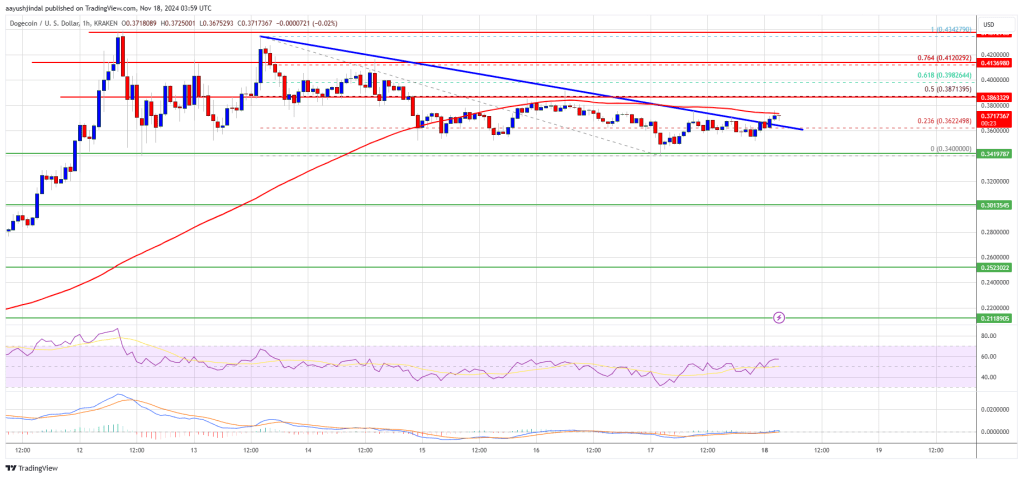

The cryptocurrency known for its climb fueled by memes, Dogecoin (DOGE), is slowly approaching crucial price points that can cause a lot of market activity.

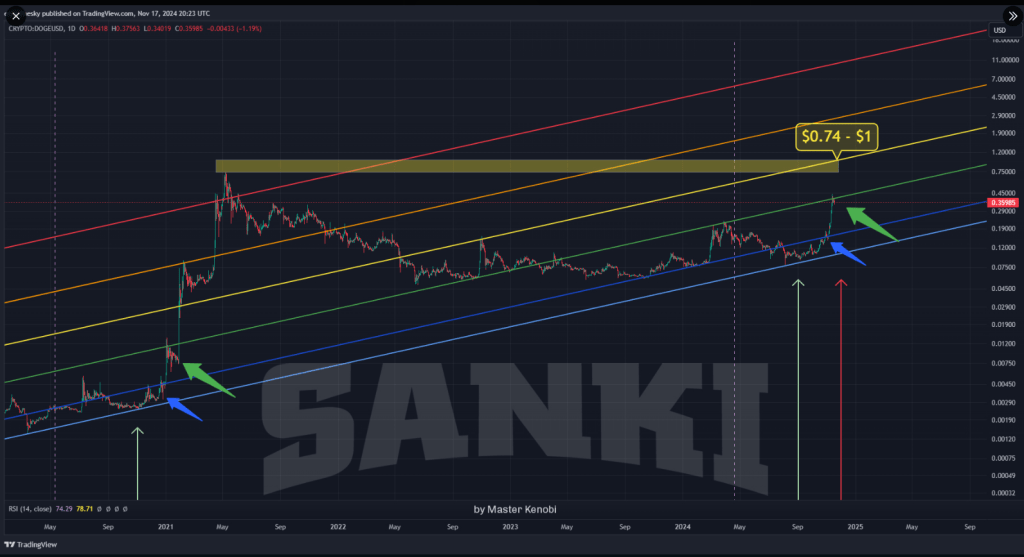

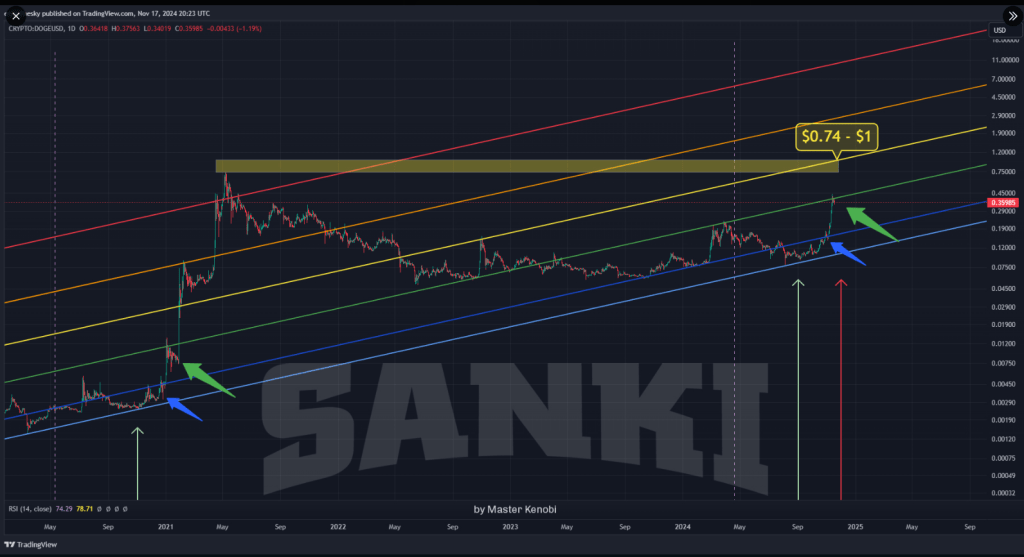

The token, which has regained attention from both casual investors and traders, might be preparing to revisit its all-time high (ATH) of $0.73, a level tied to an ambitious $100 billion market cap.

