- CZ’s “probably nothing” comment raises doubts about Russia’s Bitcoin reserve plan.

- Russia wants to use Bitcoin in its reserves to avoid sanctions and fight inflation.

- Bitcoin as a reserve asset faces challenges but is still a key topic in crypto discussions.

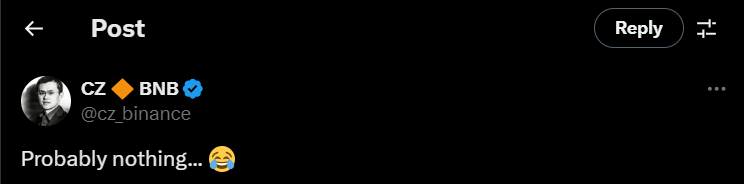

Changpeng Zhao (CZ), the CEO of Binance with his recent comment on Russia’s Bitcoin reserve proposal. When Russia suggested using Bitcoin as part of its national reserves to navigate geopolitical challenges.

CZ posted a response saying “probably nothing” with two laughing emojis. This comment raised questions, especially since CZ has long advocated for Bitcoin and cryptocurrency adoption by governments.

Russia has proposed holding Bitcoin in its reserves to handle the financial difficulties it faces due to international sanctions. By adding Bitcoin to its reserves, Russia hopes to bypass restrictions on traditional financial systems and find a hedge against inflation. It’s a step towards Russia for embracing Bitcoin’s potential to provide more financial freedom.

Why Did CZ Say “Probably Nothing”?

Given that CZ is a strong supporter of Bitcoin and believes and in its potential as a reserve asset for countries, his sarcastic comment came as a surprise. It may have been a way for him to doubt the practicalities of Russia’s plan.

Despite his support for Bitcoin, CZ might believe that Russia’s proposal will only succeed for a while due to the complexity and volatility of using Bitcoin as a national reserve.

The “probably nothing” comment, accompanied by laughing emojis, could be seen as him questioning whether the proposal is a serious, workable strategy or just a passing thought. CZ’s tone downplays the idea, likely acknowledging Russia’s challenges in implementing such a move.

While CZ’s sarcastic comment may question Russia’s approach, using Bitcoin as a reserve asset is still important. As a decentralized digital currency, Bitcoin offers countries like Russia a way to avoid the limitations of fiat currency. In a world where geopolitical tensions and economic sanctions are a reality, Bitcoin could provide an alternative.

What’s Next for Bitcoin Reserve?

Despite CZ’s humorous response, Bitcoin’s role as a potential reserve asset is still evolving. Many crypto advocates, including CZ, believe that Bitcoin should be part of a country’s reserve assets, as it offers financial independence and protection against inflation.

However, implementing Bitcoin on such a large scale requires overcoming major hurdles like volatility, regulation, and infrastructure.

While CZ’s comment at Russia’s plan may be humorous, it also highlights the scepticism and challenges surrounding governments’ use of Bitcoin. It’s a reminder that, even with widespread support for Bitcoin in the crypto community, the path to widespread adoption as a reserve asset will take time and effort.

Highlighted Crypto News Today

BlackRock Bitcoin ETF Defies Market Dip, Secures $358M in Net Inflows