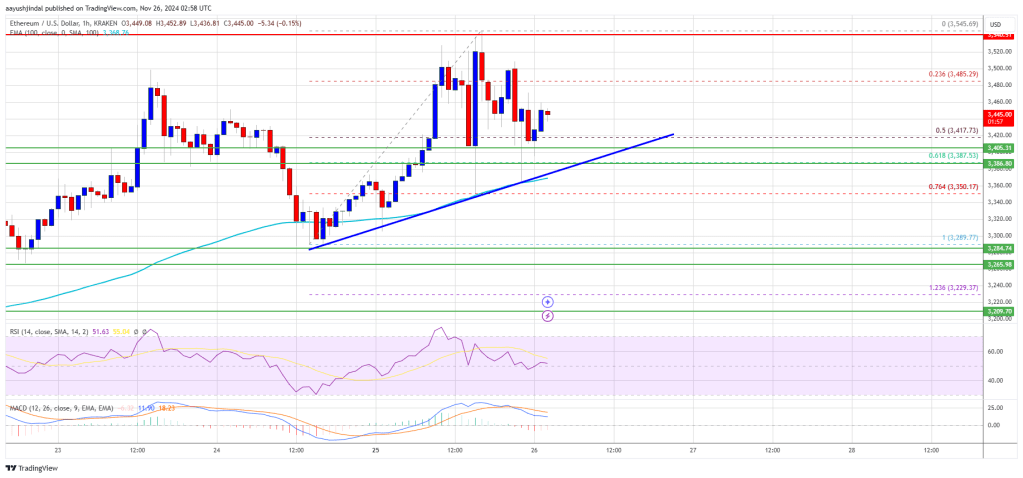

- The relative strength index (RSI) shows that prices are now oversold.

- The price of Ethereum yet again made a failed attempt to break the $1660 mark.

The overall crypto market seems to be stabilizing following a period of intense turbulence. At the time of writing Ethereum is trading at $1,645, up 0.82% in the last 24 hours as per CMC. However, Ethereum’s continuing decline over the previous month becomes more apparent at a wider scale as in the last month it has fallen by about 12.14%.

Source: CoinMarketCap

The relative strength index (RSI), shows that prices are now oversold. The price of Ethereum yet again made a failed attempt to break the $1660 mark. In order to begin a sustained rise, ETH has to break over the key short-term resistance at $1,660.

Further Decline Likely

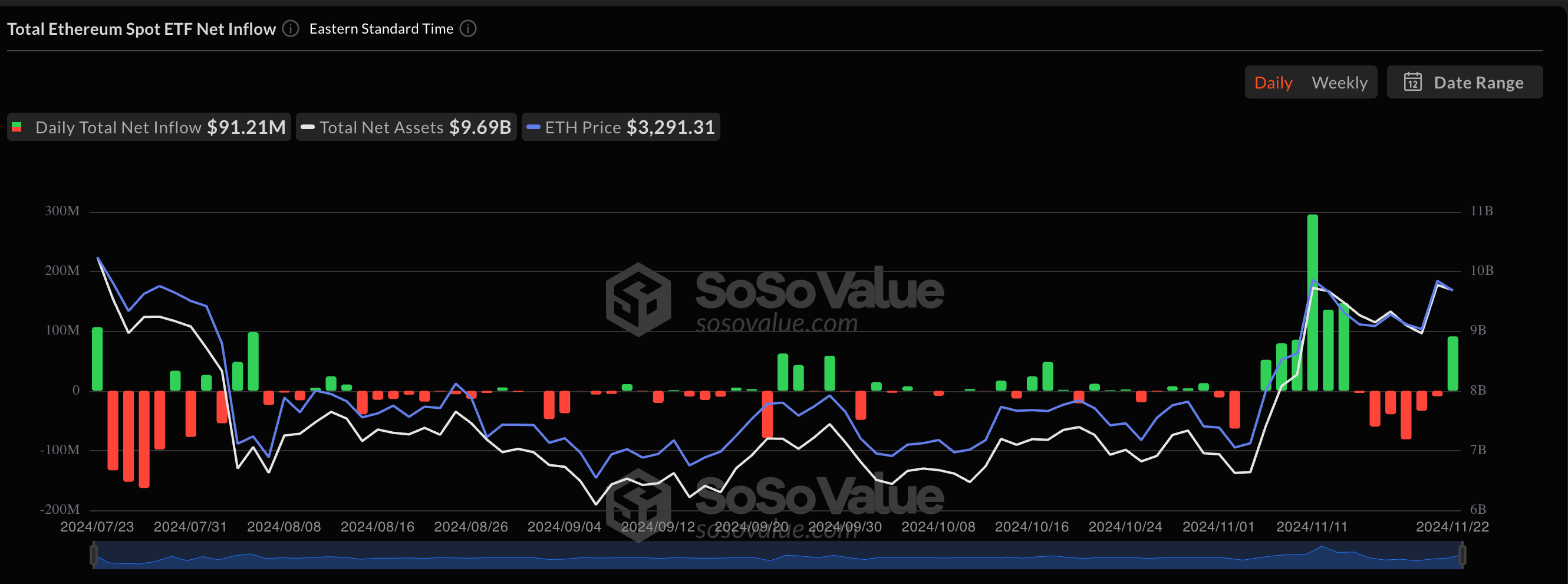

Despite significant progress in network development and the brief recovery, the price of Ethereum looks to be trending lower in the next few weeks, according to an assessment by on-chain analytics platform Santiment. Post the price of Ether soared beyond $2,000 after the Shanghai upgrade earlier this year, the analytics platform’s data implies a pattern of whales and sharks engaged in considerable selling operations.

Thus, according to Santiment’s analysis, Ethereum’s price is expected to decline further, maybe hitting a crucial support level at about $1,500. This data also supports the belief that trading activity in Ethereum will increase dramatically if the price hits the $1,500 level as traders will be eyeing to buy the dip.

Since their peak in early November of the previous year, on-chain transaction volume and trading volume have significantly declined. Investors are not able to decide whether the present price of ETH is overpriced or undervalued, thus the shrinking trading volume.