- Cardano long/Short Ratio hits monthly low of 0.82

- Whale trading activity drops 90.29%

- Price tests support at $0.90 amid growing bearish sentiment

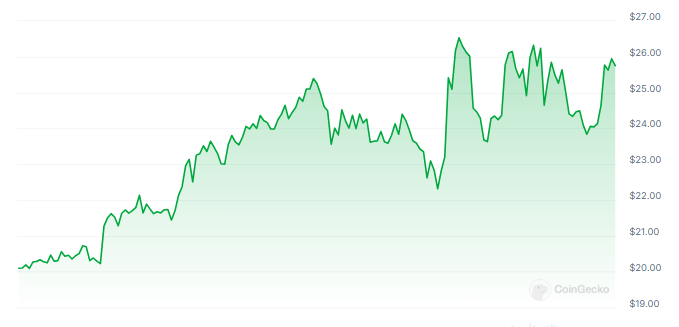

Cardano’s recent market behavior presents an interesting case study in shifting market sentiment. The cryptocurrency’s sideways price action has triggered a notable change in trader positioning, with futures market participants increasingly taking bearish stances through short positions, suggesting growing skepticism about near-term price appreciation.

Understanding Cardano Market Psychology

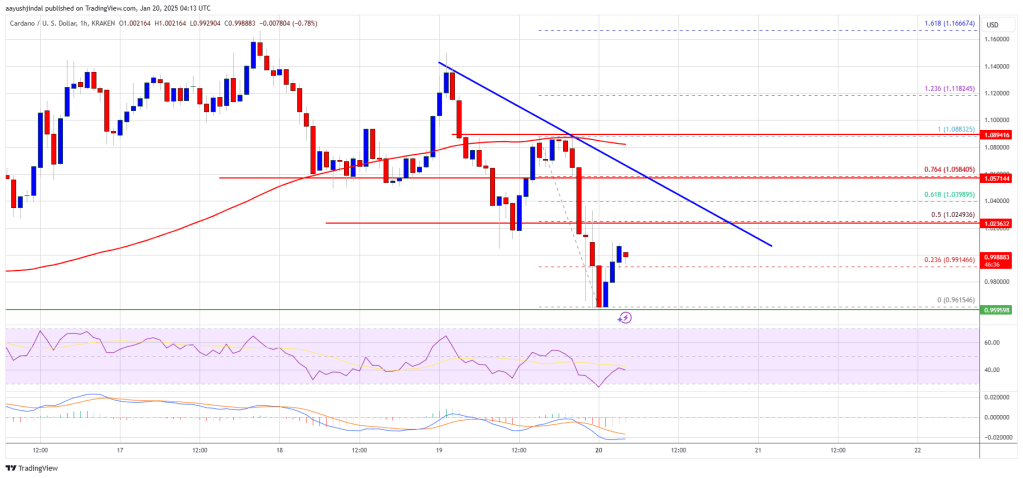

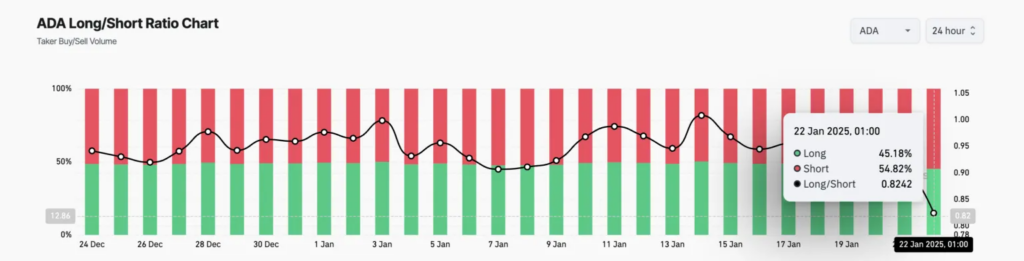

The convergence of multiple bearish indicators tells us something important about current market sentiment toward Cardano. The Long/Short Ratio’s decline to 0.82 indicates that traders are positioning themselves for potential price declines, with short positions outnumbering longs for the first time in a month.

ADA Long/Short Ratio. Source: Coinglass

This shift becomes particularly significant when viewed alongside the negative Weighted Sentiment reading of -0.074, suggesting that both technical traders and social sentiment are aligned in their cautious outlook.

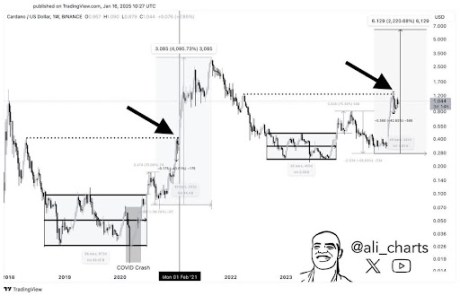

Perhaps most tellingly, the dramatic 90.29% reduction in whale trading activity, as measured by large holders’ netflow, indicates that Cardano’s most influential market participants are stepping back from active trading.

When whales, who typically possess deeper market insight and longer investment horizons, reduce their activity, it often precedes significant market moves.

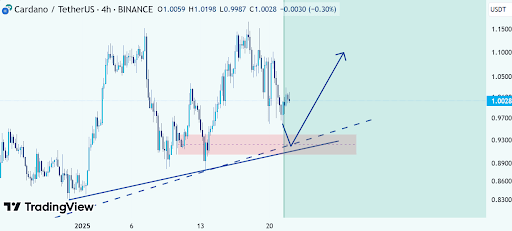

Currently trading at $0.98, ADA faces a crucial test at the $0.90 support level. The convergence of increased short positioning, negative sentiment, and reduced whale activity creates a challenging environment for maintaining price levels.

While a revival in buying interest could stabilize prices above $1, the technical and sentiment indicators suggest continued pressure toward the $0.80 support level remains likely unless market conditions improve significantly.