- Ethereum has dropped nearly 7% in January but historically performs well in February and March.

- Challenges include the Ethereum Foundation selling ETH and market impacts from DeepSeek, a Chinese AI firm.

- Despite setbacks, strong community support and historical trends suggest a possible Altseason this year.

Ethereum’s January Dip

Ethereum has dropped by approximately 7% so far this month. Between January 1 and January 27, CoinGecko documented a decline in price from $3,400 high to $3,105 low. Although this is a step in the opposite direction from the overall trend of the broader crypto market and BTC, many are expecting February and March to be positive months for Ethereum.

Traditionally, February and March were awesome months for Eth. In February 2024, Ethereum rocketed over 46%, jumping from $2,280 to $3,380. Precisely in February 2017, it also rose about 48% as Ethereum jumped from $11 to almost $16. These trends would imply that Ethereum would be bouncy back and highly perform well in the subsequent months.

The supporters are optimistic, however, even with the current price drop. Analyst “Wolf” from X said, “With eight years of experience as an analyst, I can say with certainty that I have never seen a chart as strong as ETH. What is going on here is really unique.” This optimism pervades much of the crypto community, who believe in Ethereum’s long-term value and stability.

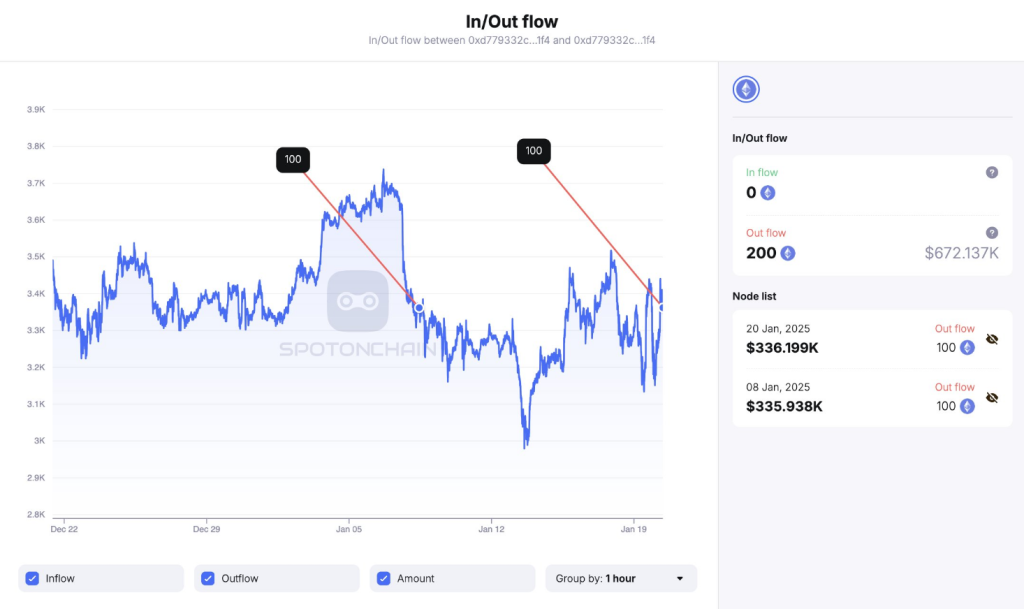

However, Ethereum is facing some setbacks. Recently, the Ethereum Foundation sold 100 ETH for 307,893 DAI. This selling spree has sent a shiver down the spines of investors. The move was made when the market was experiencing a downtrend ahead of the FOMC meeting. In addition, DeepSeek, a Chinese AI firm, has taken a toll on the crypto market. DeepSeek’s rise has made Bitcoin, Ethereum, XRP, and other coins go down.

Ethereum Future

The Ethereum Foundation’s actions have raised questions about the future price of ETH. Some believe that if the Foundation stops selling, Ethereum could see significant price increases. Analyst suggests that Ethereum could reach between $4,000 and $6,000 if the selloff halts. This projection is based on Ethereum’s strong historical performance during February and March.

According to the co-founder of Ethereum, Vitalik Buterin, Eth is made for value and accountability, not hype. This is why Ethereum is more solid even when it does not see fast price movements like some altcoins. Thus, Ethereum is a great performance in the crypto space.

Conclusion In short, even though eth has fallen sharply during the month, history speaks and an excellent community has backed this cryptocurrency. Investors must keep themselves in the know, focus on value-driven prdojects, and not expose themselves needlessly to volatility in the market. The coming months will be critical in determining whether Ethereum will rebound to kick off the next Altseason.

Highlighted Crypto News Today

Crypto Executive Order Attracts $1.9B Digital Asset Fund Inflows