- Ethereum’s fee revenue surpasses ETH price, echoing 2020’s surge.

- The Ethereum price climbed over 2% to near the $1900 range.

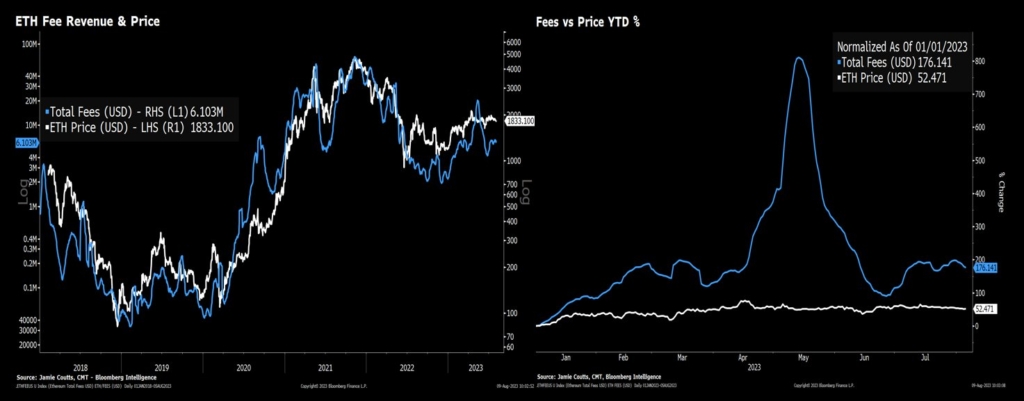

Ethereum’s fee revenue has outpaced the ETH price year-to-date (YTD), signaling a significant shift in the cryptocurrency market. This development marks the first time in two years that fees have exceeded the price of Ethereum, indicating a return to the unprecedented surge witnessed in 2020.

According to insights provided by Bloomberg Intelligence analysts, Ethereum’s fee revenue has experienced a substantial increase in the current year. In a revealing comparison, it’s apparent that the momentum behind Ethereum’s activity is expanding independently of speculative price trends. The data reveals a striking parallel between the current state of affairs and the events of 2020.

(Source: Twitter)

The year 2020 saw Ethereum’s price hovering around $52.471, while the cumulative fee revenue amassed an impressive total of $176.141. Fast forward to 2023, and the ETH price has now soared to the $1900 range. As of July, the fee revenue had surged to $6.103 million, a clear testament to the burgeoning activity within the Ethereum network.

Ethereum (ETH) Market Status

As dawn breaks on the trading floor, Ethereum finds itself comfortably nestled between $1800 and $1900. At the time of writing, Ethereum was trading at $1,857 with a 24-hour trading volume of $5.8 billion, up 7%. However, after a week, the price of ETH soared by about 2%.

Ethereum (ETH) Price Chart (Source: TradingView)

Analyzing the daily price chart, it indicates that the Ethereum price currently hovers slightly above the 50-day Exponential Moving Average (EMA), suggesting a favorable position in the market. Additionally, the Relative Strength Index (RSI) for ETH stands at 49.56, indicating a balanced momentum between the buying and selling states.