Data shows the Ethereum Estimated Leverage Ratio has shot up to extreme levels recently. Here’s what this could imply for the asset’s price.

As pointed out by an analyst in a CryptoQuant Quicktake post, the ETH Estimated Leverage Ratio has continued its uptrend recently. The “Estimated Leverage Ratio” here refers to an indicator that keeps track of the ratio between the Ethereum Open Interest and Derivatives Exchange Reserve.

The Open Interest is a measure of the total amount of derivatives positions related to ETH that are currently open on all exchanges, while the Derivatives Exchange Reserve keeps track of the amount of ETH sitting in the wallets of all derivatives platforms.

When the value of the Estimated Leverage Ratio rises, it means positions on exchanges are growing at a faster rate than the collateral inflows. Such a trend suggests the investors are opting for a higher amount of leverage on average.

On the other hand, the indicator going down implies the appetite for risk is decreasing among the derivatives market users, as they are taking on a lower amount of leverage.

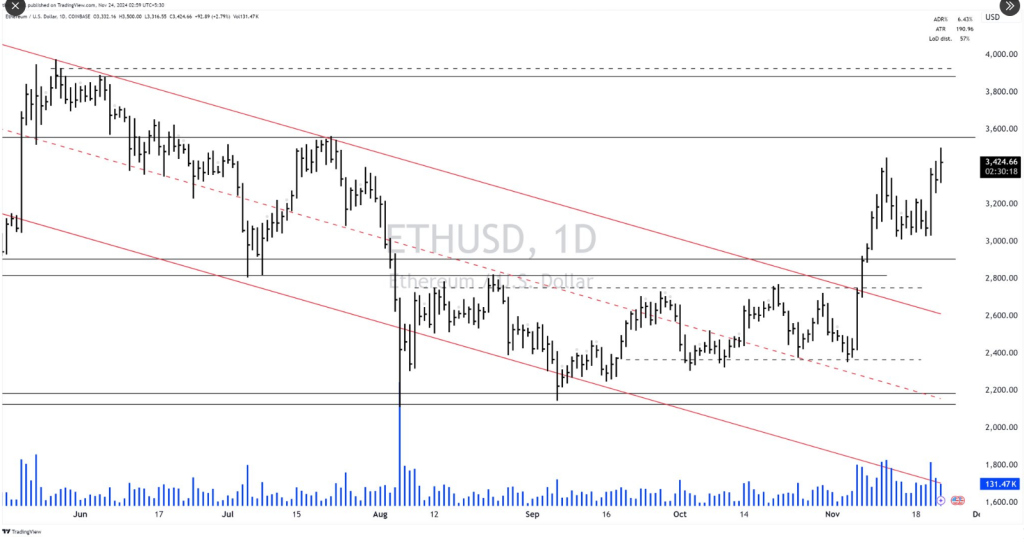

Now, here is a chart that shows the trend in the Ethereum Estimated Leverage Ratio over the past year or so:

As displayed in the above graph, the Ethereum Estimated Leverage Ratio had reached high levels earlier in the year, but its value had seen a plunge as the asset’s price had gone through its crash in late July/early August.

Over the last couple of months, however, the indicator has seen a resurgence, with its value now completely recovering back to the same highs as before. This suggests that the investors have been opening leveraged positions on the market.

Historically, an overleveraged market has generally resulted in volatility for the ETH price. This is because of the fact that a mass liquidation event, popularly called a squeeze, is probable to occur whenever the derivatives users are taking on high risk.

Earlier in the year, the increase in the Ethereum Estimated Leverage Ratio had come alongside a surge in the price, which implies the leveraged positions cropping up had been long ones.

Usually, a squeeze is more likely to affect the side of the market that’s more dominant, which may be why the overleveraged market from back then had culminated into a long squeeze.

The recent increase in the metric has come while Ethereum has been displaying an overall bearish trajectory, so the new leveraged positions may be short ones. If this is indeed the case, then the coin could end up witnessing a short squeeze alongside a rally.

Ethereum had seen a break above $2,700 earlier, but the coin appears to have seen a pullback as it’s now trading around $2,600.

Ethereum Leverage Ratio Appears To Have Been Rising Recently

As pointed out by an analyst in a CryptoQuant Quicktake post, the ETH Estimated Leverage Ratio has continued its uptrend recently. The “Estimated Leverage Ratio” here refers to an indicator that keeps track of the ratio between the Ethereum Open Interest and Derivatives Exchange Reserve.

The Open Interest is a measure of the total amount of derivatives positions related to ETH that are currently open on all exchanges, while the Derivatives Exchange Reserve keeps track of the amount of ETH sitting in the wallets of all derivatives platforms.

When the value of the Estimated Leverage Ratio rises, it means positions on exchanges are growing at a faster rate than the collateral inflows. Such a trend suggests the investors are opting for a higher amount of leverage on average.

On the other hand, the indicator going down implies the appetite for risk is decreasing among the derivatives market users, as they are taking on a lower amount of leverage.

Now, here is a chart that shows the trend in the Ethereum Estimated Leverage Ratio over the past year or so:

As displayed in the above graph, the Ethereum Estimated Leverage Ratio had reached high levels earlier in the year, but its value had seen a plunge as the asset’s price had gone through its crash in late July/early August.

Over the last couple of months, however, the indicator has seen a resurgence, with its value now completely recovering back to the same highs as before. This suggests that the investors have been opening leveraged positions on the market.

Historically, an overleveraged market has generally resulted in volatility for the ETH price. This is because of the fact that a mass liquidation event, popularly called a squeeze, is probable to occur whenever the derivatives users are taking on high risk.

Earlier in the year, the increase in the Ethereum Estimated Leverage Ratio had come alongside a surge in the price, which implies the leveraged positions cropping up had been long ones.

Usually, a squeeze is more likely to affect the side of the market that’s more dominant, which may be why the overleveraged market from back then had culminated into a long squeeze.

The recent increase in the metric has come while Ethereum has been displaying an overall bearish trajectory, so the new leveraged positions may be short ones. If this is indeed the case, then the coin could end up witnessing a short squeeze alongside a rally.

ETH Price

Ethereum had seen a break above $2,700 earlier, but the coin appears to have seen a pullback as it’s now trading around $2,600.