Dogecoin is up 5% during the past week, but data from Santiment reveals that social media talk around the asset still continues to be low.

According to data from the on-chain analytics firm Santiment, there haven’t been many discussions around DOGE on social media recently. The relevant indicator here is “social dominance,” which tells us about the percentage of the total discussions happening on social media platforms related to the top 100 assets (by market cap) that involve the topic of Dogecoin.

When the value of this metric is high, it means that the DOGE-related talks currently make up a significant part of the discussions involving the wider cryptocurrency market. Such a trend is usually a sign that the interest in the asset is high among the general investor.

On the other hand, low values imply that social media users aren’t talking that much about the meme coin. Naturally, this kind of trend suggests that there is no excitement around the coin in the market at the moment.

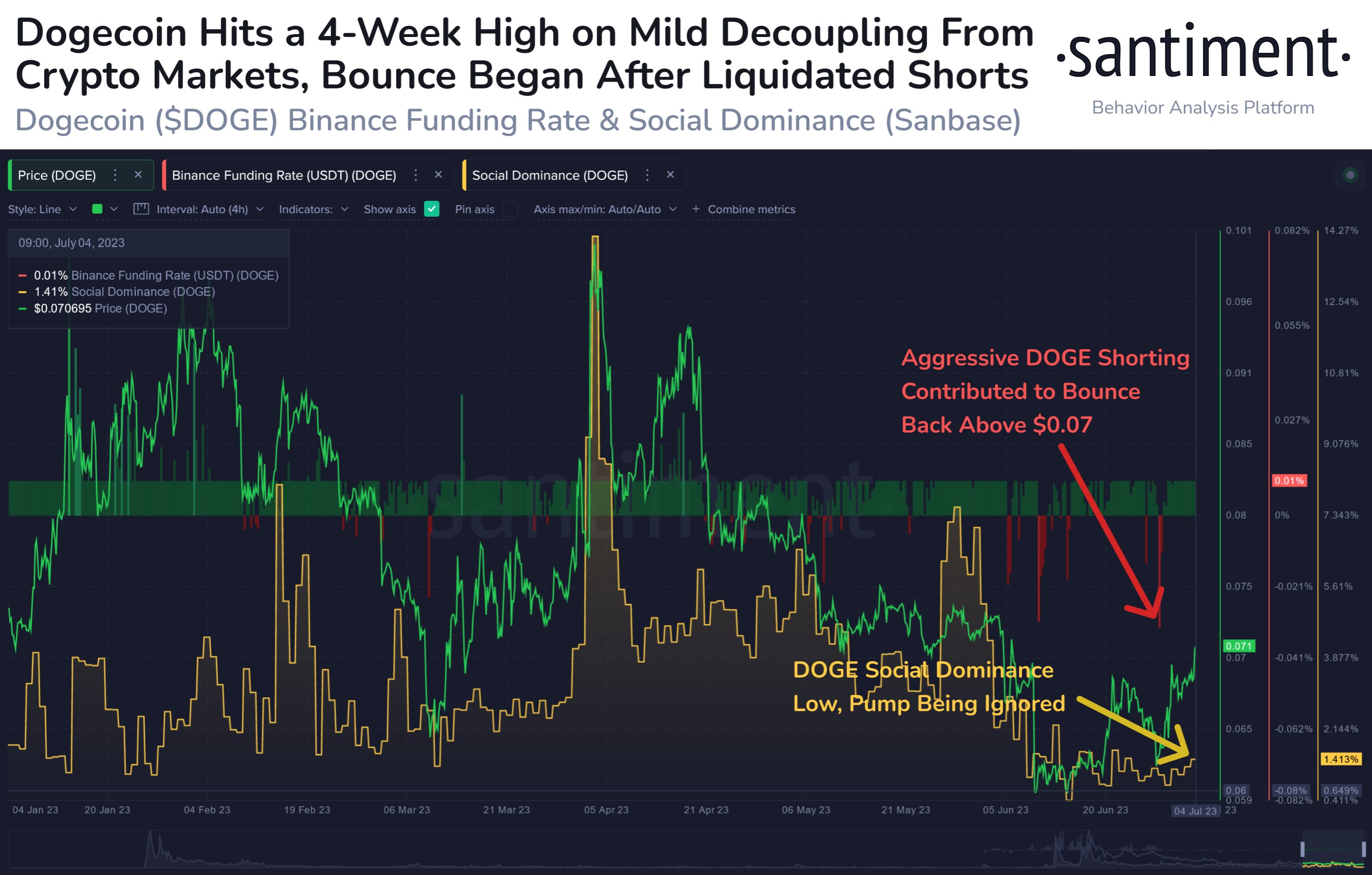

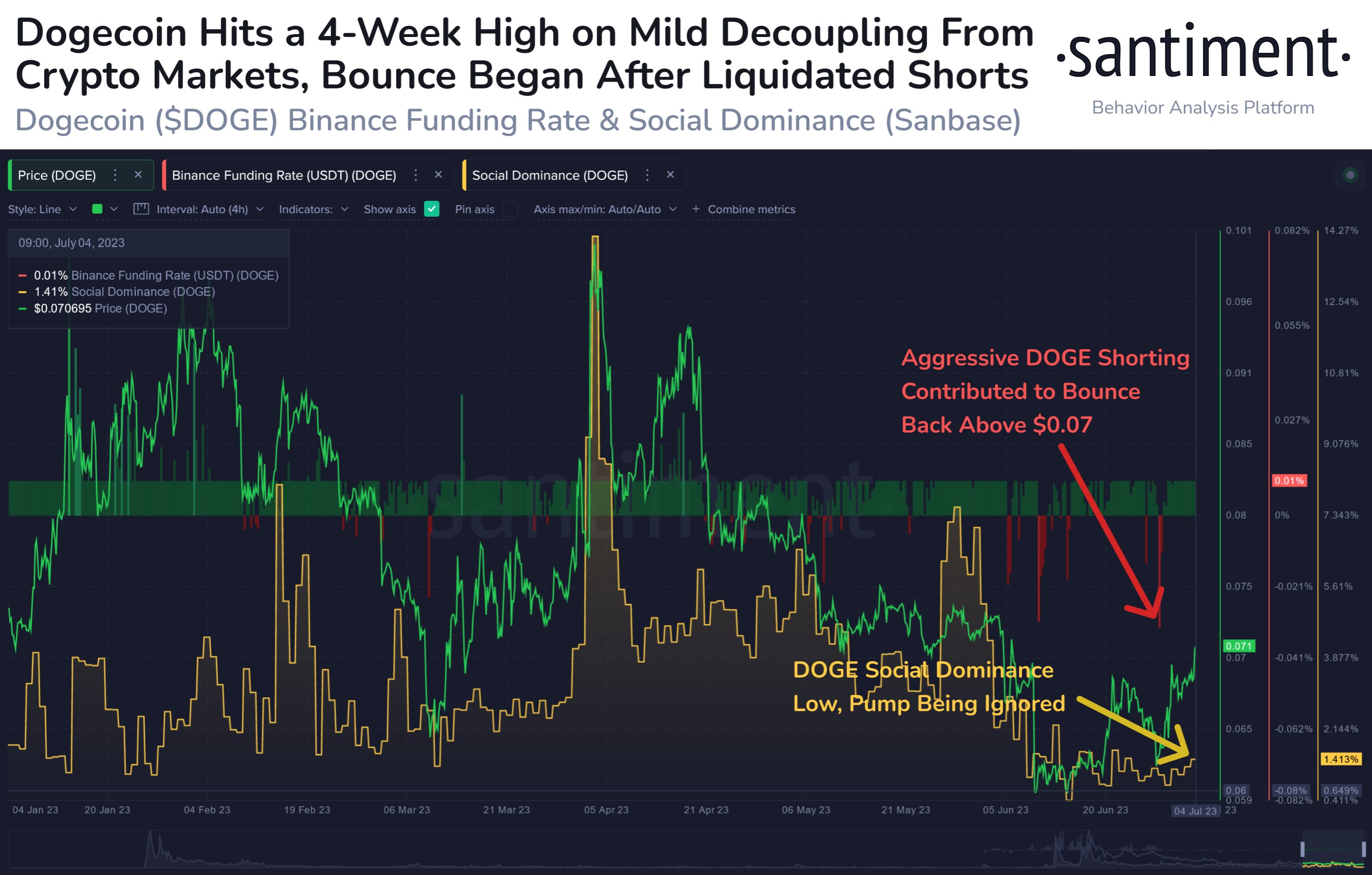

Now, here is a chart that shows the trend in Dogecoin’s social dominance over the last few months:

As displayed in the above graph, the Dogecoin social dominance has been quite low during the past month. Currently, the indicator’s value is around 1.4%, which means that DOGE-related discussions make up for just 1.4% of all talks related to the top 100 assets.

These recent low values of the metric are particularly notable as the meme coin has observed an increase of about 5% during the last week or so. It would appear that despite this rise, interest in the cryptocurrency hasn’t particularly shifted one way or the other.

In the chart, Santiment has also attached the data for another indicator: the “Binance funding rate.” This metric keeps track of the periodic fee that Dogecoin futures traders are exchanging with each other on the Binance platform.

