Dogecoin (DOGE) has entered a period of weakness, slipping roughly 16% from its November 23 local high of $0.4795. As the original meme cryptocurrency struggles to reclaim key technical levels, the consensus among some analysts is that DOGE’s ability to stabilize or recover may hinge almost entirely on an external factor: Bitcoin’s trajectory.

Technical analysis suggests that the previously well-respected uptrend line, established in mid-November, has now turned into a formidable barrier. After breaching this support line earlier in the week, Dogecoin bulls attempted several times to push the price back above it. Yet none of these efforts have succeeded.

Crypto analyst Kevin (@Kev_Capital_TA), who has been closely tracking the DOGE/USD 1-day chart, notes that DOGE is “getting rejected from the re test of this trend line that we were holding for almost a month on top of that it sits right in the macro .786 Fib.”—a technical zone often associated with significant turning points and potential reversals.

Beyond the trend line, internal momentum indicators paint a challenging picture. Kevin emphasizes that the daily MACD for DOGE is showing “strong momentum to the downside,” a technical signal suggesting the market’s short- to mid-term bias may lean lower unless the broader crypto environment shifts.

In his view, “It’s safe to say without a BTC move higher the more probable move for DOGE in the short to mid term is lower. A BTC move higher could save us though.” He identifies $0.32—the origin of the prior uptrend line—as a primary downside target. Should DOGE fail to hold above that level, traders may look toward the $0.29 to $0.26 range as potential next stops.

In another post on X, Kevin emphasized that Dogecoin price pinned between two critical long-term Fibonacci levels. He describes DOGE as currently “trading between the macro golden pocket,” roughly at $0.47, and the macro 0.5 Fib level near $0.39. According to him, a firm break above or below these pivotal levels could trigger what he calls a “cascading” effect of “aggressive movement.”

He adds: “My position is that DOGE is not in control of itself and it’s fate lies purely in BTC’s hands at the moment so overly focusing on the asset is sort of a waste of time. I see nothing telling me the cycle is over therefore this should head higher soon enough regardless of short term noise. Nothing else to do but sit back and wait if you’re a long term holder who got in early like myself.”

However, there is at least one silver lining worth noting. Kevin mentions he is “tracking [a] potential hidden bullish divergence” on the DOGE daily chart. Hidden bullish divergences occur when price action continues to trend higher over a longer timeframe, while momentum indicators—like the Relative Strength Index (RSI)—trend lower.

This pattern can sometimes signal that a market’s underlying strength is greater than it appears. It is, as the analyst puts it, “pretty textbook” at the moment, though it still needs the all-important help from Bitcoin. “Still need BTC to cooperate so nothing guaranteed,” Kevin remarks.

