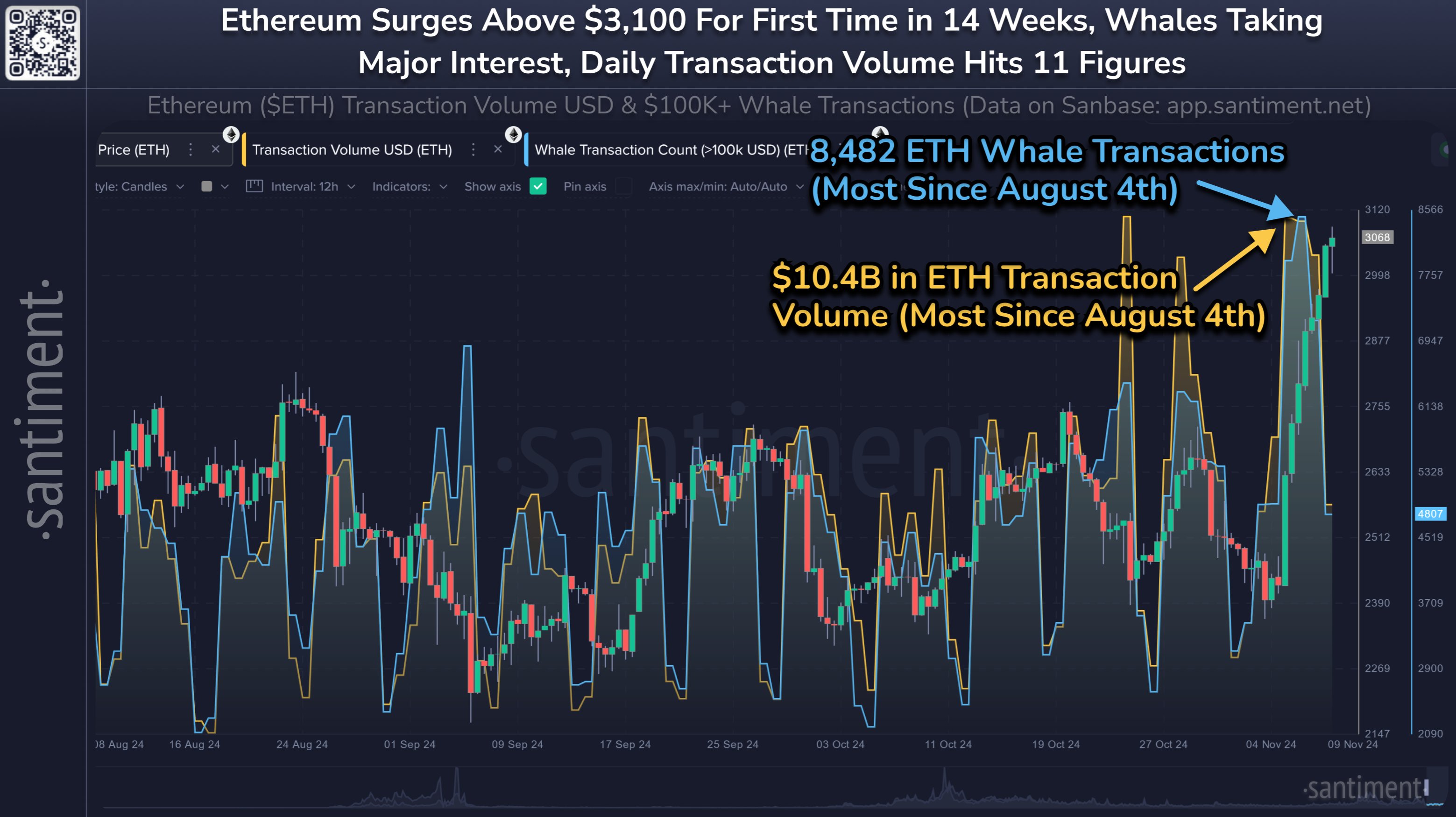

Following Donald Trump’s victory in the US presidential election on November 5, Ethereum (ETH), alongside the general cryptocurrency market, has experienced notable price gains. In particular, the second-largest cryptocurrency has witnessed its value increase by 24.31% in the past four days as it approaches a crucial $3,000 resistance zone.

Amidst the recent price rally in the last week, crypto analyst Burak Kesmeci notes that Ethereum funding rates have now climbed above 0.02, which can be described as a strong bullish signal.

Generally, funding rates are periodic payments made between traders in the perpetual future contracts during funding intervals. A funding rate of 0.02 indicates long position domination and demands that long traders pay 2% of the notional value of their position to short traders in order to maintain the price of perpetual contracts close to the spot market price of an asset.

According to Kesmeci, long positions in futures markets are crucial to initiating strong bull rallies in the same vein as spot market acquisitions. Interestingly, historical data as shared by the analyst shows that Ethereum has consistently experienced a major price uptrend whenever funding rates have risen and stayed above 0.02.

