- Solana’s surge faces market fluctuations and 8% price correction.

- SOL remains 15.7% below its all-time high, but bullish.

Solana (SOL) captivated the crypto community as it recently surged above $225, hitting its highest point in nearly three years. This rally, which briefly brought SOL’s market cap into the coveted $100 billion “club,” marks a significant milestone in the ongoing bullish phase called “Moonvember.” Despite an overall 8% weekly increase, recent market shifts tempered the celebration, with Solana experiencing a 7% decline in the past 24 hours as the global crypto market cap fell 3.7%.

Despite the 24-hour setback, SOL’s performance over the past week still showcases the strong sentiment. Notably, SOL remains 21% below its all-time high of $259, achieved in November 2021. Recent analysis suggests that if Solana maintains its hold above the $200 level—a barrier breached for the first time in six months—the asset could continue its upward trajectory, especially with key support in the $180–$200 range.

Moreover, Solana’s Open Interest (OI) hit a record $4.28 billion earlier in the month but has since dropped by 5.18%, suggesting a possible shift toward profit-taking. Simultaneously, the trading volume surged by over 55%, highlighting strong ongoing interest despite slight bearish indicators, including a long/short ratio near 0.95. These mixed signals indicate a balance between bullish enthusiasm and caution.

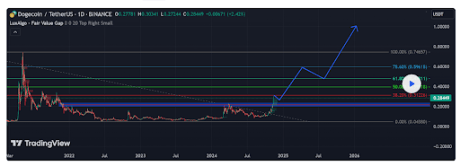

SOL Price And Demand

Adding to the dynamics, approximately 524,030 SOL tokens (worth $110.25 million) are set for release, an increase that may slightly affect price momentum if demand does not keep pace. However, this minor influx into the circulating supply is unlikely to significantly impact SOL’s price given the current market strength.

SOL Price Chart, Source: Sanbase

Looking forward, analysts predict a potential continuation of the rally, with some speculating that Solana could break into a long-term uptrend reminiscent of its 2021 performance. If historical patterns hold, SOL could potentially reach a $1,000 valuation, especially given the strong trading volume and recent breakout above key resistance levels.

Highlighted News Of The Day

Bitget Re-enters UK Market with 150 Tokens Following FCA Approval