- Ethereum trades 19% below all-time high with strong momentum toward $4,000

- 7-day MVRV rises to 6.1%, suggesting potential for continued rally

- Whale addresses holding 1,000+ ETH reach highest level since October 6

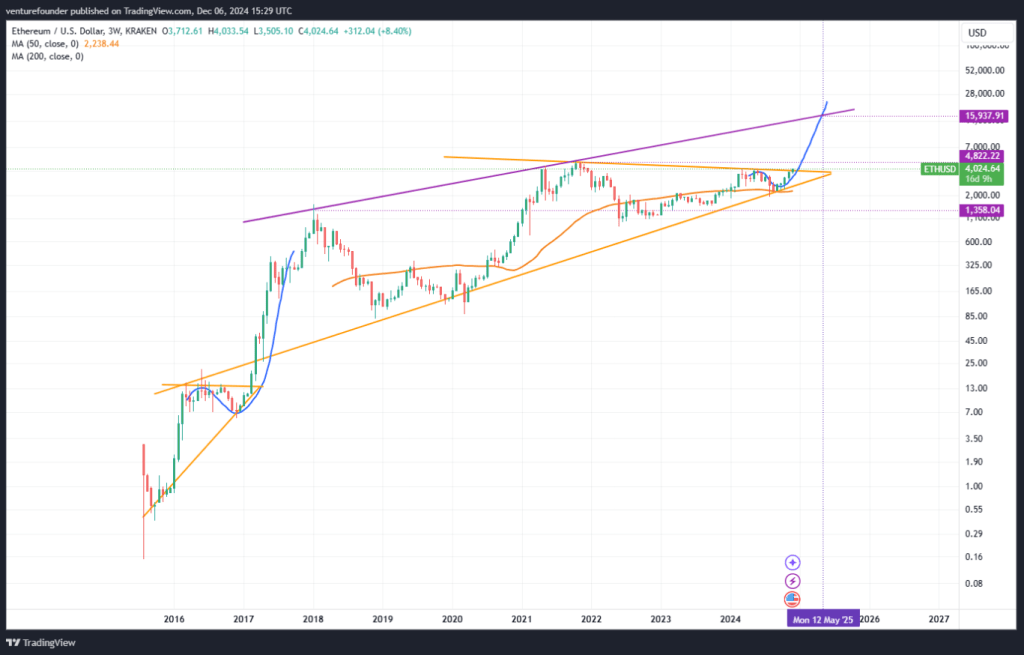

As Ethereum approaches the psychologically significant $4,000 level, a threshold not seen since March 2024, multiple on-chain indicators suggest the potential for continued upward movement.

The convergence of increasing whale accumulation and favorable market metrics paints a picture of growing institutional confidence in ETH’s value proposition.

Ethereum Market Value to Realized Value Analysis

The 7-day MVRV ratio has experienced a dramatic increase from 0.28% to 6.1% in just two days, reflecting growing unrealized profits among short-term holders.

To understand the significance of this metric, think of MVRV as a thermometer measuring market temperature – while current readings show warmth, they haven’t yet reached the fever pitch of 7% to 13% that historically precedes significant corrections. This suggests room for further price appreciation before profit-taking pressure becomes a serious concern.

The recent increase in addresses holding at least 1,000 ETH tells a compelling story about institutional confidence. After reaching a concerning three-month low of 5,524 wallets on October 30, this metric has rebounded to 5,599, its highest point since October 6.

This reversal in whale behavior is particularly significant because these large holders often serve as market bellwethers, their accumulation patterns frequently preceding broader market movements.

IntoTheBlock’s senior researcher, Juan Pellicer, identifies multiple catalysts supporting a potential break above $4,000, including record institutional inflows into Ethereum ETFs and growing interest in staking-enabled products.

The increasing transaction volumes on layer 2 solutions and rising DeFi Total Value Locked (TVL) provide fundamental support for a possible test of the previous all-time high at $4,867.

Despite the bullish indicators, traders should remain mindful of critical support levels at $3,688, $3,500, and $3,255, which could come into play if ETH fails to establish itself above $4,000. The sustainability of the current rally will likely depend on maintaining the positive momentum in institutional interest and whale accumulation patterns observed in recent weeks.