- Citi and Fidelity announced a proof-of-concept for an on-chain money-market fund.

- USD MMFs have a large number of issuers with over USD 6.1 trillion.

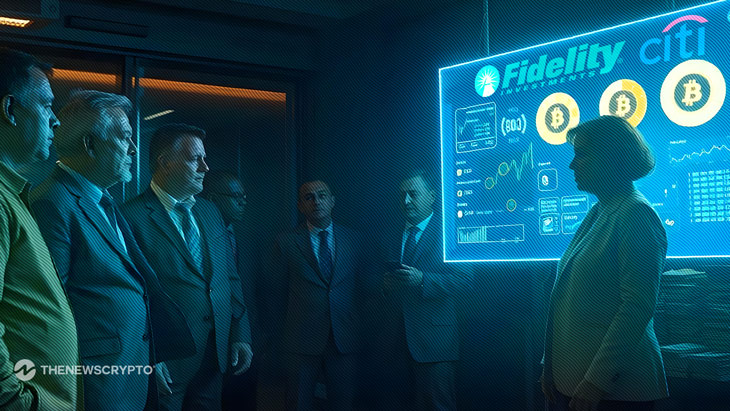

Fidelity International and Citi have unveiled a proof-of-concept (PoC) for an on-chain money market fund (MMF) featuring a digital foreign exchange (FX) swap solution. This was announced ahead of the Singapore FinTech Festival 2024 happening from November 6–8.

The solution jointly developed demonstrates the real-time settlement of tokenized MMF transactions with integrated FX swaps. The on-chain approach allows investors to manage multi-asset positions across different currencies effectively and with reduced settlement delays.

In addition, by exploiting blockchain, the tokenized MMF provides the potential for seamless, immediate, enhanced operational liquidity. It allows investors access to diversified USD-denominated money market funds for higher yield opportunities.

For managing corporate treasurers’ non-USD capital, the tokenized MMF solution allows investing in USD MMFs without the traditional challenges of separate foreign exchange hedging and manual reconciliation.

In traditional systems, FX risk management comprises complex manual booking and reconciliation processes, which may result in settlement delays, time irregularities, and liquidity inefficiencies. The new tokenized version addresses these issues by enabling fast, programmable multi-asset transactions on-chain. It also eliminates the frictions seen in traditional infrastructures.

Moreover, tokenized MMFs are one of the fastest-growing digital asset classes, reaching USD 400 billion by 2030. At press time, USD MMFs represent a significant proportion of global financial assets, with over USD 6.1 trillion.

On the other hand, by introducing real-time, programmable settlement mechanisms, Citi and Fidelity International’s tokenized MMF initiative stands to reshape the landscape of liquidity management and FX risk mitigation.

Highlighted Crypto News

MAS Accelerates Global Push for Commercializing Asset Tokenization