Non-fungible tokens continue to play a significant role in developing the Web3 ecosystem, despite the enthusiasm around them having subsided since its peak in 2021.

Unquestionably, these distinctive digital assets have been a significant force behind the NFT transformations that have taken place. Despite the wide variety of NFT collections and their accomplishments, it is crucial to recognize that some particular ones have recently been severely affected by market pressures and are now beginning to fall from their lofty positions.

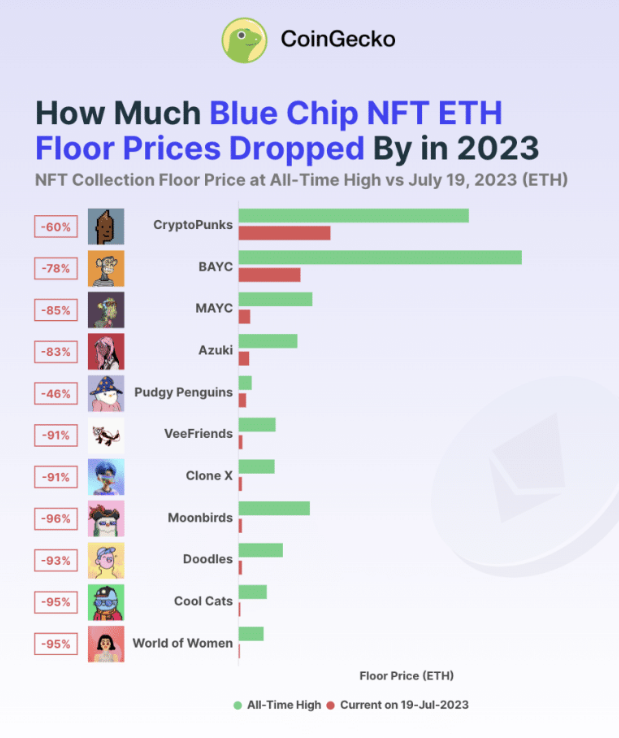

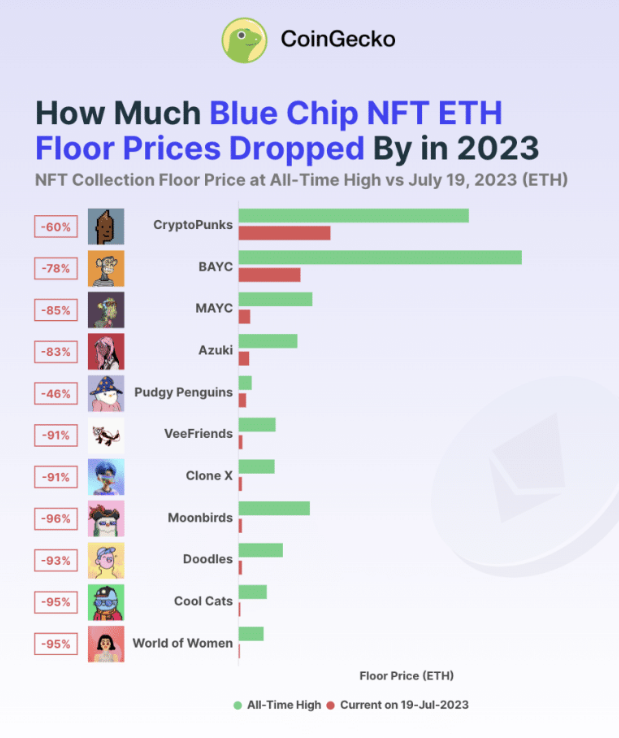

Consider the situation with CryptoPunks. CoinGecko discovered that of the top 11 “blue chip” NFT projects studied, CryptoPunks suffered the worst losses.

Non-fungible tokens known as “blue chip NFTs” are regarded as highly precious and prestigious in digital assets. These NFTs are frequently linked to well-known and recognized producers or organizations, such as renowned artists, enduring businesses, or essential historical items.

Collectors and investors widely seek after them due to scarcity, historical relevance, and the artist’s reputation that determine their value.

Alarming statistics currently facing CryptoPunks are raising questions among NFT enthusiasts. These formerly well-liked digital assets have recently encountered a worrying situation, sparking disputes and disagreements among investors and fans.

At the time of writing, the floor price for these NFT collections was set at 47.69 ETH. Data from NFT Floor Price shows that the collection’s value declined after reaching a high of 11,000ETH during the 2021 NFT bull market.

The volume and sales of CryptoPunks have significantly decreased during the past seven days, claims OpenSea. Sales were down 60%, while volume dropped sharply by 64%.

Due to their distinctiveness and variable rarity, CryptoPunks, developed by Larva Labs in 2017 and helped increase generative PFP collections, are still incredibly sought-after NFTs.

CryptoPunks, regarded as art and collectibles, have generated respectable profits for their owners. CryptoPunk #5822, which sold for $23 million in February last year, was the most expensive ever.

Now, in terms of the number of unique active wallets, CryptoPunks has seen a depressing reduction of about 20%, and transactions have also suffered, losing more than 32% of their values.

Meanwhile, CryptoPunks’ monthly sales volume is also feeling the heat, declining precipitously since March. The NFT initiative reported sales of $30.43 million for the month, but by the end of June, those figures had substantially dropped to less than $10 million.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Reuters

Unquestionably, these distinctive digital assets have been a significant force behind the NFT transformations that have taken place. Despite the wide variety of NFT collections and their accomplishments, it is crucial to recognize that some particular ones have recently been severely affected by market pressures and are now beginning to fall from their lofty positions.

Consider the situation with CryptoPunks. CoinGecko discovered that of the top 11 “blue chip” NFT projects studied, CryptoPunks suffered the worst losses.

Non-fungible tokens known as “blue chip NFTs” are regarded as highly precious and prestigious in digital assets. These NFTs are frequently linked to well-known and recognized producers or organizations, such as renowned artists, enduring businesses, or essential historical items.

Collectors and investors widely seek after them due to scarcity, historical relevance, and the artist’s reputation that determine their value.

Alarming statistics currently facing CryptoPunks are raising questions among NFT enthusiasts. These formerly well-liked digital assets have recently encountered a worrying situation, sparking disputes and disagreements among investors and fans.

At the time of writing, the floor price for these NFT collections was set at 47.69 ETH. Data from NFT Floor Price shows that the collection’s value declined after reaching a high of 11,000ETH during the 2021 NFT bull market.

The volume and sales of CryptoPunks have significantly decreased during the past seven days, claims OpenSea. Sales were down 60%, while volume dropped sharply by 64%.

Due to their distinctiveness and variable rarity, CryptoPunks, developed by Larva Labs in 2017 and helped increase generative PFP collections, are still incredibly sought-after NFTs.

CryptoPunks, regarded as art and collectibles, have generated respectable profits for their owners. CryptoPunk #5822, which sold for $23 million in February last year, was the most expensive ever.

Now, in terms of the number of unique active wallets, CryptoPunks has seen a depressing reduction of about 20%, and transactions have also suffered, losing more than 32% of their values.

Meanwhile, CryptoPunks’ monthly sales volume is also feeling the heat, declining precipitously since March. The NFT initiative reported sales of $30.43 million for the month, but by the end of June, those figures had substantially dropped to less than $10 million.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Reuters