From the graph, it’s visible that this indicator became quite negative a while back, implying that a large number of short contracts piled up. Before long, however, the metric turned back positive as the price observed its latest rally.

This timing would suggest that a “short squeeze” might have helped with the recent price growth. A short squeeze is an event where a mass liquidation of short contracts takes place at once and ends up providing fuel for an upward price move.

Even though this was the largest short squeeze of 2023, it would appear that social media users have remained uninterested in the asset. This may not be all bad for Dogecoin, though, as excessive social media hype usually ends up in a top formation for the meme coin.

Nonetheless, the indicator still staying as low as it has can be concerning, as a lack of any attention also means that the rally may run out of fuel before too long.

At the time of writing, Dogecoin is trading around $0.066, up 5% in the last week.

Interest In Dogecoin Remains Low Despite Surge In Price

According to data from the on-chain analytics firm Santiment, there haven’t been many discussions around DOGE on social media recently. The relevant indicator here is “social dominance,” which tells us about the percentage of the total discussions happening on social media platforms related to the top 100 assets (by market cap) that involve the topic of Dogecoin.

When the value of this metric is high, it means that the DOGE-related talks currently make up a significant part of the discussions involving the wider cryptocurrency market. Such a trend is usually a sign that the interest in the asset is high among the general investor.

On the other hand, low values imply that social media users aren’t talking that much about the meme coin. Naturally, this kind of trend suggests that there is no excitement around the coin in the market at the moment.

Now, here is a chart that shows the trend in Dogecoin’s social dominance over the last few months:

As displayed in the above graph, the Dogecoin social dominance has been quite low during the past month. Currently, the indicator’s value is around 1.4%, which means that DOGE-related discussions make up for just 1.4% of all talks related to the top 100 assets.

These recent low values of the metric are particularly notable as the meme coin has observed an increase of about 5% during the last week or so. It would appear that despite this rise, interest in the cryptocurrency hasn’t particularly shifted one way or the other.

In the chart, Santiment has also attached the data for another indicator: the “Binance funding rate.” This metric keeps track of the periodic fee that Dogecoin futures traders are exchanging with each other on the Binance platform.

From the graph, it’s visible that this indicator became quite negative a while back, implying that a large number of short contracts piled up. Before long, however, the metric turned back positive as the price observed its latest rally.

This timing would suggest that a “short squeeze” might have helped with the recent price growth. A short squeeze is an event where a mass liquidation of short contracts takes place at once and ends up providing fuel for an upward price move.

Even though this was the largest short squeeze of 2023, it would appear that social media users have remained uninterested in the asset. This may not be all bad for Dogecoin, though, as excessive social media hype usually ends up in a top formation for the meme coin.

Nonetheless, the indicator still staying as low as it has can be concerning, as a lack of any attention also means that the rally may run out of fuel before too long.

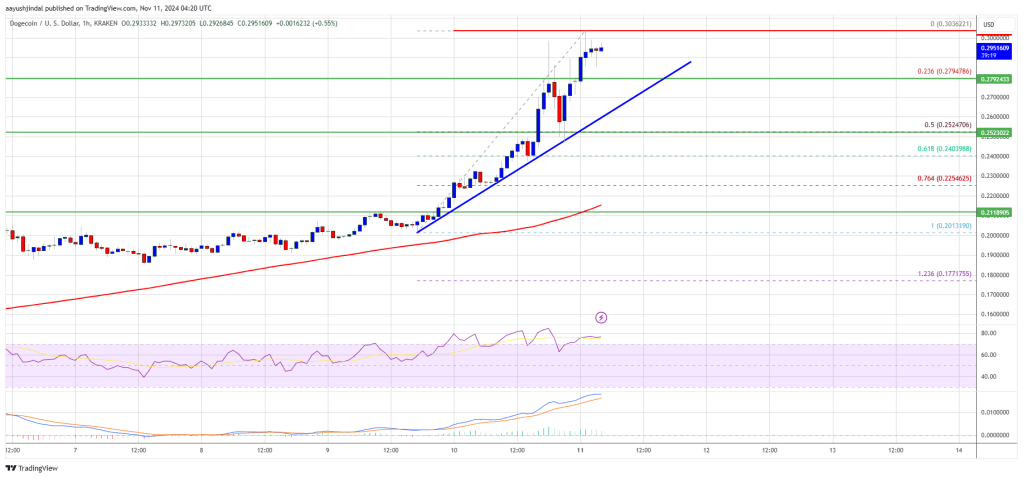

DOGE Price

At the time of writing, Dogecoin is trading around $0.066, up 5% in the last week.