- Cardano has dropped nearly 10% in the past week, facing increased selling pressure.

- Whale netflow has plummeted 90%, signaling reduced large-holder accumulation.

- If bearish momentum continues, ADA could test $0.82, while a shift in demand may push it above $1.

Cardano (ADA) has struggled over the past week, declining nearly 10% amid broader market downturns. However, a deeper look at on-chain metrics reveals that ADA’s price drop is largely driven by a sharp decline in whale activity.

With mounting selling pressure and weakening investor confidence, ADA is at risk of hitting a 30-day low unless market sentiment shifts in favor of accumulation.

Cardano Whales Reduce Buying Activity

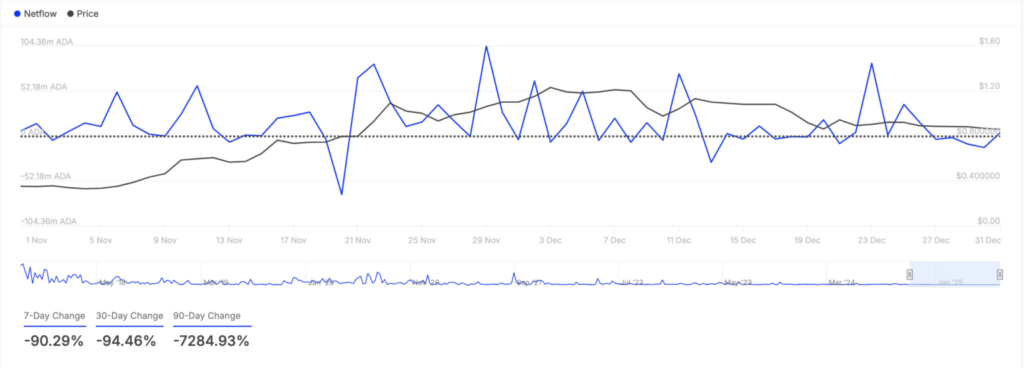

On-chain data from IntoTheBlock shows that Cardano’s large holders’ netflow has dropped by 90% over the past seven days. Large holders—whales who own more than 0.1% of ADA’s circulating supply—have significantly reduced their buying activity, indicating a shift toward selling.

ADA Large Holders Netflow. Source: IntoTheBlock

Large holders’ netflow measures the balance of ADA moving in and out of whale wallets. A sharp decline suggests that whales are offloading their holdings, increasing supply and contributing to downward price pressure.

This decline in whale activity often leads to a ripple effect, with retail traders also hesitating to buy or selling their holdings in anticipation of further losses. This behavior exacerbates ADA’s price decline, making recovery more difficult.

Profit-Taking Accelerates Downtrend

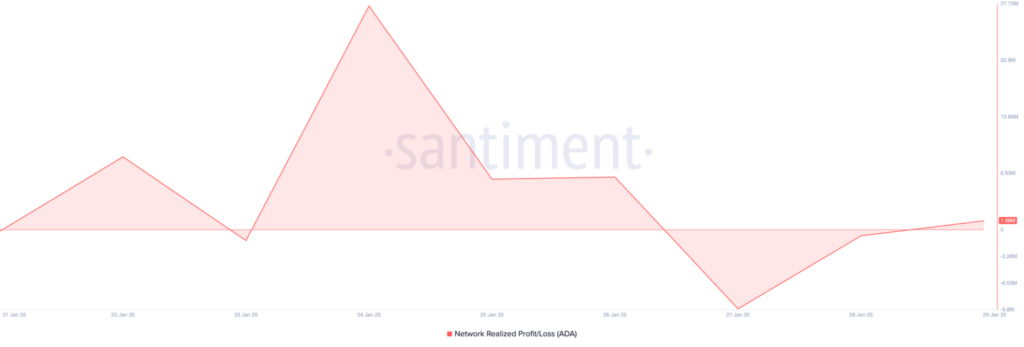

Beyond whale movements, Santiment data shows that Cardano’s Network Realized Profit/Loss (NPL) has turned positive, indicating a surge in profit-taking.

ADA NPL. Source: Santiment

The NPL metric tracks the difference between an asset’s last movement price and its current market price. When the NPL is positive, more holders are selling at a profit than at a loss, leading to increased market supply.

This widespread sell-off suggests that ADA is facing heightened bearish sentiment, making it difficult to maintain key support levels.

If the current downtrend persists, ADA could drop to a 30-day low of $0.82. However, if market conditions shift toward accumulation and demand rises, ADA could reclaim the $1 level, invalidating the bearish outlook.