Bitcoin (BTC) has shown much resilience in the wake of the US Federal Reserve announcing a 25 basis points hike in the Federal Funds Rate (FFR) on Wednesday.

Based on data from CoinMarketCap, the premier cryptocurrency is up by 0.78% in the last 24 hours, with the majority of the market also posting notable gains. However, a crypto analyst has predicted a significant bearish trend for the market leader.

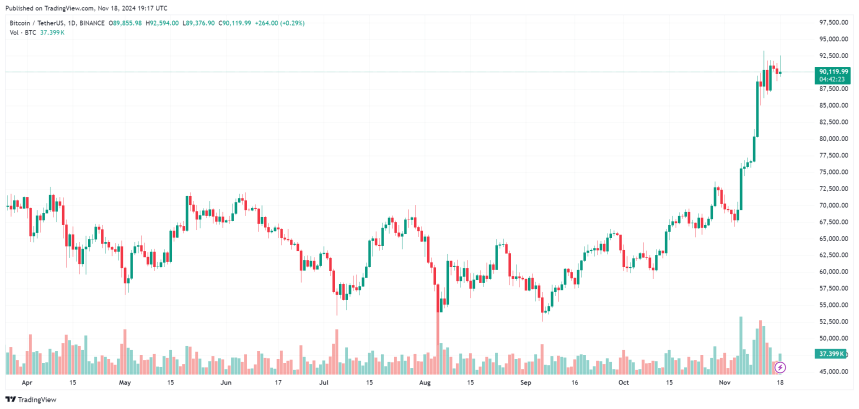

According to a technical report on July 27 by an analyst with the Twitter handle @CryptoFaibik, BTC is likely to plummet in value by 15-20% in the coming weeks.

Related Reading: FOMC Delivers Expected 0.25% Rate Hike, Bitcoin Holds Steady Above $29,000

However, the analyst noted that Bitcoin could first hit the $32,000 mark, indicating an imminent potential 8.6% gain on the token’s current market price.

Following @CryptoFaibik’s predictions, BTC is then expected to fall to around $25,000, with a breakout below its current ascending channel, as seen on the daily chart.

While this might be an interesting projection, it is worth stating that there were no specific reasons backing this bearish outlook. In fact, there has been a positive sentiment surrounding Bitcoin in the last few weeks.

Besides its recent positive performance in the face of the Fed rate hike, the market leader appears to be poised for an increase in institutional demand.

Currently, prominent asset managers have filed applications with the United States Securities and Exchange Commission(SEC) seeking approval to launch the first Spot Bitcoin ETF in the United States

On July 20, Bitcoin research firm NYDIG reported that the approval of these ETF applications could result in $30 billion in new demand for Bitcoin.

The report stated this prediction is based on several factors, including the brand recognition that asset managers such as BlackRock offer, alongside the popular understanding of the regular trading methods of securities brokers.

In other news, Bitcoin’s resilience amidst the increased Federal Funding Rate has garnered much attention among investors, with the token’s social dominance recording a significant boost.

According to data by on-chain analytics company, Santiment, Bitcoin now accounts for one-third of all discussions surrounding the top 100 crypto assets. Its social dominance stands at 33.33%, the highest it has been in the last two weeks.

Related Reading: Bitcoin Pre-Halving Patterns Suggest Bull Market Is Not Starting In 2023

Santiment further highlighted that an increased social dominance indicated fear which means a price rise is likely on the horizon.

At the time of writing, Bitcoin is trading at $29,406.94, with a 0.16% decline in the last hour. Meanwhile, its daily trading volume has surged by 20.46% and is valued at $12.97 billion. With a market cap of $571.05 billion, Bitcoin ranks as the largest cryptocurrency in the market.

Based on data from CoinMarketCap, the premier cryptocurrency is up by 0.78% in the last 24 hours, with the majority of the market also posting notable gains. However, a crypto analyst has predicted a significant bearish trend for the market leader.

Incoming Dip For Bitcoin?

According to a technical report on July 27 by an analyst with the Twitter handle @CryptoFaibik, BTC is likely to plummet in value by 15-20% in the coming weeks.

Related Reading: FOMC Delivers Expected 0.25% Rate Hike, Bitcoin Holds Steady Above $29,000

However, the analyst noted that Bitcoin could first hit the $32,000 mark, indicating an imminent potential 8.6% gain on the token’s current market price.

I think $BTC will hit 32k first, and then We may Witness a 15-20% Correction in the Coming Weeks.

Share Your Thoughts#Crypto #Bitcoin #BTC pic.twitter.com/Qni4cCBxLX

— Captain Faibik (@CryptoFaibik) July 27, 2023

Following @CryptoFaibik’s predictions, BTC is then expected to fall to around $25,000, with a breakout below its current ascending channel, as seen on the daily chart.

While this might be an interesting projection, it is worth stating that there were no specific reasons backing this bearish outlook. In fact, there has been a positive sentiment surrounding Bitcoin in the last few weeks.

Besides its recent positive performance in the face of the Fed rate hike, the market leader appears to be poised for an increase in institutional demand.

Currently, prominent asset managers have filed applications with the United States Securities and Exchange Commission(SEC) seeking approval to launch the first Spot Bitcoin ETF in the United States

On July 20, Bitcoin research firm NYDIG reported that the approval of these ETF applications could result in $30 billion in new demand for Bitcoin.

The report stated this prediction is based on several factors, including the brand recognition that asset managers such as BlackRock offer, alongside the popular understanding of the regular trading methods of securities brokers.

Bitcoin Marks Highest Social Dominance In Two Weeks

In other news, Bitcoin’s resilience amidst the increased Federal Funding Rate has garnered much attention among investors, with the token’s social dominance recording a significant boost.

According to data by on-chain analytics company, Santiment, Bitcoin now accounts for one-third of all discussions surrounding the top 100 crypto assets. Its social dominance stands at 33.33%, the highest it has been in the last two weeks.

Related Reading: Bitcoin Pre-Halving Patterns Suggest Bull Market Is Not Starting In 2023

Santiment further highlighted that an increased social dominance indicated fear which means a price rise is likely on the horizon.

At the time of writing, Bitcoin is trading at $29,406.94, with a 0.16% decline in the last hour. Meanwhile, its daily trading volume has surged by 20.46% and is valued at $12.97 billion. With a market cap of $571.05 billion, Bitcoin ranks as the largest cryptocurrency in the market.