- As of November 20th, USDC accounted for around 25% of the total stablecoins in circulation.

- Users all throughout the world may now access the USDC reward.

The digital wallet platform of crypto exchange giant Coinbase, Coinbase Wallet, has announced a new incentive structure for USDC, a stablecoin tethered to the US dollar.

On the Coinbase-incubated Layer 2 network Base, users who hold USDC in their Coinbase Wallet now have the opportunity to earn a 4.7% annual percentage yield. This yield is paid out monthly. Users all throughout the world may now access the USDC reward, and the release notes that Americans can expect to use the functionality this week.

Previously, Coinbase increased the incentives return for USDC holders from 2% to 4%. According to Coinbase’s frequently asked questions (FAQ), the cryptocurrency exchange pays USDC users with its own assets in an effort to encourage more people to use Coinbase’s platforms to store USDC.

In 2018, Coinbase and Circle, the creators of USDC, collaborated to introduce the stablecoin. The exact amount of Coinbase’s stock investment in Circle remains a mystery as of August 2023. Among stablecoins linked to the US dollar, USDC is second only in popularity to Tether’s USDT. As of November 20th, USDC accounted for around 25% of the total 107.33 billion stablecoins in circulation, as reported by The Block’s Data Dashboard.

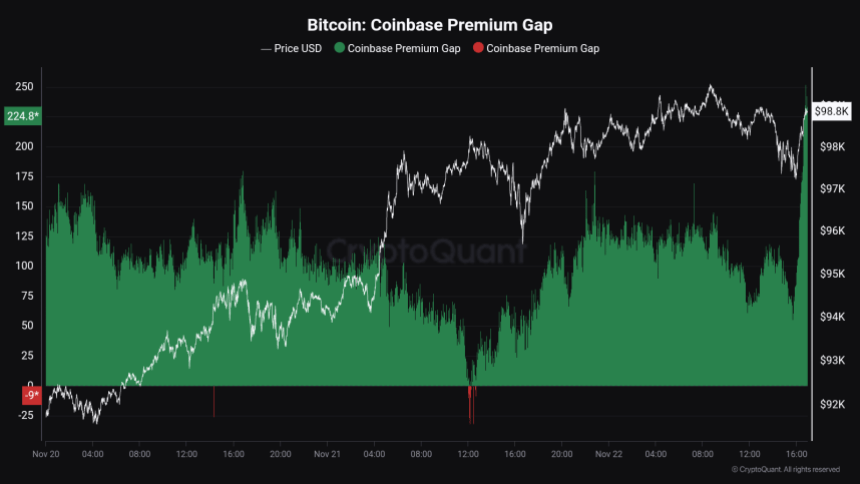

Bullish Momentum

The crypto market has been witnessing bullish momentum for quite some time now. Compared to gold, which has lost over 3% in value over the last month, bitcoin has gained almost 46%. According to experts, institutional investors’ opinion is changing as bitcoin establishes itself as a potential vehicle for high-growth investments, and this discrepancy reflects that.

In the run-up to Trump’s inauguration, bitcoin call options are being purchased by derivatives traders, indicating a very positive outlook. Investor interest in gold has been declining as a result of the Federal Reserve’s recent aggressive approach.

Fed Chair Jerome Powell’s recent signals of reluctance to decrease interest rates have kept U.S. Treasury yields high and reduced interest in gold and other conventional inflation hedges.

Highlighted Crypto News Today:

Binance Launches Verified WhatsApp Channel to Boost User Communication