The founder and CEO of the on-chain analytics firm CryptoQuant has explained where the peak Bitcoin market cap lies based on the current hashrate.

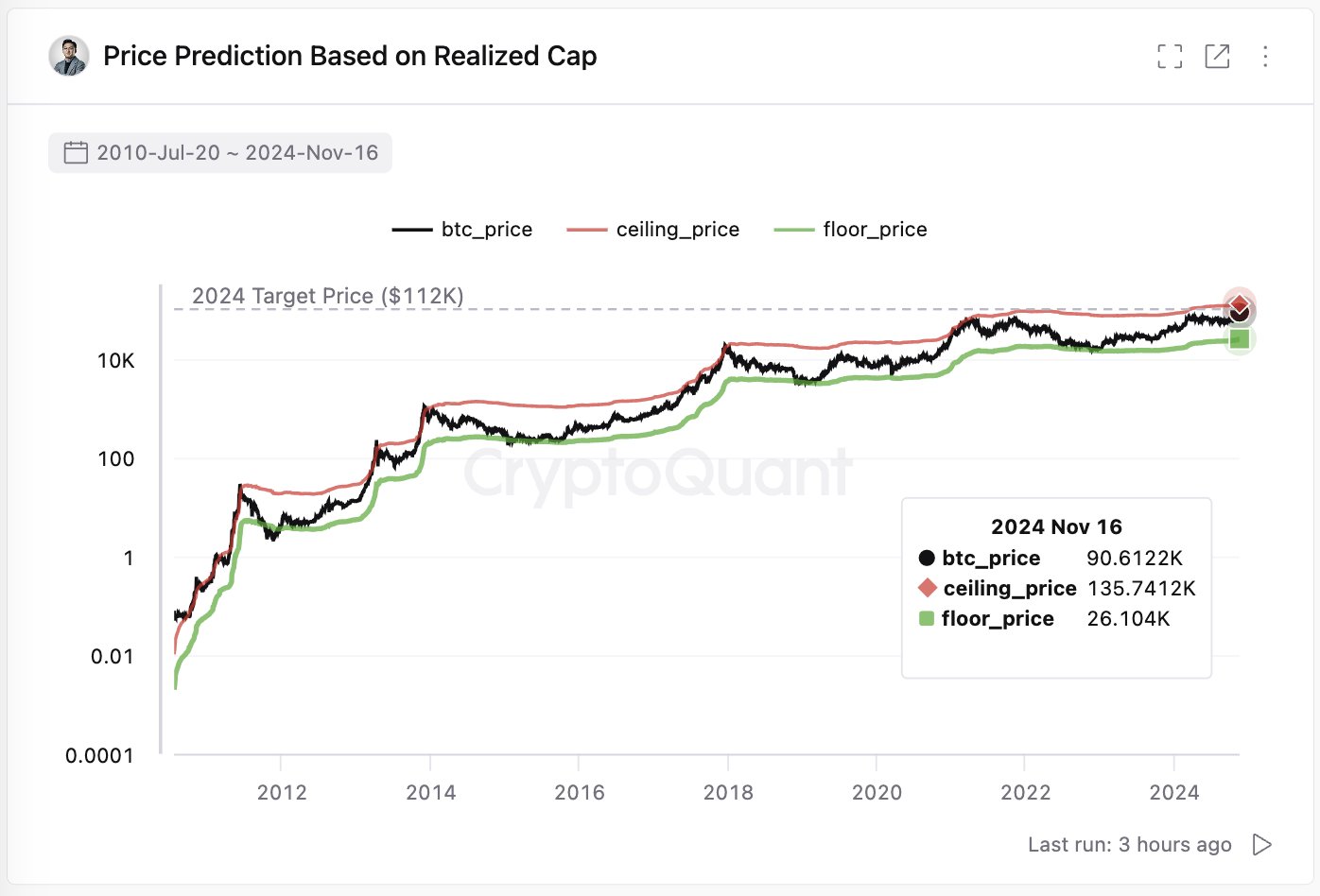

In a new post on X, CryptoQuant founder and CEO Ki Young Ju discussed a BTC pricing model that puts upper and lower bounds on the cryptocurrency’s price using the trend in the mining hashrate.

