~Bitcoin Reigns Supreme in Germany: Top Crypto Choices Revealed, Including Ethereum, NFTs, and Metaverse Projects ~

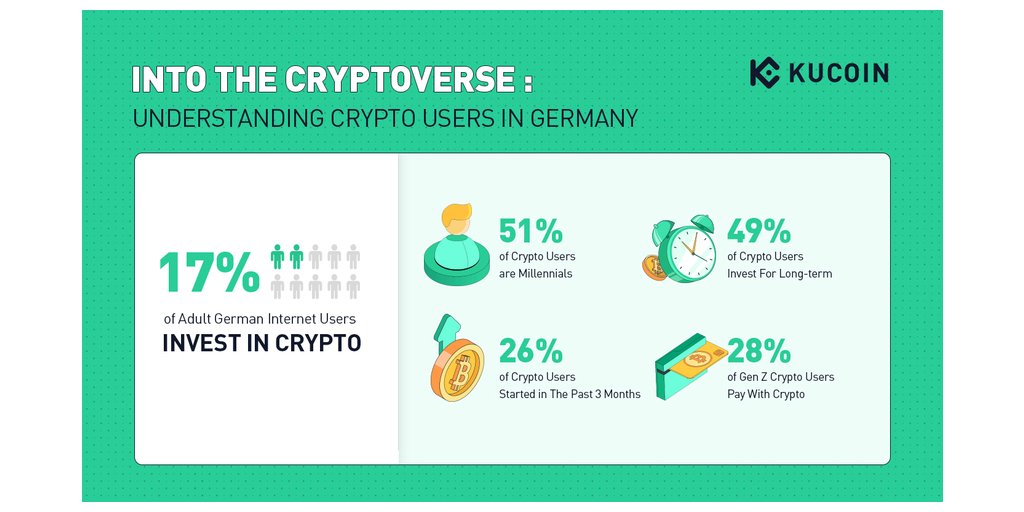

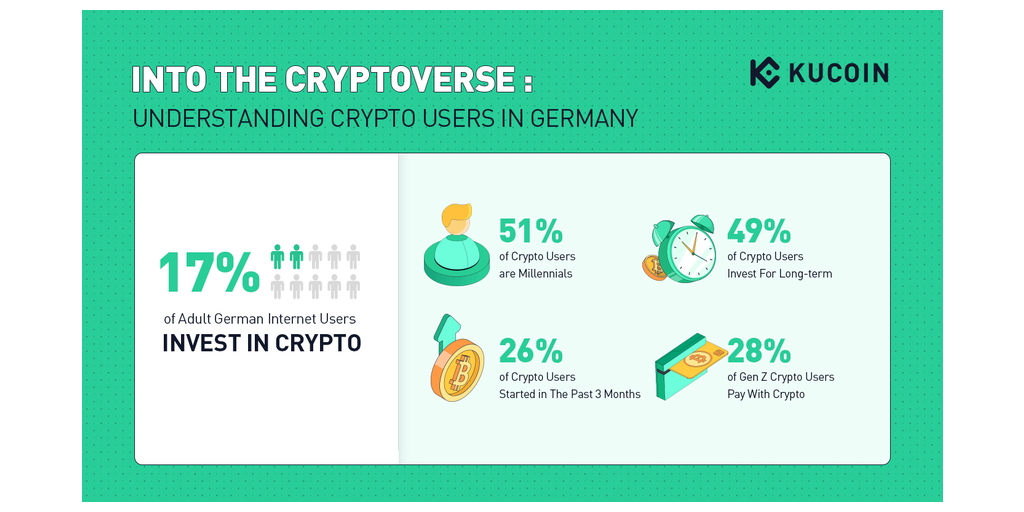

VICTORIA, Seychelles–(BUSINESS WIRE)–#crypto–KuCoin, a leading cryptocurrency exchange, unveils the key findings of its highly anticipated Cryptoverse report on Germany, shedding light on the evolving landscape of the German crypto market. The comprehensive report, based on a survey of adult crypto investors aged 18 to 60 in Germany, highlights the remarkable trends and motivations driving the adoption of cryptocurrencies in the country.