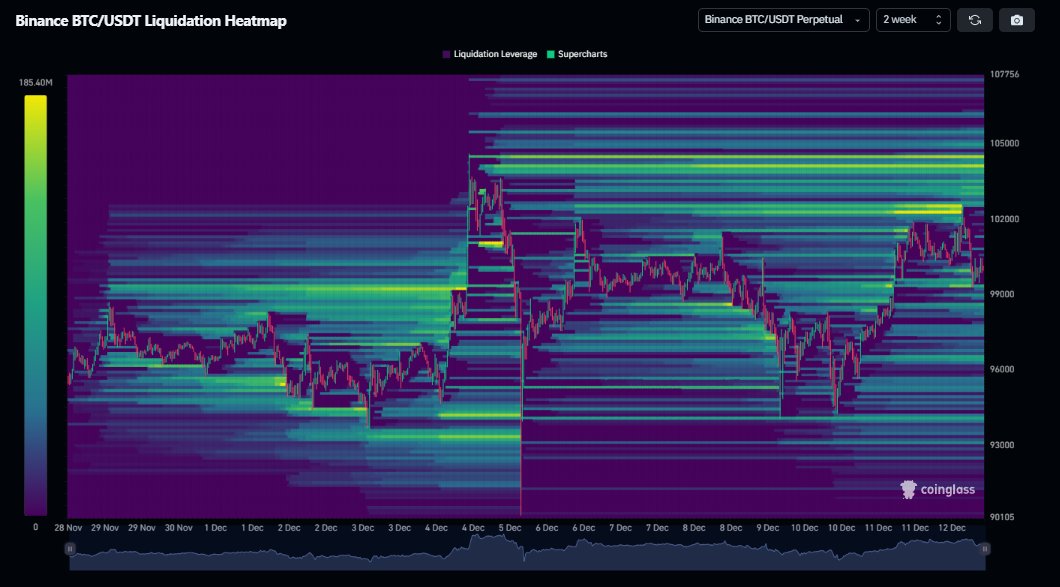

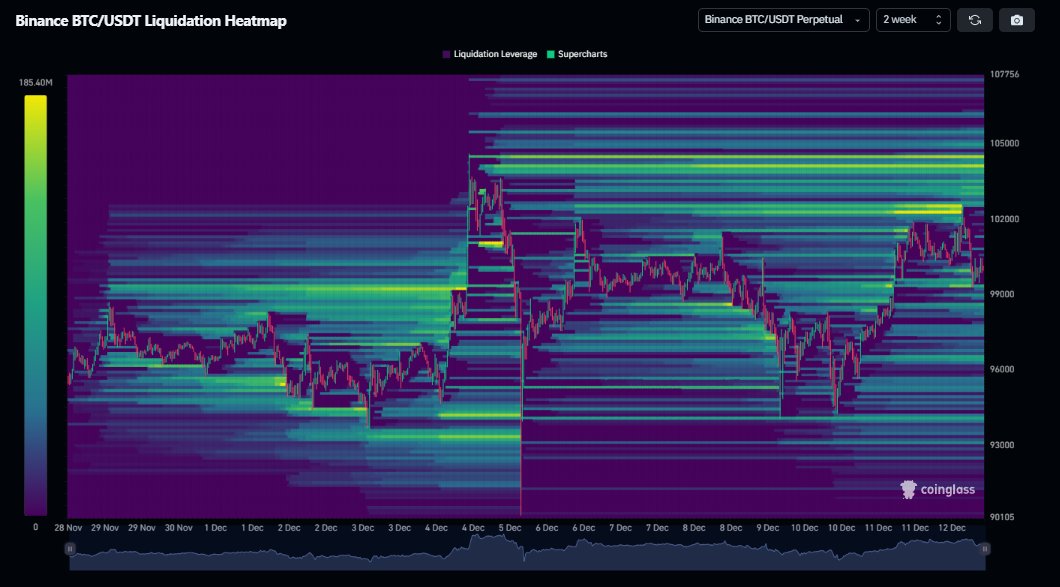

Kevin points out that Bitcoin is currently “squeezing” between an upward trend line of support and a macro golden pocket—levels derived from the previous bull market high to bear market low. This tightening price action suggests an imminent resolution: BTC is unlikely to remain compressed in this zone much longer. A decisive breakout, in either direction, seems imminent and could have far-reaching consequences. “This upwards consolidation cannot last much longer. We will get a bust in either direction very soon,” Kevin predicts.

On the liquidity front, Kevin sees significant upside liquidity blocks for BTC, noting that “built up liquidity” over the last 48 hours aligns with the macro 1.703 Fibonacci level. He also mentions observing data that shows whales purchasing large options calls for MicroStrategy (MSTR) stock. Such purchases may reflect anticipation of a BTC move higher, given MicroStrategy’s well-known Bitcoin treasury holdings. If these whales and liquidity indicators are correct, and BTC does indeed push upward, DOGE might find the “one lifeline” it needs to stabilize and reverse its current downtrend.

At press time, DOGE traded at $0.405.

Dogecoin Price At Risk Of Another Slump

Technical analysis suggests that the previously well-respected uptrend line, established in mid-November, has now turned into a formidable barrier. After breaching this support line earlier in the week, Dogecoin bulls attempted several times to push the price back above it. Yet none of these efforts have succeeded.

Crypto analyst Kevin (@Kev_Capital_TA), who has been closely tracking the DOGE/USD 1-day chart, notes that DOGE is “getting rejected from the re test of this trend line that we were holding for almost a month on top of that it sits right in the macro .786 Fib.”—a technical zone often associated with significant turning points and potential reversals.

Beyond the trend line, internal momentum indicators paint a challenging picture. Kevin emphasizes that the daily MACD for DOGE is showing “strong momentum to the downside,” a technical signal suggesting the market’s short- to mid-term bias may lean lower unless the broader crypto environment shifts.

In his view, “It’s safe to say without a BTC move higher the more probable move for DOGE in the short to mid term is lower. A BTC move higher could save us though.” He identifies $0.32—the origin of the prior uptrend line—as a primary downside target. Should DOGE fail to hold above that level, traders may look toward the $0.29 to $0.26 range as potential next stops.

In another post on X, Kevin emphasized that Dogecoin price pinned between two critical long-term Fibonacci levels. He describes DOGE as currently “trading between the macro golden pocket,” roughly at $0.47, and the macro 0.5 Fib level near $0.39. According to him, a firm break above or below these pivotal levels could trigger what he calls a “cascading” effect of “aggressive movement.”

He adds: “My position is that DOGE is not in control of itself and it’s fate lies purely in BTC’s hands at the moment so overly focusing on the asset is sort of a waste of time. I see nothing telling me the cycle is over therefore this should head higher soon enough regardless of short term noise. Nothing else to do but sit back and wait if you’re a long term holder who got in early like myself.”

However, there is at least one silver lining worth noting. Kevin mentions he is “tracking [a] potential hidden bullish divergence” on the DOGE daily chart. Hidden bullish divergences occur when price action continues to trend higher over a longer timeframe, while momentum indicators—like the Relative Strength Index (RSI)—trend lower.

This pattern can sometimes signal that a market’s underlying strength is greater than it appears. It is, as the analyst puts it, “pretty textbook” at the moment, though it still needs the all-important help from Bitcoin. “Still need BTC to cooperate so nothing guaranteed,” Kevin remarks.

What About Bitcoin?

Kevin points out that Bitcoin is currently “squeezing” between an upward trend line of support and a macro golden pocket—levels derived from the previous bull market high to bear market low. This tightening price action suggests an imminent resolution: BTC is unlikely to remain compressed in this zone much longer. A decisive breakout, in either direction, seems imminent and could have far-reaching consequences. “This upwards consolidation cannot last much longer. We will get a bust in either direction very soon,” Kevin predicts.

On the liquidity front, Kevin sees significant upside liquidity blocks for BTC, noting that “built up liquidity” over the last 48 hours aligns with the macro 1.703 Fibonacci level. He also mentions observing data that shows whales purchasing large options calls for MicroStrategy (MSTR) stock. Such purchases may reflect anticipation of a BTC move higher, given MicroStrategy’s well-known Bitcoin treasury holdings. If these whales and liquidity indicators are correct, and BTC does indeed push upward, DOGE might find the “one lifeline” it needs to stabilize and reverse its current downtrend.

At press time, DOGE traded at $0.405.