- Cardano trades sideways above $1 amid fading bullish momentum

- Foundation’s X account hack adds to market uncertainty

- MACD signals potential bearish trend shift

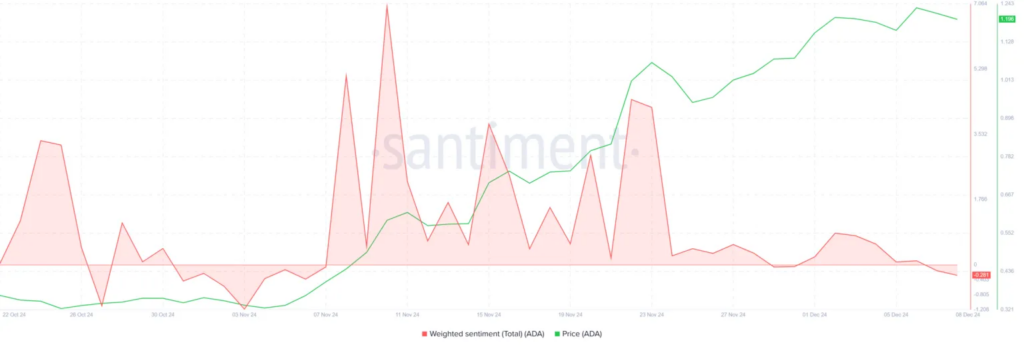

Cardano’s recent price action presents a complex picture as the cryptocurrency maintains its position above $1 while showing signs of weakening momentum. The market landscape has shifted notably from the previous period of strong investor confidence to one of increasing uncertainty and cautious positioning.

Cardano Security Incident Impact

Sunday’s security breach of the Cardano Foundation’s X account, while quickly contained, adds another layer of complexity to market sentiment.

Source: Santiment

The hackers’ false claims about SEC litigation and promotion of fraudulent tokens, though swiftly addressed, highlight the ongoing security challenges facing cryptocurrency projects. Interestingly, the market showed resilience to this incident, with minimal direct impact on ADA’s price action.

The technical picture has grown more cautious, with the Moving Average Convergence Divergence (MACD) completing a bearish crossover during the weekend.

This technical development, particularly significant given the current market context, suggests increasing probability of near-term price pressure. The combination of this bearish signal with subdued trading volume amplifies concerns about sustainable upward momentum.

At the current price of $1, Cardano faces immediate resistance at $1.10. This price point has become increasingly significant as it represents both a psychological barrier and a technical resistance level. The market’s ability to breach and hold above this threshold could determine the next major price movement.

The path forward presents two distinct scenarios. A successful break above $1.20 could catalyze movement toward $1.32, though this would require renewed buying interest and improved market sentiment.