- Cardano needs to hold $0.72 for continued bullish momentum

- ADA retraces 8% from recent multi-year high

- Analysts project targets ranging from $1.36 to $6

Leading cryptocurrency analyst Rekt Capital has identified a crucial price level that Cardano (ADA) must maintain to continue its bullish trajectory. The analysis comes as ADA consolidates following its recent surge to $0.8466, a level not seen since April 2022.

Analyst shares key Cardano support levels

$ADA

Cardano has rallied significantly since discussed in the previous Altcoin Newsletter#ADA is now on the cusp of a new Macro Uptrend

Holding above $0.72 (black) would confirm the new uptrend#BTC #Crypto #Cardano https://t.co/OLG6vey1Am pic.twitter.com/NR9UzIL6CD

— Rekt Capital (@rektcapital) November 20, 2024

According to Rekt Capital, the $0.72 mark has transformed from resistance into a critical support level. “Cardano needs to establish solid support at this former supply zone to maintain its upward momentum,” the analyst noted.

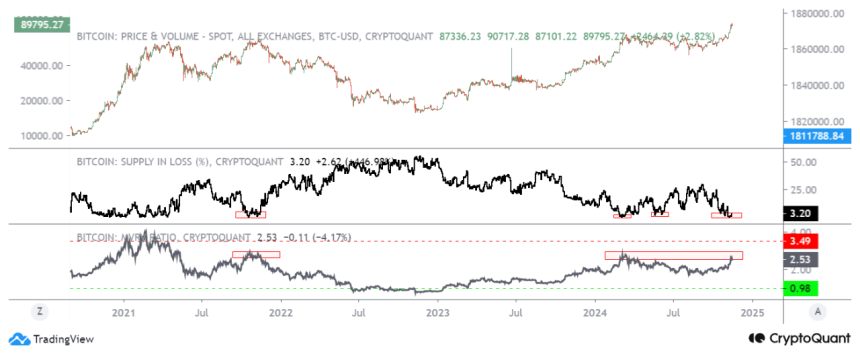

Despite Bitcoin’s push to a new all-time high of $98,000, Cardano has shown divergent behavior, retracing over 8% from its recent peak. This disconnect from the market leader’s performance has raised questions about ADA’s immediate trajectory.

Technical analysis suggests several potential targets for ADA:

- Near-term Fibonacci extension at $0.994 (1.272)

- Secondary target at $1.363 (1.618)

- Long-term projection of $6 by analyst Ali Martinez (July-September 2025)

“Cardano could replicate its 2020 bull cycle performance,” Martinez stated, dismissing criticism of the asset while maintaining his bullish long-term outlook.

Trading at $0.78, ADA shows marginal daily losses but maintains a 9% buffer above the crucial $0.72 support zone. The sustainability of this position could determine the asset’s next major move as the market watches for confirmation of continued bullish momentum.