price of $1,884.

This modest plunge indicates whales might not have moved or sold just a small amount of the ETH deposited. Notably, a ‘whale’ in cryptocurrency refers to an individual or entity holding a large amount of a cryptocurrency.

This individual or entity has the potential to influence the market due to the sizeable volume of its holdings. When such transfers occur, they can create waves in the market and often signal potential price shifts.

Over the past week, Ethereum has seen more than a $3 billion surge in its market capitalization. The second largest asset by market cap has surged from the $223 billion seen last Thursday to $226 billion. ETH’s daily trading volume has also surged significantly in the same period.

Ethereum’s daily trading volume has soared from $6 billion last week to above $12 billion over the past 24 hours.

Featured image from Shutterstock, Chart from TradingView