- 7,728 ETH ($20M) added to circulation in past week.

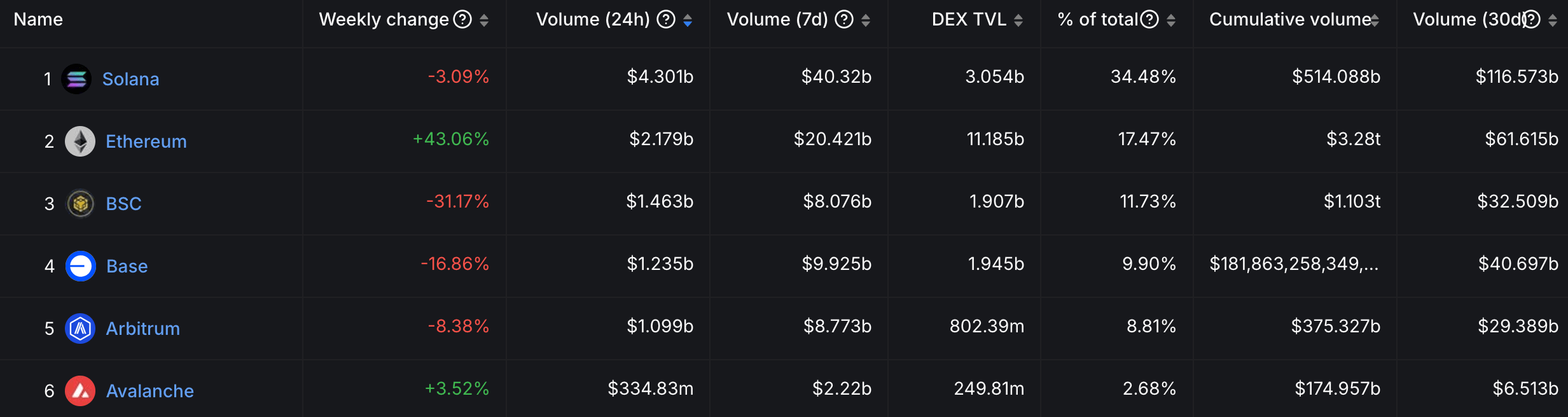

- Network activity drops 3%, with 43% decrease in fees.

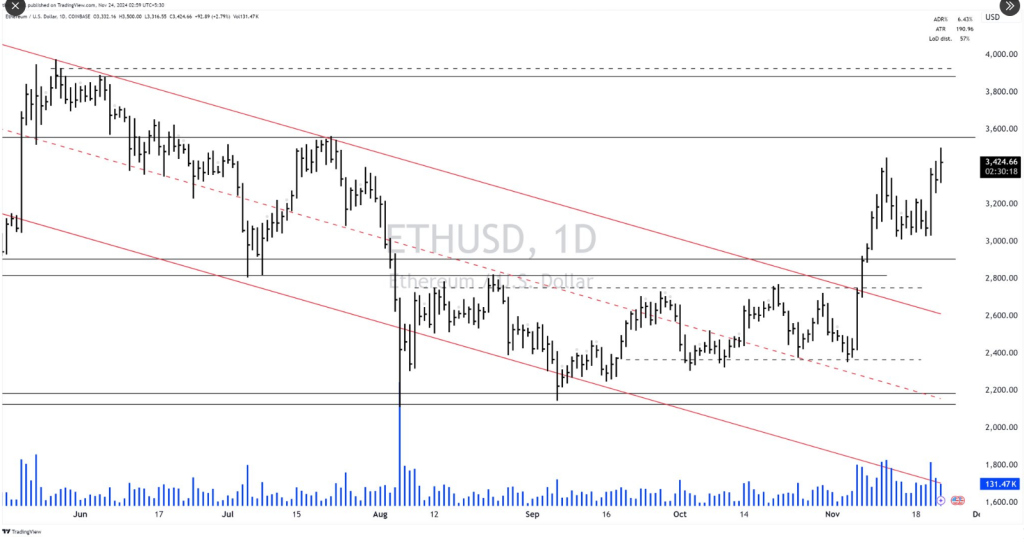

- Price targets: potential drop to $2,264, or rally to $3,336 if demand increases.

Ethereum’s circulating supply has reached a significant milestone, hitting a six-month high of 120.39 million ETH following the addition of 7,728 tokens worth over $20 million.

This substantial increase in available tokens raises questions about potential price implications, particularly if market demand fails to match the growing supply.

The surge in circulating supply coincides with a notable decline in network activity on Ethereum’s Layer 1 blockchain. Data from Artemis reveals a 3% drop in daily unique on-chain interactions over the past week, accompanied by a dramatic 43% reduction in network fees.

This decrease in transaction volume and fee revenue suggests waning network usage, potentially impacting ETH’s market value.

Where’s Ethereum headed next?

Network activity serves as a crucial indicator of Ethereum’s ecosystem health and demand for the native token. The recent decline in daily transactions signals reduced platform engagement, which could exert downward pressure on ETH’s price.

Source: Artemis

This relationship between network usage and price action has become evident in recent days, with ETH experiencing a 3% decline despite broader market influences.

Currently trading at $2,619, Ethereum hovers precariously above critical support at $2,579. The combination of increased supply and decreased network activity creates a challenging environment for bulls attempting to maintain this support level. Should current trends persist, ETH could potentially retrace towards the next major support at $2,264.

However, the situation isn’t without potential upside. A revival in network activity could stimulate renewed demand for ETH, potentially catalyzing a price recovery. Under such circumstances, Ethereum could target the $3,336 level, representing a significant recovery from current valuations.