- Chainlink whale addresses drop from 558 to 516 since November

- BBTrend declines from 19.31 to 7.46, indicating weakening momentum

- Technical support at $26.89 becomes crucial for maintaining uptrend

After achieving a three-year high and an impressive 87% monthly gain, Chainlink’s market structure shows signs of strain as key metrics suggest waning momentum. The recent 5% pullback in 24 hours may signal a more significant shift in market dynamics, particularly when viewed alongside changes in whale behavior and technical indicators.

Understanding Chainlink Whale Behavior and Its Implications

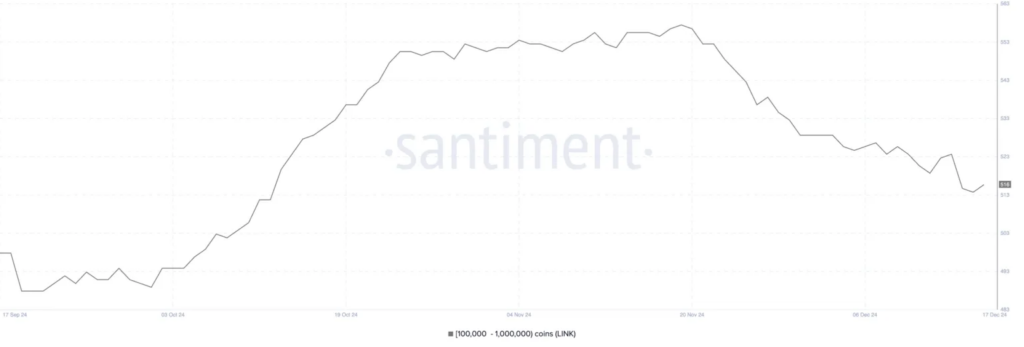

The decline in addresses holding between 100,000 and 1,000,000 LINK tokens tells an important story about institutional confidence. The drop from 558 wallets in November to 516 currently represents more than just numbers – it signals a shift in how large investors view LINK’s risk-reward profile at current levels.

Addresses Holding Between 100,000 to 1,000,000 LINK. Source: Santiment

The recent acceleration of this trend, with a notable decrease from 524 to 515 wallets between December 14-15, suggests growing caution among major market participants.

The BBTrend indicator provides additional context for understanding the current market phase. While maintaining a positive reading at 7.46, the significant decline from its recent peak of 19.31 suggests deteriorating momentum.

This technical indicator, derived from Bollinger Bands, helps us understand not just the direction but the strength of price trends. The current reading suggests LINK remains in an uptrend but with notably reduced conviction.

The EMAs (Exponential Moving Averages) present an interesting technical picture, with short-term averages maintaining position above longer-term ones but showing signs of potential weakness.

This creates a critical juncture where maintaining support at $26.89 becomes crucial for preserving bullish market structure. A failure to hold this level could trigger a cascade toward $22.41 or even $19.56.

The convergence of declining whale positions, weakening momentum indicators, and crucial technical levels suggests LINK has entered a period requiring careful monitoring. While the broader uptrend remains intact, the immediate future likely depends on whether current support levels can maintain buying interest and potentially stabilize institutional positioning.