- Cardano price DAA Divergence signals deteriorating market sentiment

- Chaikin Money Flow hits lowest level in 2.5 months

- Support at $0.85 becomes crucial for preventing further decline

Cardano’s recent price action paints a concerning picture as the cryptocurrency touches a multi-week low of $0.84. This decline represents more than just a price drop – it reflects a broader shift in market confidence and participation that could have lasting implications for ADA’s near-term prospects.

Cardano Technical Warning Signs

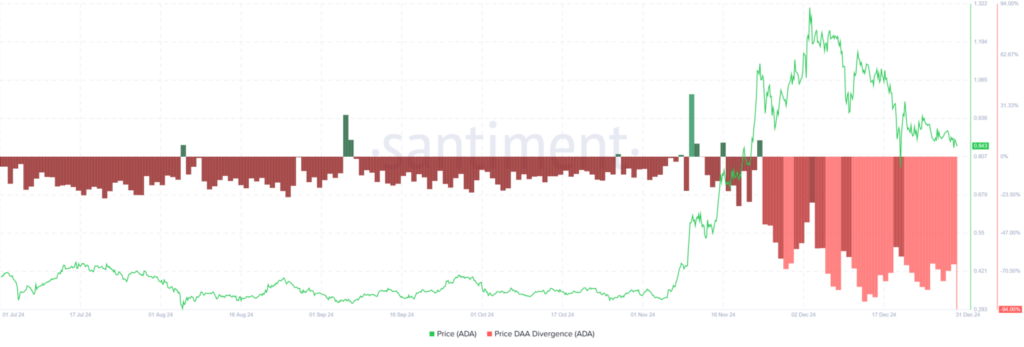

The convergence of technical indicators provides a comprehensive view of Cardano’s current market health. The Price DAA Divergence indicator, which measures the relationship between price and network activity, has triggered a sell signal.

Source: Santiment

This ADA metric is particularly meaningful because it captures not just price movements, but also user engagement with the network – think of it as a measure of Cardano’s ecosystem vitality rather than just its market value.

The Chaikin Money Flow’s descent to its lowest point in two-and-a-half months adds another layer of concern to this analysis.

This indicator, which tracks the flow of capital in and out of an asset, suggests that investors are actively moving funds away from ADA. The prolonged negative reading indicates this isn’t just short-term profit-taking but rather a more sustained shift in investor sentiment.

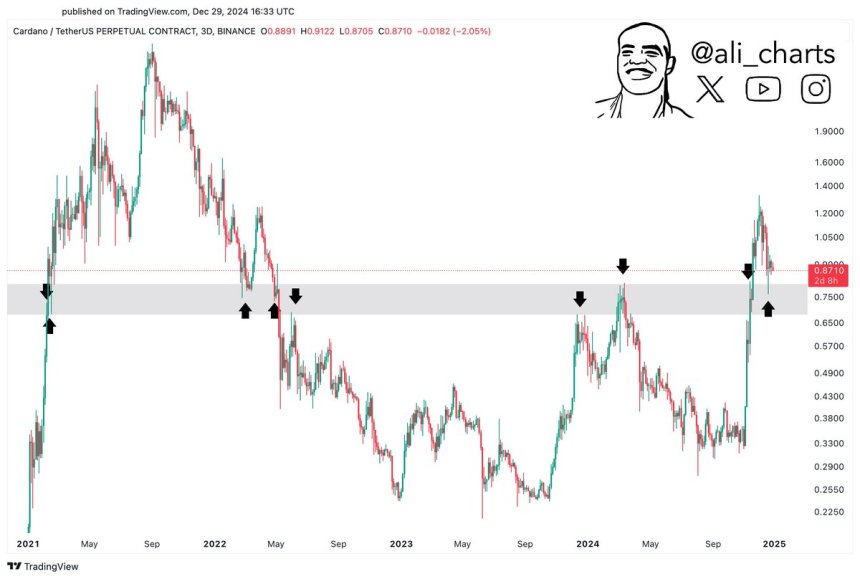

From a price perspective, ADA’s position below the crucial $0.85 support level creates a precarious situation. This level, which previously served as a reliable floor for price action, now looms overhead as potential resistance.

A sustained break below this mark could accelerate the decline toward $0.77, while reclaiming it might open the path to retesting the psychologically important $1.00 level.

The combination of weakening network participation, sustained capital outflows, and technical damage suggests that Cardano faces significant challenges in reversing its current downtrend. However, the market remains dynamic, and a shift in broader sentiment or network-specific developments could quickly alter this bearish outlook.