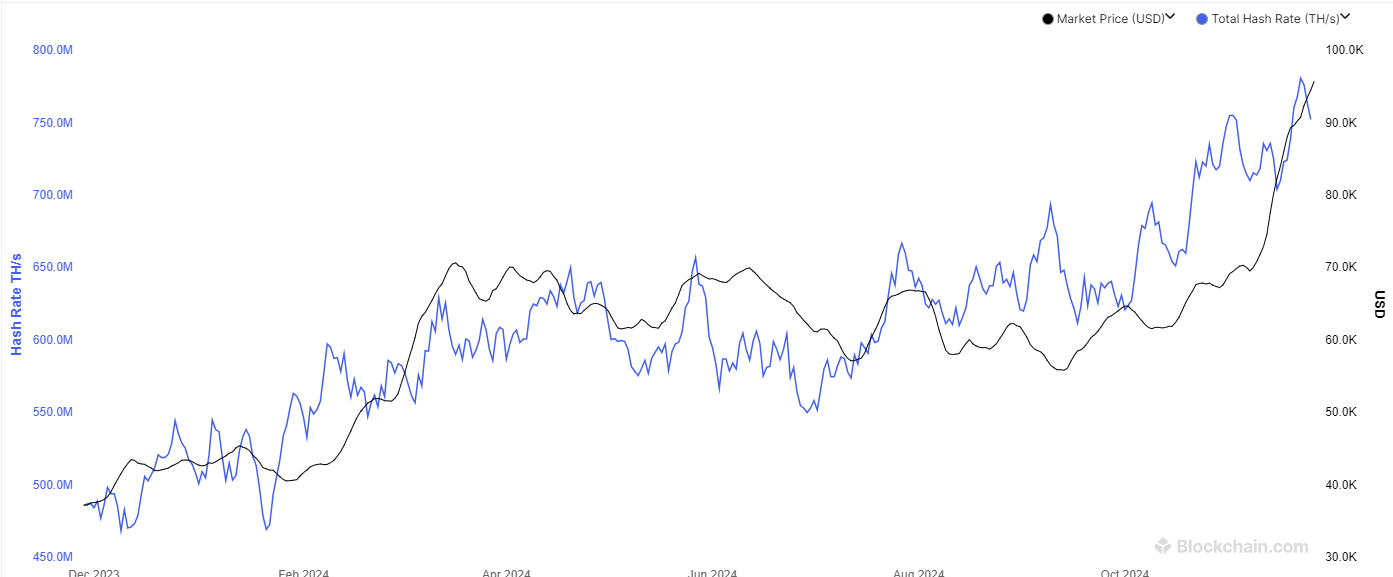

The mining hashrate here refers to a metric that keeps track of the total computing power the miners have currently connected to the Bitcoin blockchain.

Miners use their computing power to compete against each other to become the first to solve certain mathematical puzzles and receive the block reward as compensation.

Given that BTC can’t exist without the miners or, at least, not be as secure without a decentralized network, some believe the intrinsic value of the cryptocurrency can be measured using the hashrate.

After all, the Bitcoin miners have to pay constant electricity bills to host the hashrate, and they would only be willing to run as many farms as would be worth it.

