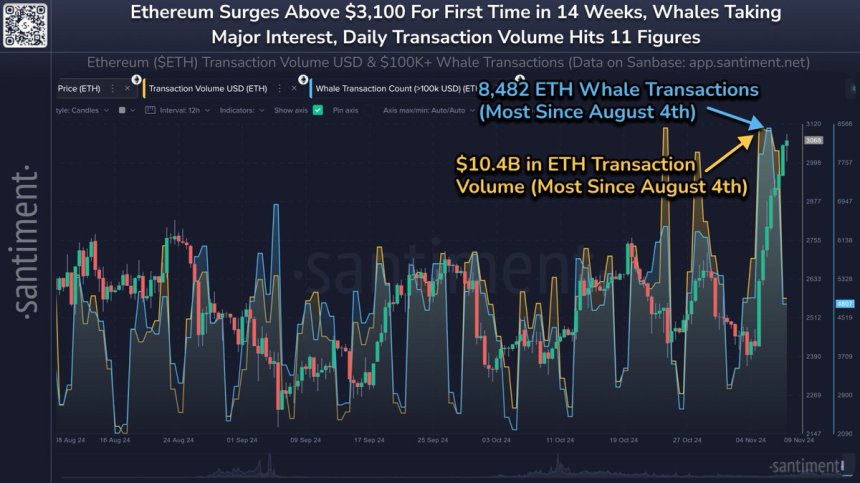

Ethereum whales have been ramping up their activities on the blockchain as it eyes an important level. This time around, their recent spike in activity has been in the form of transactions. These whale transactions which are carrying at least $100,000, making it so only large holders could be behind the transactions, have been on the rise.

Mostly, the Ethereum whales ramped up their activities following ETH’s price increase over the last week. The first spike was noticed after the crypto broke above $1,900 and as it has continued to maintain this level, there has been more consistency among the whales.

IntoTheBlock data shows that ETH whales have doubled their transaction counts over a few days. This increase saw their total transactions go from 2,120 to 3,230 in two days. This jump in number of transactions translates to an over 54% increase in just 48 hours – from July 2 to July 4. In a 7-day period, almost $20 billion has been moved by ETH whales.

However, while this jump is significant in its own right, it is not unusual for Ethereum to see such a high number of large transactions. For example, toward the end of June, the total whale transactions had also spiked above the $3,000 level.

Ethereum’s holder base is made up of a high number of whales when compared to its largest competitor Bitcoin. While the latter’s whale holders only make up 11% of the total holder base, Ethereum whale wallets account for 42% of its total wallets, according to data from IntoTheBlock. Hence, a high volume of large transactions happening in a short period is not out of place.

A high number of whale transactions can have significant impacts on the price of coins like Ethereum depending on what the holders of these coins intend to do with them. If these transactions carrying at least $100,000 worth of coins are for selling, then the price of ETH would see a downtrend.

However, since the price of ETH has remained relatively stable and maintained its hold on the $1,900 support, then it is likely that these whales are just moving their coins around without selling. Additionally, these on-chain transactions do not point toward a good volume of ETH flowing toward centralized exchanges, further giving credence to the fact that these whales are not moving their coins for selling purposes.

Ethereum, on its own, has not had the best of days though as its trading volume is down significantly from Monday. It is currently sitting at $6 billion, a 27% decline from Monday’s figures. Nevertheless, its price is holding steady with meager gains of 0.1% as the coin trades at a price of $1,963.

Mostly, the Ethereum whales ramped up their activities following ETH’s price increase over the last week. The first spike was noticed after the crypto broke above $1,900 and as it has continued to maintain this level, there has been more consistency among the whales.

IntoTheBlock data shows that ETH whales have doubled their transaction counts over a few days. This increase saw their total transactions go from 2,120 to 3,230 in two days. This jump in number of transactions translates to an over 54% increase in just 48 hours – from July 2 to July 4. In a 7-day period, almost $20 billion has been moved by ETH whales.

However, while this jump is significant in its own right, it is not unusual for Ethereum to see such a high number of large transactions. For example, toward the end of June, the total whale transactions had also spiked above the $3,000 level.

Ethereum’s holder base is made up of a high number of whales when compared to its largest competitor Bitcoin. While the latter’s whale holders only make up 11% of the total holder base, Ethereum whale wallets account for 42% of its total wallets, according to data from IntoTheBlock. Hence, a high volume of large transactions happening in a short period is not out of place.

How The Ethereum Whales Can Affect Price

A high number of whale transactions can have significant impacts on the price of coins like Ethereum depending on what the holders of these coins intend to do with them. If these transactions carrying at least $100,000 worth of coins are for selling, then the price of ETH would see a downtrend.

However, since the price of ETH has remained relatively stable and maintained its hold on the $1,900 support, then it is likely that these whales are just moving their coins around without selling. Additionally, these on-chain transactions do not point toward a good volume of ETH flowing toward centralized exchanges, further giving credence to the fact that these whales are not moving their coins for selling purposes.

Ethereum, on its own, has not had the best of days though as its trading volume is down significantly from Monday. It is currently sitting at $6 billion, a 27% decline from Monday’s figures. Nevertheless, its price is holding steady with meager gains of 0.1% as the coin trades at a price of $1,963.