- Ethereum trades in the $3.2K range, with a brief 1.47% spike.

- ETH experienced a liquidation of $88.74 million in the market.

The surge in crypto asset prices ignited a bullish sentiment in the cryptocurrency market. Notably, the global crypto market cap currently settles at $2.99 trillion, with a 3.64% increase over the day. Bitcoin (BTC) hit its new all-time high of $93.4K, which lifted the crypto market.

Despite the surge, the largest altcoin Ethereum (ETH) struggles to break the crucial $3.5K mark after crossing the $3.2K mark. The altcoin began a downside correction and is now consolidating and facing obstacles at $3,260. As per analysts’ predictions, Ethereum’s upside movement could fuel the upcoming altcoin season.

The asset has recorded a moderate gain of 1.47% over the past 24 hours. With the current bearish momentum, ETH may end up trading to the downside today. At the time of writing, Ethereum trades at $3,224.

Ethereum has dipped to a low of $3,121 and ascended to $3,337. It’s crucial to note that the market observed a liquidation of $88.74 million worth of Ethereum within this span. Also, ETH’s daily trading volume stays at $48 billion.

On the other hand, on-chain data reveals that whales are actively accumulating Ethereum. A new whale wallet added 7,389.5 ETH, worth $23.44 million. Over the past 3 days, this whale has collected 18,049 ETH, amounting to $59.3 million.

Will ETH Break Through Key Resistance Soon?

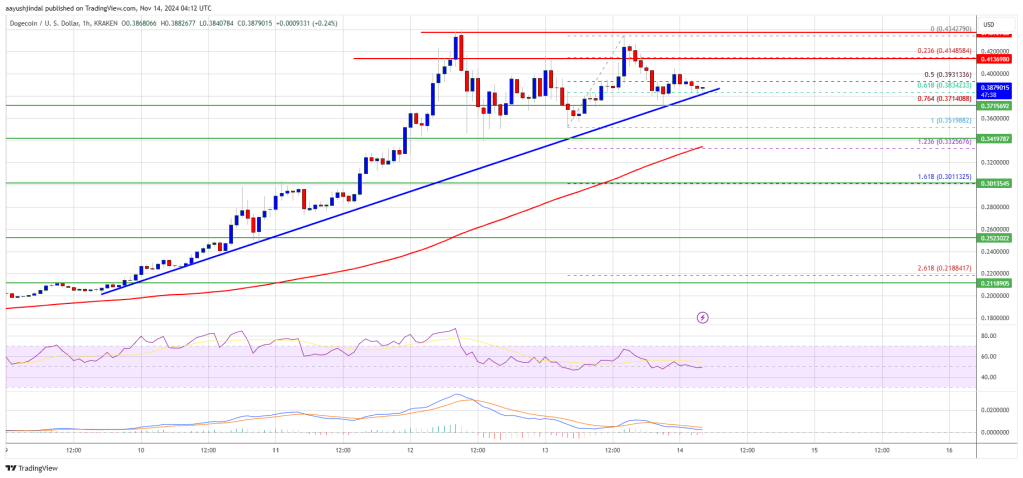

The technical analysis of the ETH/USDT trading pair unveiled a brief negative sentiment as the Moving Average Convergence Divergence (MACD) line settled beneath the signal line. This indicates the incoming negative trend in the market.

ETH chart (Source: TradingView)

The Chaikin Money Flow (CMF) indicator is at 0.15, suggesting a positive money flow, briefly hinting at the possibility of an upside correction. Meanwhile, ETH’s daily trading volume has slipped by over 11.95%.

Besides, the existing market sentiment of ETH is likely in the neutral zone, as the daily relative strength index (RSI) is positioned at 50.64. In addition, the daily frame of Ethereum exhibits the short-term 50-day moving average above the long-term 200-day moving average.

Ethereum’s four-hour price chart signals a brief downside correction. After a strong rally, the ETH price has faced a minor pullback. If Ethereum fails to clear the $3,308 resistance, it could likely start a steady downside correction. The immediate support on the downside might be at $3,103. Notably, a decisive drop below the $3K mark could drive the price further down.

On the contrary, if the ETH bull blocks the asset from dropping below $3.2K, the closest resistance level might be $3,398. If this resistance is broken, Ethereum’s price could potentially climb to the $3.5K mark.

Highlighted Crypto News

Trump Endorses Pro Crypto Matt Gaetz for US Attorney General