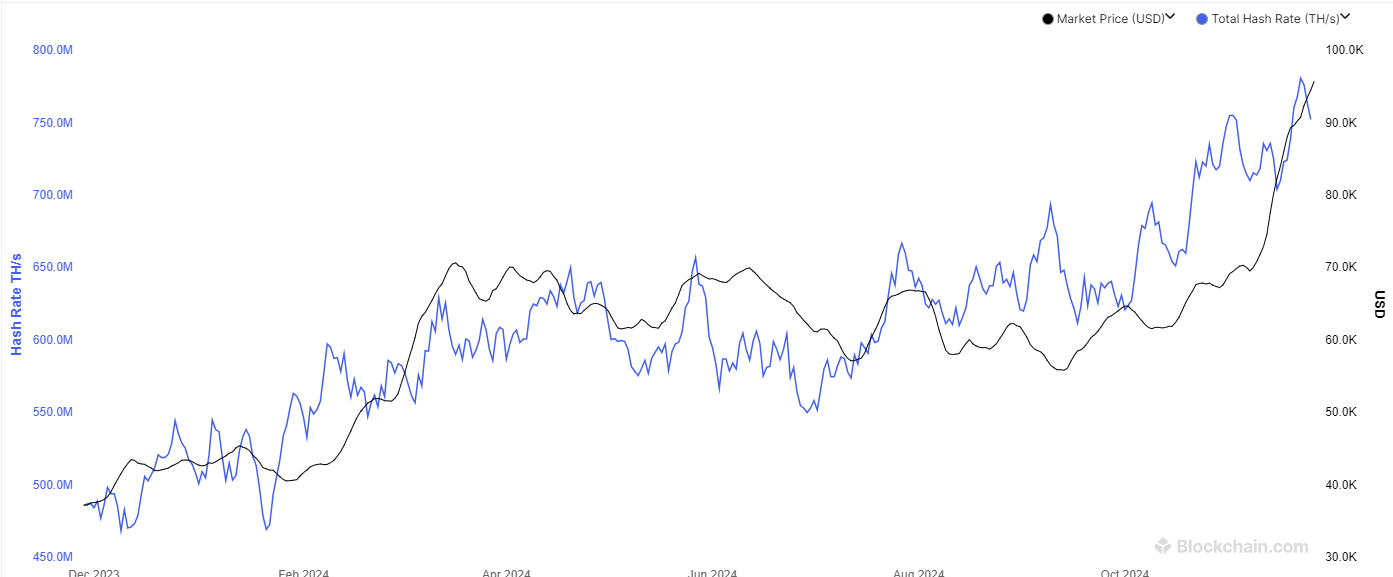

The chart below shows that the BTC mining hashrate has been rising recently and setting new all-time highs (ATHs).

The reason behind this uptrend is the rally that the asset has been observing; price is the main variable for the revenue of these chain validators, as the block subsidy they receive in BTC naturally fluctuates with it.

Speaking of the block subsidy, a feature of the BTC network is that its value is permanently slashed in half about every four years in an event called the Halving. A consequence of the Halving is that miner revenue in BTC is constantly heading down.

The pricing model shared by Young Ju considers this fact by adjusting the mining hashrate. This indicator then takes the market cap’s ratio with this adjusted hashrate and determines the highest and lowest values for this ratio in the asset’s history.

Here is the chart for the model that shows what values the asset’s market cap would need to attain for the ratio to become equal to either of these extremes:

As displayed in the above graph, the maximum potential Bitcoin market cap based on the current value of the network’s hashrate is almost $5 trillion. The asset’s market cap is a little under $1.9 trillion, which means it’s just 38% of this upper limit.

Something to note, though, is that the 2021 bull run top occurred under the top line of the model. So, it’s possible that the top for the current cycle may not touch the line, either. That said, the market cap did come closer to the peak ratio back then than it has so far in this cycle, which could at least suggest there is room left for BTC in the rally.

A peculiar feature in the chart’s lines is that they have some abrupt drawdowns in 2016, 2020, and 2024. These naturally correspond to the Halving events that occurred in those years and reflect their economic effect on Bitcoin mining.

At the time of writing, Bitcoin is trading at around $94,400, up more than 2% over the last seven days.

Bitcoin Ceiling Could Lie At This Level Based On Network Hashrate

In a new post on X, CryptoQuant founder and CEO Ki Young Ju discussed a BTC pricing model that puts upper and lower bounds on the cryptocurrency’s price using the trend in the mining hashrate.

The mining hashrate here refers to a metric that keeps track of the total computing power the miners have currently connected to the Bitcoin blockchain.

Miners use their computing power to compete against each other to become the first to solve certain mathematical puzzles and receive the block reward as compensation.

Given that BTC can’t exist without the miners or, at least, not be as secure without a decentralized network, some believe the intrinsic value of the cryptocurrency can be measured using the hashrate.

After all, the Bitcoin miners have to pay constant electricity bills to host the hashrate, and they would only be willing to run as many farms as would be worth it.

The chart below shows that the BTC mining hashrate has been rising recently and setting new all-time highs (ATHs).

The reason behind this uptrend is the rally that the asset has been observing; price is the main variable for the revenue of these chain validators, as the block subsidy they receive in BTC naturally fluctuates with it.

Speaking of the block subsidy, a feature of the BTC network is that its value is permanently slashed in half about every four years in an event called the Halving. A consequence of the Halving is that miner revenue in BTC is constantly heading down.

The pricing model shared by Young Ju considers this fact by adjusting the mining hashrate. This indicator then takes the market cap’s ratio with this adjusted hashrate and determines the highest and lowest values for this ratio in the asset’s history.

Here is the chart for the model that shows what values the asset’s market cap would need to attain for the ratio to become equal to either of these extremes:

As displayed in the above graph, the maximum potential Bitcoin market cap based on the current value of the network’s hashrate is almost $5 trillion. The asset’s market cap is a little under $1.9 trillion, which means it’s just 38% of this upper limit.

Something to note, though, is that the 2021 bull run top occurred under the top line of the model. So, it’s possible that the top for the current cycle may not touch the line, either. That said, the market cap did come closer to the peak ratio back then than it has so far in this cycle, which could at least suggest there is room left for BTC in the rally.

A peculiar feature in the chart’s lines is that they have some abrupt drawdowns in 2016, 2020, and 2024. These naturally correspond to the Halving events that occurred in those years and reflect their economic effect on Bitcoin mining.

BTC Price

At the time of writing, Bitcoin is trading at around $94,400, up more than 2% over the last seven days.