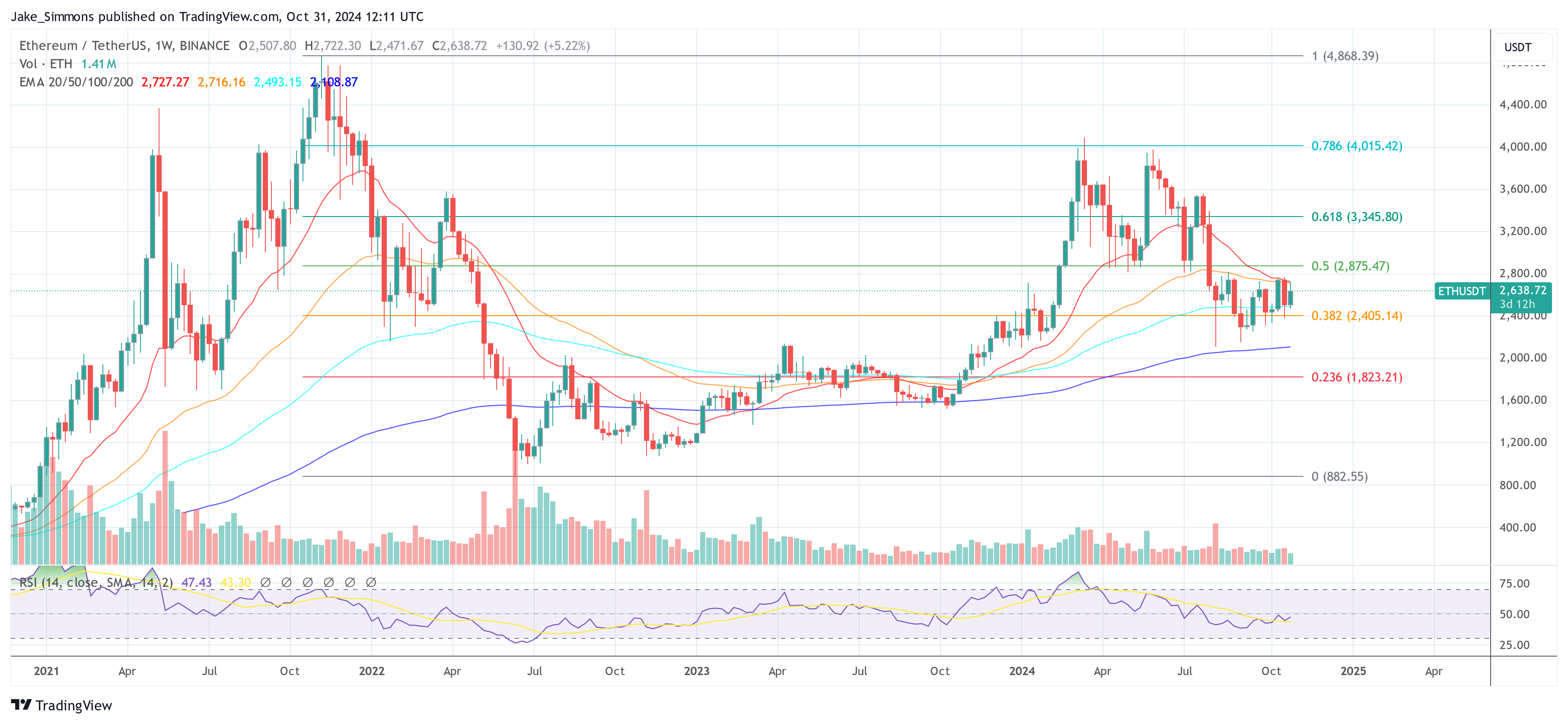

The crypto market has been under intense bearish pressure in recent days, with the Ethereum price falling by 6% in the past week. On Saturday, October 26th, the “king of altcoins” experienced an abrupt price downturn before finding support just above $2,400.

A popular crypto pundit on X has come forward with an interesting prognosis for the price of Ethereum, saying that the cryptocurrency is set for a rebound. The question here is — how far can the altcoin climb before facing major resistance?