Cryptocurrency specialist Master Kenobi is of the opinion that this particular milestone can give a psychological edge not only to the holders of Dogecoin but also to the whole cryptocurrency community at large.

Dogecoin may use this valuation as an advertising of sorts, reviving interest and attracting new investors to the ecosystem. It is yet unclear if DOGE will be able to overcome its past propensity for short-term consolidation and steer toward a more gradual ascent this time.

Two different possibilities are emerging, according to analysts, as DOGE moves closer to these critical zones. According to the first scenario, there may be a low-volatility phase of stasis followed by an explosive breakout. Before a retreat happens, a surge like this might drive DOGE’s price toward the desired $1 level or perhaps higher, aiming for a range of $1.2 to $1.3.

The second scenario suggests a quicker rise fueled by strong momentum, breaking through resistance levels without a prolonged pause. For now, the 43.14% price volatility recorded in the past 30 days serves as a reminder of Dogecoin’s unpredictable nature, even during bullish cycles.

The picture painted by market indicators is conflicting but generally positive. Dogecoin has shown resiliency and investor trust by achieving green days on 63% of the previous month.

The Fear & Greed Index, which states a reading of 90, indicates growing enthusiasm. However, CoinCodex has already predicted a possible decline in price by 7.63% by December.

This prognosis emphasizes the need for caution rather than undermining the current bullish mood. While long-term holders should balance the risks of volatility against the possibility of significant rewards, short-term traders may discover opportunities during times of consolidation or declines.

A Crucial Moment For DOGE

The success of Dogecoin in navigating significant resistance levels and sustaining market interest will determine if it retests its ATH. Investors must be alert despite the euphoria around its development.

As DOGE continues to generate headlines and conjecture in the cryptocurrency world, it will be crucial to strike a balance between the excitement of potential new highs and the realities of market swings.

Featured image from Kurt Pas from Getty Images, chart from TradingView

The token, which has regained attention from both casual investors and traders, might be preparing to revisit its all-time high (ATH) of $0.73, a level tied to an ambitious $100 billion market cap.

Cryptocurrency specialist Master Kenobi is of the opinion that this particular milestone can give a psychological edge not only to the holders of Dogecoin but also to the whole cryptocurrency community at large.

Dogecoin may use this valuation as an advertising of sorts, reviving interest and attracting new investors to the ecosystem. It is yet unclear if DOGE will be able to overcome its past propensity for short-term consolidation and steer toward a more gradual ascent this time.

#DOGE quick UPDATE:

Have you ever wondered what the #Dogecoin chart would look like when scaled to the previous cycle?

If the price starts moving toward a new level now, the first stop would likely be the ATH, a zone that coincides with a market cap of approximately $100B.… https://t.co/uuRPgGjcuw pic.twitter.com/IlG0e80ZZ2

— Master Kenobi (@btc_MasterPlan) November 17, 2024

Is It A Surge Or Stagnation?

Two different possibilities are emerging, according to analysts, as DOGE moves closer to these critical zones. According to the first scenario, there may be a low-volatility phase of stasis followed by an explosive breakout. Before a retreat happens, a surge like this might drive DOGE’s price toward the desired $1 level or perhaps higher, aiming for a range of $1.2 to $1.3.

The second scenario suggests a quicker rise fueled by strong momentum, breaking through resistance levels without a prolonged pause. For now, the 43.14% price volatility recorded in the past 30 days serves as a reminder of Dogecoin’s unpredictable nature, even during bullish cycles.

A Bullish Market With Cautionary Notes

The picture painted by market indicators is conflicting but generally positive. Dogecoin has shown resiliency and investor trust by achieving green days on 63% of the previous month.

The Fear & Greed Index, which states a reading of 90, indicates growing enthusiasm. However, CoinCodex has already predicted a possible decline in price by 7.63% by December.

This prognosis emphasizes the need for caution rather than undermining the current bullish mood. While long-term holders should balance the risks of volatility against the possibility of significant rewards, short-term traders may discover opportunities during times of consolidation or declines.

A Crucial Moment For DOGE

The success of Dogecoin in navigating significant resistance levels and sustaining market interest will determine if it retests its ATH. Investors must be alert despite the euphoria around its development.

As DOGE continues to generate headlines and conjecture in the cryptocurrency world, it will be crucial to strike a balance between the excitement of potential new highs and the realities of market swings.

Featured image from Kurt Pas from Getty Images, chart from TradingView