- ETH has displayed a Descending Channel Pattern on the daily time frame

- Traders may consider entering a long position at $1650, targeting $1890

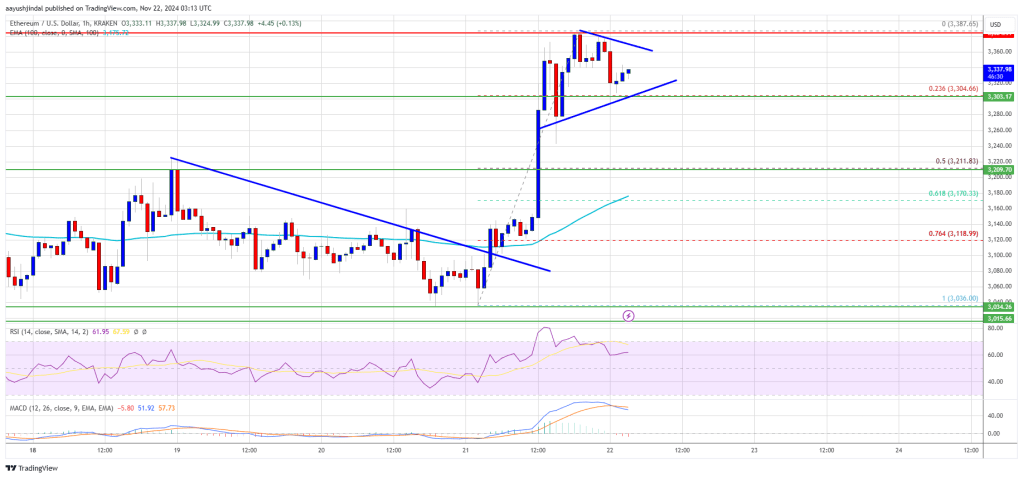

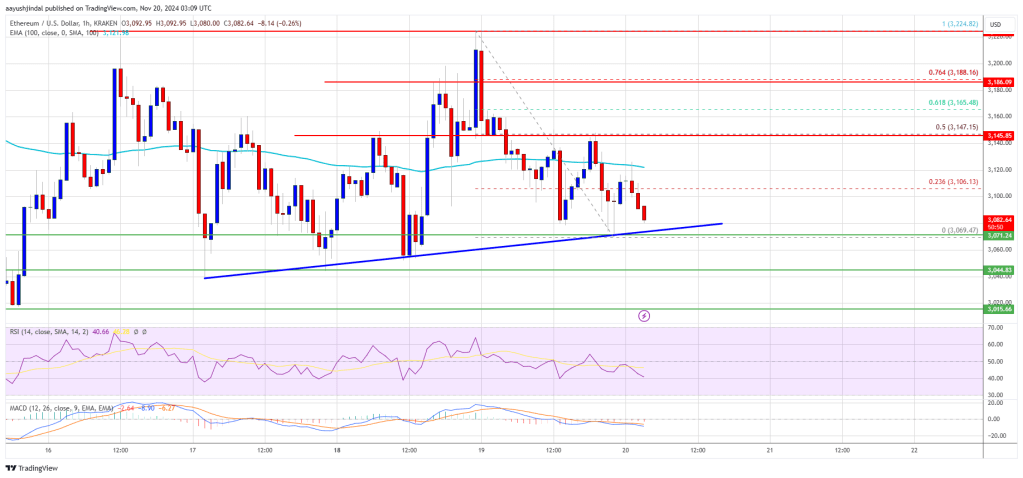

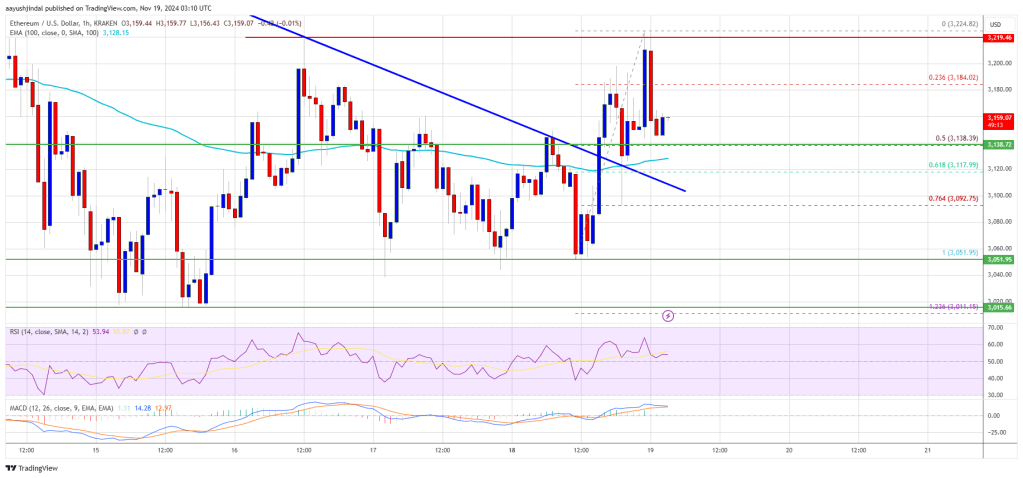

Ethereum (ETH) has recently displayed a Descending Channel Pattern on the daily time frame, indicating a prevailing bearish trend. However, it is important to note that technical patterns are not infallible and can sometimes provide opportunities for trend reversals. In this trade setup, we will explore the potential for a bullish trend reversal in ETH. And discuss the entry point, target, and stop loss levels for a long position.

The Descending Channel Pattern is characterized as a series of lower highs and lower lows, forming parallel trendlines that converge towards each other. More so, this pattern suggests a gradual weakening of bullish momentum and a potential continuation of the bearish trend. However, it is important to remain open to the possibility of a breakout and trend reversal.

Ethereum Price Analysis: Trade Setup

Entry: Following the Smart Money Move concept, we recommend considering a long position in ETH at $1650. This level is identified as an opportune entry point, taking into account the potential breakout from the Descending Channel Pattern. By entering at this level, traders and investors aim to capitalize on a potential shift in market sentiment towards the bullish side.

Target: Our target for this trade setup is set at $1890. This target represents a significant upside potential from the breakout level, reflecting the expected price movement following a successful trend reversal. In addition, traders can look to book profits around this level or adjust their targets based on subsequent market developments.

Stop Loss: To effectively manage risk, it is advisable to set a stop loss at $1620. This stop-loss level is strategically placed below the entry point, providing a buffer against potential downside risks. Even more, by implementing a stop loss, traders can limit potential losses in the event that the anticipated trend reversal does not materialize.

Ethereum Price Analysis: ETH’s Descending Channel Pattern

While Ethereum (ETH) has display a Descending Channel Pattern on the daily time frame, shows a bearish trend. Moreso, it is important to remain open to the potential for a trend reversal.

By entering a long position at $1650, with a target set at $1890. And traders can position themselves to take advantage of a breakout and potential bullish momentum. However, risk management is crucial, and setting a stop loss at $1620 helps protect against adverse price movements. More so, as with any trading decision, it is recommended to conduct thorough analysis and consider personal risk tolerance before executing trades.

Disclaimer: Any information contained in this article is not proposed to be and doesn’t constitute financial advice, investment advice, trading advice, or any other advice. The NewsCrypto is not responsible to anyone for any decision made or action taken in conjunction with the information and/or statements in this article.