- Dogecoin falls 3.33% amid broader market correction

- Technical indicators show potential bullish divergence

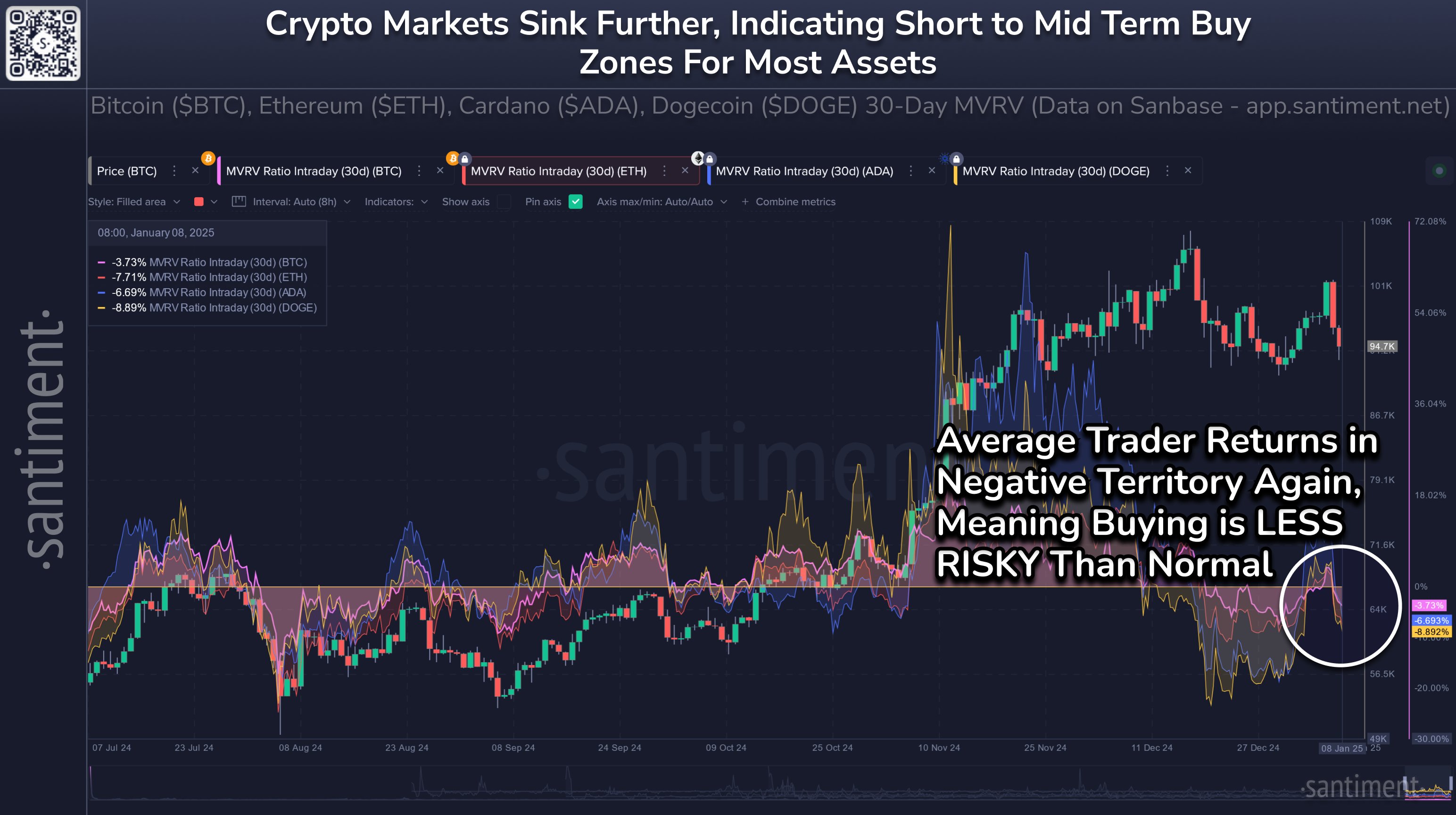

- MVRV ratio at -8.892% suggests possible accumulation zone

As the broader cryptocurrency market experiences a correction with Bitcoin dropping to $92K, Dogecoin faces a crucial test of support levels. Currently commanding over 50% of the meme coin segment with a $50 billion market capitalization, Dogecoin’s recent price action reflects the tension between technical weakness and potential value opportunities.

Dogecoin’s Technical Framework

Understanding Dogecoin’s current market position requires careful analysis of multiple technical factors. The failed attempt to maintain position above the 61.80% Fibonacci level at $0.37772 led to a period of consolidation before succumbing to broader market pressure. However, the 38.20% Fibonacci level at $0.33030 has provided crucial support, preventing a more severe decline.

The emergence of a bearish crossover between the 20- and 50-period EMA lines signals immediate weakness, yet the 4-hour RSI presents an intriguing counterpoint.

Its sideways movement above oversold territory suggests a potential bullish divergence that could precede a recovery in DOGE price. This technical setup becomes particularly interesting when considered alongside the MVRV ratio of -8.892%, which indicates possible oversold conditions.

Average trading returns are a great representation of whether 'buying low' or 'selling high' is actually the right timing. Currently, wallets active in the past 30 days are in negative range for BTC, ETH, ADA, and DOGE, and the vast majority of altcoins.

When MVRV's are… pic.twitter.com/Y8yEahhIft

— Santiment (@santimentfeed) January 8, 2025

Looking forward, Dogecoin faces immediate resistance near the 50% Fibonacci level and 200 EMA at $0.35, with the psychological $0.40 level looming as a more significant barrier.

However, the combination of technical support and negative MVRV readings suggests that current price levels might present an attractive entry point for traders looking to capitalize on potential mean reversion.

The path forward for Dogecoin likely depends on its ability to maintain support at $0.33 while building momentum for a potential recovery toward $0.35 and ultimately $0.40. Failure to hold current levels could see a test of crucial support at $0.30.