- The top 10 non-exchange wallet addresses now contain a whopping 39.22 million ETH.

- The price at the time of writing, broke $1569 key support level.

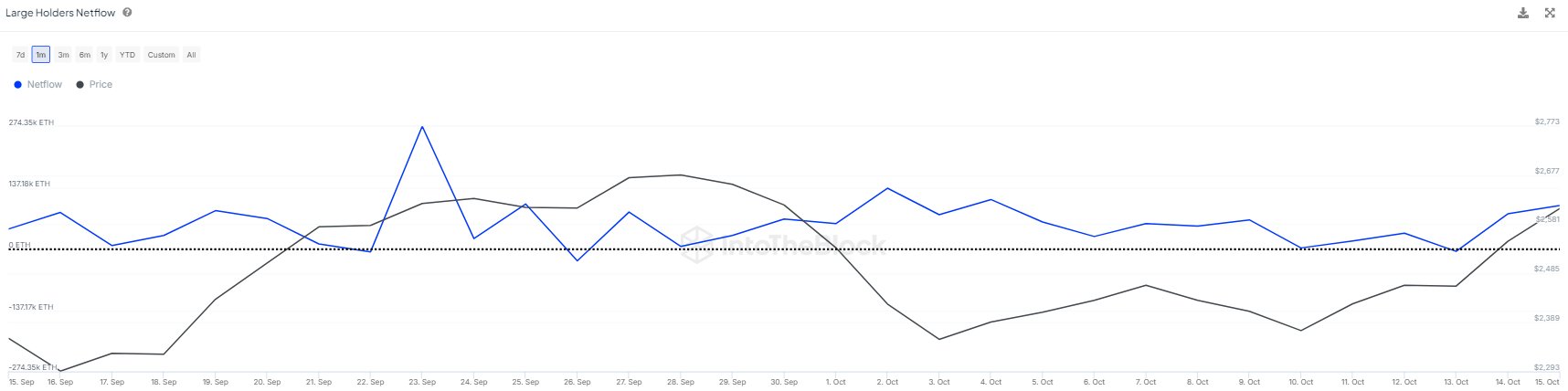

On-chain data suggests that Ethereum whales are showing resilience in the face of heavy selling pressure. According to the available data, the top 10 Ethereum whales have amassed an incredible 40 million ETH in the last few days.

Santiment, an on-chain data source, noted that the wealthiest Ethereum wallet addresses on and off exchanges continue to amass ETH even while the price of Ethereum hovers around $1,550. The top 10 non-exchange wallet addresses now contain a whopping 39.22 million ETH, while only around 8.51 percent of the total supply is held on exchanges.

However, Ethereum is falling behind Bitcoin as a result of the present selling pressure. Since the beginning of the year, Ethereum’s share of the total crypto market worth has declined from about 18.4% to 17.8%. While Ethereum’s market share is falling, Bitcoin’s has risen beyond 50%.

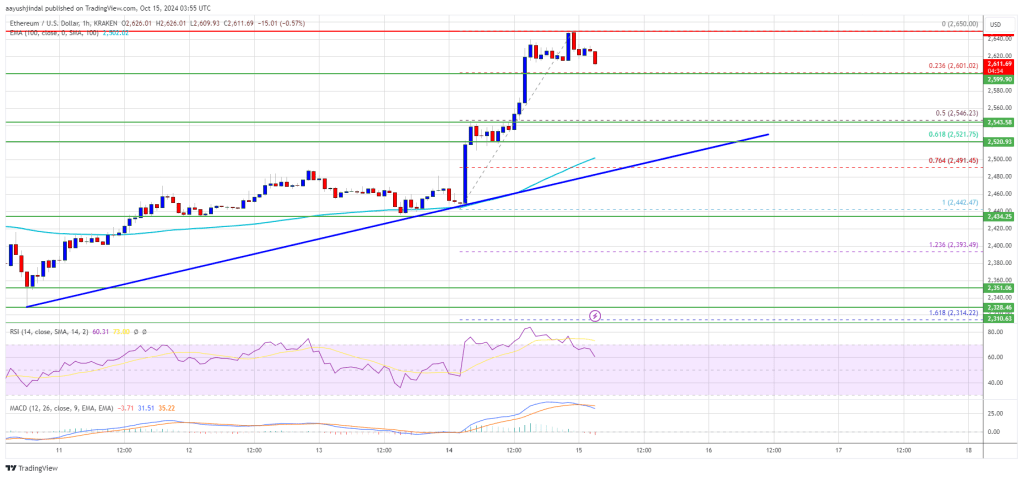

Severe Downtrend

At the time of writing, ETH is trading at $1557, down 2.17% in the last 24 hours as per data from CMC. Moreover, the trading volume is down 22.80%. The price has been facing high selling pressure. After facing strong resistance at $1734 level, the price has been witnessing severe downtrend.

Source: CoinMarketCap

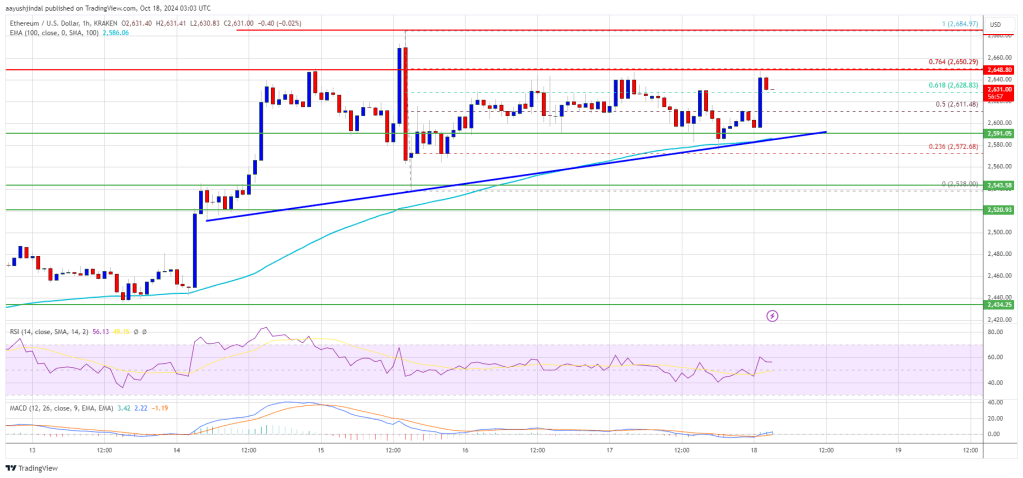

Moreover, the price at the time of writing, broke $1569 key support level. It will now likely test the $1430 level. Further decline will likely see price testing the $1120 area.

On the other hand, if bulls could drive the price above $1654 resistance level, then a fresh rally can be expected. With the U.S inflation data expected to be out today, investors and traders can expect high volatility.