For context, when funding rates hit 0.02 on July 1, 2020, the ETH market recorded a price gain of over 100% in 50 days. Likewise, on November 2, 2020, Ethereum also embarked on a bullish course surging by over 1000% in 350 days. Most recently, Kesmeci notes that the altcoin’s price grew by 150% in 150 days as the funding rates crossed 0.02 on October 4, 2023. Therefore, the analyst postulates ETH may be primed for a robust bullish run in the coming days.

In addition, this potential uptrend is expected to influence other altcoin markets due to Ethereum’s position as the largest altcoin by market cap.

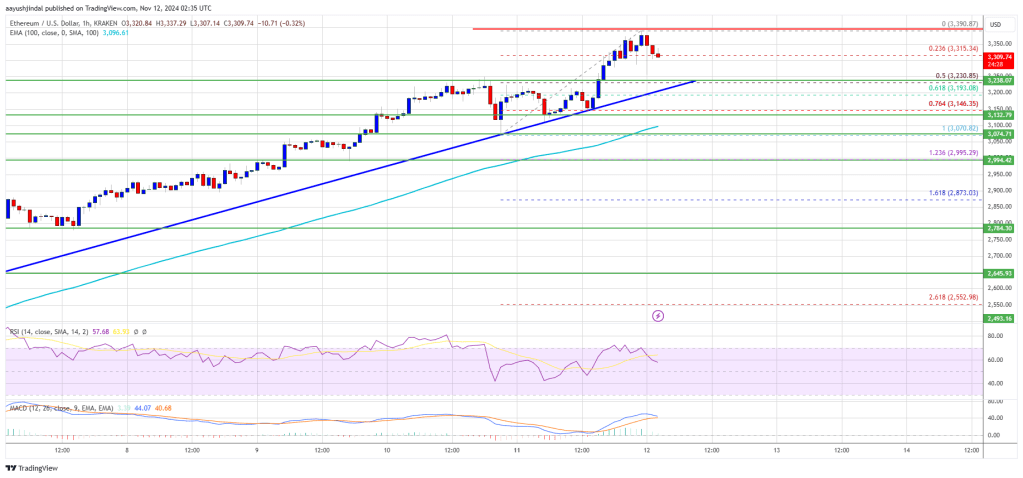

With Ethereum’s price hovering above $2,900, the token is set to soon encounter a major resistance at the $3,000 price mark. According to a report by blockchain analytics company IntoTheBlock, this particular resistance level which can be described as a historically significant demand zone is normally expected to provide much opposition to Ethereum’s ascent.

However, the current bullish momentum in the ETH market is likely to subdue this resistance, allowing the asset to maintain its current rally. If Ethereum breaks beyond $3,000, the altcoin could attain a $4,000 price target. Albeit a rejection would result in ETH trading as low as $2,400.

At the time of writing, Ethereum continues to trade at $2,970 following a 0.98% gain in the last day.

Ethereum Prepares For Potential Surge As Funding Rates Hit 0.02

Amidst the recent price rally in the last week, crypto analyst Burak Kesmeci notes that Ethereum funding rates have now climbed above 0.02, which can be described as a strong bullish signal.

Generally, funding rates are periodic payments made between traders in the perpetual future contracts during funding intervals. A funding rate of 0.02 indicates long position domination and demands that long traders pay 2% of the notional value of their position to short traders in order to maintain the price of perpetual contracts close to the spot market price of an asset.

According to Kesmeci, long positions in futures markets are crucial to initiating strong bull rallies in the same vein as spot market acquisitions. Interestingly, historical data as shared by the analyst shows that Ethereum has consistently experienced a major price uptrend whenever funding rates have risen and stayed above 0.02.

For context, when funding rates hit 0.02 on July 1, 2020, the ETH market recorded a price gain of over 100% in 50 days. Likewise, on November 2, 2020, Ethereum also embarked on a bullish course surging by over 1000% in 350 days. Most recently, Kesmeci notes that the altcoin’s price grew by 150% in 150 days as the funding rates crossed 0.02 on October 4, 2023. Therefore, the analyst postulates ETH may be primed for a robust bullish run in the coming days.

In addition, this potential uptrend is expected to influence other altcoin markets due to Ethereum’s position as the largest altcoin by market cap.

ETH Meets Crucial $3,000 Resistance Level

With Ethereum’s price hovering above $2,900, the token is set to soon encounter a major resistance at the $3,000 price mark. According to a report by blockchain analytics company IntoTheBlock, this particular resistance level which can be described as a historically significant demand zone is normally expected to provide much opposition to Ethereum’s ascent.

However, the current bullish momentum in the ETH market is likely to subdue this resistance, allowing the asset to maintain its current rally. If Ethereum breaks beyond $3,000, the altcoin could attain a $4,000 price target. Albeit a rejection would result in ETH trading as low as $2,400.

At the time of writing, Ethereum continues to trade at $2,970 following a 0.98% gain in the last day.