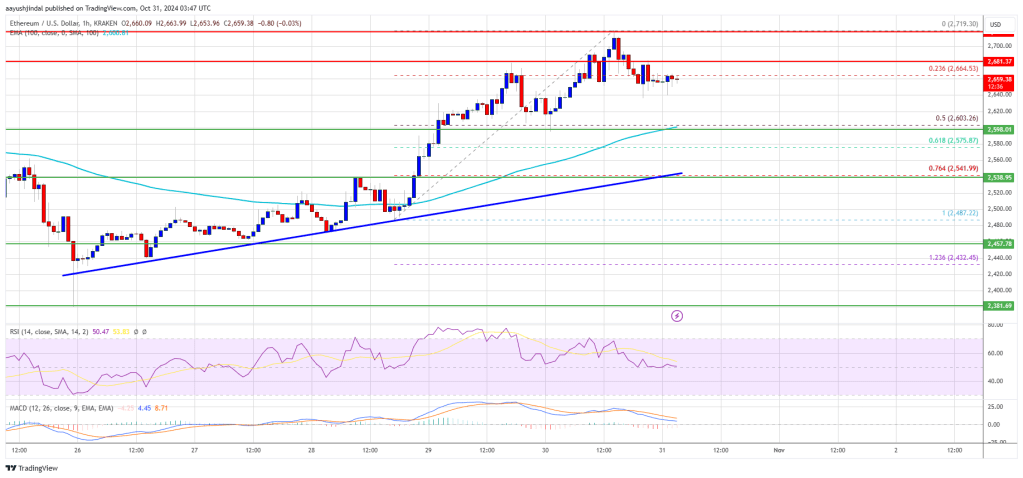

Prominent crypto analyst Ali Martinez took to the X platform to share an exciting projection for the Ethereum price in the short term. According to the pundit, the Tom Demark “TD” Sequential has sounded a buy alarm for the second-largest cryptocurrency on its 12-hour chart.

For context, the Tom Demark Sequential is a technical analysis indicator designed to pinpoint the exact time of trend exhaustion and price reversal. This indicator features two phases known as the TD Setup (or the momentum phase) and the TD Countdown (or the trend exhaustion phase).

The TD Setup phase occurs after a price reversal and comprises a 9-candle count. The TD Countdown phase, on the other hand, is valid only after the Setup phase has been established and is made up of 13 candles (typically of the same polarity).

As shown in the chart above, the Ethereum price seems to have completed the TD Setup phase, with figure “9” plotted on the last candlestick. This suggests that the altcoin’s price might have reached a bottom, with a rebound on the horizon.

According to Martinez, the case for an Ethereum price rebound is stronger should the support level at $2,412 hold. The analyst noted that the altcoin could travel as high as $2,665 before encountering the next major resistance.

After the Ethereum price made a comeback around $2,400, it appears that the $2,412 support did hold strong. As of this writing, the Ether token is valued at $2,478, reflecting a negligible 0.1% dip in the past 24 hours.

According to the latest on-chain data, the ETH coinbase premium continues to lag in the negative territory, falling to -2 in recent weeks. This trend suggests that whales and institutional investors in the United States are selling their Ethereum tokens.

With the Ethereum price looking to make a quick comeback, the selling pressure from the US large investors could stall any price growth in the short term. However, the bearish period could provide an opportunity for long-term investors to “buy the dip.”

A popular crypto pundit on X has come forward with an interesting prognosis for the price of Ethereum, saying that the cryptocurrency is set for a rebound. The question here is — how far can the altcoin climb before facing major resistance?

TD Sequential Flashes Buy Signal For Ethereum Price

Prominent crypto analyst Ali Martinez took to the X platform to share an exciting projection for the Ethereum price in the short term. According to the pundit, the Tom Demark “TD” Sequential has sounded a buy alarm for the second-largest cryptocurrency on its 12-hour chart.

For context, the Tom Demark Sequential is a technical analysis indicator designed to pinpoint the exact time of trend exhaustion and price reversal. This indicator features two phases known as the TD Setup (or the momentum phase) and the TD Countdown (or the trend exhaustion phase).

The TD Setup phase occurs after a price reversal and comprises a 9-candle count. The TD Countdown phase, on the other hand, is valid only after the Setup phase has been established and is made up of 13 candles (typically of the same polarity).

As shown in the chart above, the Ethereum price seems to have completed the TD Setup phase, with figure “9” plotted on the last candlestick. This suggests that the altcoin’s price might have reached a bottom, with a rebound on the horizon.

According to Martinez, the case for an Ethereum price rebound is stronger should the support level at $2,412 hold. The analyst noted that the altcoin could travel as high as $2,665 before encountering the next major resistance.

After the Ethereum price made a comeback around $2,400, it appears that the $2,412 support did hold strong. As of this writing, the Ether token is valued at $2,478, reflecting a negligible 0.1% dip in the past 24 hours.

On-Chain Data: Negative Region

According to the latest on-chain data, the ETH coinbase premium continues to lag in the negative territory, falling to -2 in recent weeks. This trend suggests that whales and institutional investors in the United States are selling their Ethereum tokens.

With the Ethereum price looking to make a quick comeback, the selling pressure from the US large investors could stall any price growth in the short term. However, the bearish period could provide an opportunity for long-term investors to “buy the dip.”