- Ethereum whale activity fuels ETH rally, nearing critical $4,000 resistance.

- Long-term holders showing confidence; ETH holding time steadily increases.

Ethereum (ETH) has experienced a notable rally over the past week, reaching a high of $3,184—a level last seen three months ago. This price surge follows Bitcoin’s own bullish movement, pushing the overall crypto market into a “greed” zone and boosting Ethereum by 8% in the past 24 hours and 33% over the past week.

The current rally can be attributed to a combination of factors. First, increased trading volume and substantial whale accumulation suggest high market confidence. According to Santiment data, Ethereum whales have recently ramped up transaction volumes, reinforcing upward price momentum. This whale activity often indicates potential for sustained gains, given that large investors typically exhibit longer-term optimism in price trends.

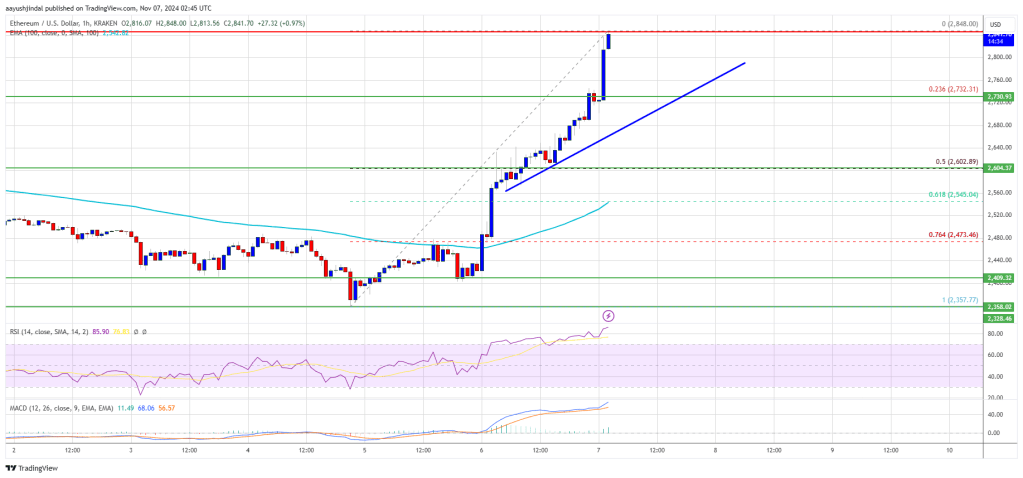

Meanwhile, the technical indicators reveal both opportunities and risks. Ethereum’s 14-day Relative Strength Index (RSI) stands at approximately 76, indicating overbought conditions. While an elevated RSI could signal the likelihood of a pullback as traders take profits, it can also reflect strong bullish momentum if volume support holds. On Balance Volume (OBV) is also trending upwards, a sign of strong buying interest, possibly underpinned by whale accumulation.

What Awaits Ethereum Investors?

Additionally, long-term holders (LTHs) have contributed to market stability, as many refrained from selling during Ethereum’s recent consolidation around the $2,700 mark. However, with ETH nearing critical resistance at $3,200, some LTHs are starting to take profits, signaling a subtle change in sentiment. This shift could create headwinds if enough seasoned holders reintroduce supply into the market, testing Ethereum’s rally strength.

ETH Price Chart, Source: Sanbase

In terms of investor sentiment, Ethereum’s coin holding time they are increased by 40% over the past seven days, suggesting confidence in ETH’s future potential. Short-term holders have also shown greater resilience, with a 9% rise in holding periods.

If Ethereum establishes support around $3,103, it may have a clear path toward its year-to-date high of $4,095. However, intensified selling pressure could invalidate this bullish outlook, potentially leading ETH below $3,000 and even testing the $2,869 level if market sentiment shifts.

Highlighted News Of The Day

Dogecoin Surpasses $45.35B Market Cap, Eyes $1 Target After 52-Week High