KuCoin’s report showcases a surprising surge in crypto interest, with 26% of German crypto users entering the crypto market in the past quarter. Leading the charge in recent engagement are Millennials, who are embracing cryptocurrencies as a potential investment opportunity despite the market downturn.

The report also reveals that 49% of German crypto users are primarily motivated by long-term wealth accumulation. This finding underscores the growing recognition of cryptocurrencies as a viable asset class for investors in Germany, who see digital assets as a means of securing their financial future.

Furthermore, the report highlights the increasing mainstream adoption of cryptocurrencies in Germany. A notable 28% of Gen Z users are utilizing digital currencies through credit cards or for online payments, indicating the integration of cryptocurrencies into traditional financial activities. This shift demonstrates the broader acceptance and convenience that digital currencies offer to the younger generation.

In terms of preferred crypto choices, Bitcoin continues to reign supreme among German crypto users, followed closely by Ethereum, NFTs, and Metaverse projects. These findings signify the strong influence and appeal of these digital assets within the German market.

“We are delighted to present our most recent Cryptoverse Report, showcasing Germany’s distinctive standing in the global crypto landscape. The country’s advantageous regulatory environment, marked by reduced uncertainty and a relatively crypto-friendly framework, has played a pivotal role in fostering cryptocurrency adoption among German citizens. This progress is further bolstered by Germany’s tech-driven, innovation-centric economic initiatives, the influence of prominent KOLs, and the existence of robust communities and well-established crypto media outlets. Moreover, the comparatively higher wealth of Germany’s population, in relation to other European nations, has facilitated a broader range of investment opportunities, ultimately paving the way for increased crypto adoption and continued growth in the sector.” – Dorian Vincelloni, Head of Europe Business Development KuCoin.

KuCoin invites industry professionals, analysts, and investors to explore the full Cryptoverse report on Germany to gain deeper insights into the findings.

Visit KuCoin blog to read the full report.

Industry expert quotes on the report:

Prices may fluctuate significantly on a temporary basis, but the report shows that the number of crypto users in Germany is steadily increasing. Contrary to the widespread assumption that cryptocurrencies are only a short-term speculation, the survey results reveal that around half of crypto investors want to hold their coins for the long term. This fact is more than positive.

Doubts may be part of any new technology. This is no different with crypto. The survey results, on the other hand, prove that cryptocurrencies cannot be kept down, especially in Germany. No matter what happens, interest in cryptocurrencies is on the rise and younger generations in particular are aware of this change, as the survey results suggest. There is no way around cryptocurrencies in the long term. Those who understand this in time will be among the winners.

– Sven Wagenknecht, Editor-in-Chief and Co-Founder at BTC-ECHO

The German blockchain and cryptocurrency market is relatively new and still at a nascent stage. With the rise of FinTech, Germany was slower to adopt new payment technologies, causing them to miss out on certain opportunities. However, they are determined not to miss out on the blockchain revolution.

To encourage blockchain startups and founders, the German government has been taking necessary steps. For example, the Federal Ministry for Economic Affairs and Energy has launched a blockchain strategy, which aims to create a supportive regulatory framework for blockchain-based businesses. The strategy also aims to promote research and development in this field.

Overall, the German government is taking a proactive approach to encourage the growth of the blockchain and cryptocurrency industry. With the right support and investment, Germany has the potential to become a major player in this emerging field. It is no surprise that Germany is the most crypto-friendly country in the world overtaking Singapore in 2022.

– Vijay Pravin, Founder and CEO of bitsCrunch

About KuCoin

Launched in September 2017, KuCoin is a global cryptocurrency exchange with its operational headquarters in Seychelles. As a user-oriented platform with a focus on inclusiveness and community action reach, it offers over 700 digital assets and currently provides spot trading, margin trading, P2P fiat trading, futures trading, staking, and lending to its 27 million users in 207 countries and regions.

In 2022, KuCoin raised over $150 million in investments through a pre-Series B round, bringing total investments to $170 million with Round A combined, at a total valuation of $10 billion. KuCoin is currently one of the top 5 crypto exchanges according to CoinMarketCap. Forbes also named KuCoin one of the Best Crypto Exchanges in 2023. In 2022, The Ascent named KuCoin the Best Crypto App for enthusiasts.

Contacts

For media inquiries or to request a copy of the report, please contact: [email protected]