The Cross-Chain Interoperability Protocol (CCIP), designed for building cross-chain applications and services, has now launched for early access users on the Avalanche, Ethereum, Optimism, and Polygon blockchains.

On July 20, the Chainlink protocol will become available to developers across the four blockchains’ testnets and also Arbitrum’s Goerli. As a result of this, the price of Chainlink’s native token, LINK, rallied nearly 10% to touch $7.30 following this announcement on Monday.

In a blog post dated July 17, Chainlink announced the launch of the Cross-Chain Interoperability Protocol to early access users on Avalanche, Ethereum, Optimism, and Polygon blockchains. While DeFi lending protocol Aave is set to integrate the protocol, it has already been adopted on the derivatives platform Synthetix.

Related Reading: Bitcoin Price Needs To Clear $30,500 For Hopes of a Fresh Rally

According to the post, CCIP is an interoperability protocol that allows developers to design their own cross-chain solutions. It also offers “Simplified Token Transfers”, which allows protocols to swiftly send tokens across chains through audited token pool contracts.

Chainlink claims that CCIP is a blockchain layer designed to foster a connection between enterprises and any public or private blockchain ecosystem.

The cross-chain protocol is a collaborative effort with Swift, the renowned global financial messaging network. It leverages Swift’s messaging infrastructure to facilitate token transfers across various public and private blockchains.

According to Chainlink’s co-founder Sergey Nazarov, CCIP is a solution that aims to “connect the fragmented public blockchain landscape and the growing bank ecosystem into a single Internet of Contracts.”

He also stated that such technology will be crucial to developing and maintaining a blockchain-powered society.

Some of the financial institutions and enterprises also exploring the Cross-Chain Interoperability Protocol include Australia and New Zealand Banking Group (ANZ), BNP Paribas, BNY Mellon, Citi, Euroclear, and Lloyds Banking Group.

Following the announcement of the CCIP launch, the price of LINK experienced a significant pump, recording an almost 10% increase in the early hours of Tuesday. However, the token’s price appears to be slowing down, losing over 2% since reaching a 24-hour high of $7.29.

As of this writing, LINK is valued at $7.12, with a 7.3% increase in the last day. CoinGecko data shows that the cryptocurrency has a daily trading volume of roughly $549.8 million, representing a 219% boost in the last 24 hours.

Related Reading: LINK Price Prediction: Chainlink Rallies Over 7% As The Bulls Aim $8.8

A broader look at the Chainlink market reveals that the LINK price has been on an upward trajectory in recent weeks. Thanks to this bullish momentum, the token has gained about 35% in the past month.

On July 20, the Chainlink protocol will become available to developers across the four blockchains’ testnets and also Arbitrum’s Goerli. As a result of this, the price of Chainlink’s native token, LINK, rallied nearly 10% to touch $7.30 following this announcement on Monday.

Chainlink’s CCIP – The Future Of Interoperability?

In a blog post dated July 17, Chainlink announced the launch of the Cross-Chain Interoperability Protocol to early access users on Avalanche, Ethereum, Optimism, and Polygon blockchains. While DeFi lending protocol Aave is set to integrate the protocol, it has already been adopted on the derivatives platform Synthetix.

Related Reading: Bitcoin Price Needs To Clear $30,500 For Hopes of a Fresh Rally

According to the post, CCIP is an interoperability protocol that allows developers to design their own cross-chain solutions. It also offers “Simplified Token Transfers”, which allows protocols to swiftly send tokens across chains through audited token pool contracts.

Chainlink claims that CCIP is a blockchain layer designed to foster a connection between enterprises and any public or private blockchain ecosystem.

The cross-chain protocol is a collaborative effort with Swift, the renowned global financial messaging network. It leverages Swift’s messaging infrastructure to facilitate token transfers across various public and private blockchains.

According to Chainlink’s co-founder Sergey Nazarov, CCIP is a solution that aims to “connect the fragmented public blockchain landscape and the growing bank ecosystem into a single Internet of Contracts.”

He also stated that such technology will be crucial to developing and maintaining a blockchain-powered society.

Just like key standards such as TCP/IP remade a fragmented early internet into the single global internet we all know and use today, we are making CCIP to connect the fragmented public blockchain landscape and the growing bank chain ecosystem into a single Internet of Contracts.… https://t.co/BDMFMfknY2 pic.twitter.com/DDscglD2An

— Sergey Nazarov (@SergeyNazarov) July 17, 2023

Some of the financial institutions and enterprises also exploring the Cross-Chain Interoperability Protocol include Australia and New Zealand Banking Group (ANZ), BNP Paribas, BNY Mellon, Citi, Euroclear, and Lloyds Banking Group.

Chainlink (LINK) Up By 35% In One Month – Price Overview

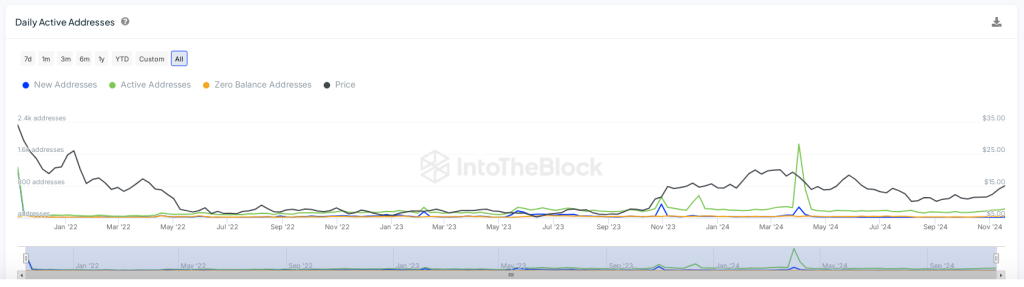

Following the announcement of the CCIP launch, the price of LINK experienced a significant pump, recording an almost 10% increase in the early hours of Tuesday. However, the token’s price appears to be slowing down, losing over 2% since reaching a 24-hour high of $7.29.

As of this writing, LINK is valued at $7.12, with a 7.3% increase in the last day. CoinGecko data shows that the cryptocurrency has a daily trading volume of roughly $549.8 million, representing a 219% boost in the last 24 hours.

Related Reading: LINK Price Prediction: Chainlink Rallies Over 7% As The Bulls Aim $8.8

A broader look at the Chainlink market reveals that the LINK price has been on an upward trajectory in recent weeks. Thanks to this bullish momentum, the token has gained about 35% in the past month.