- Ethereum whales accumulate, suggesting a potential market rebound despite recent declines.

- Technical indicators hint at price stabilization and a possible bullish breakout.

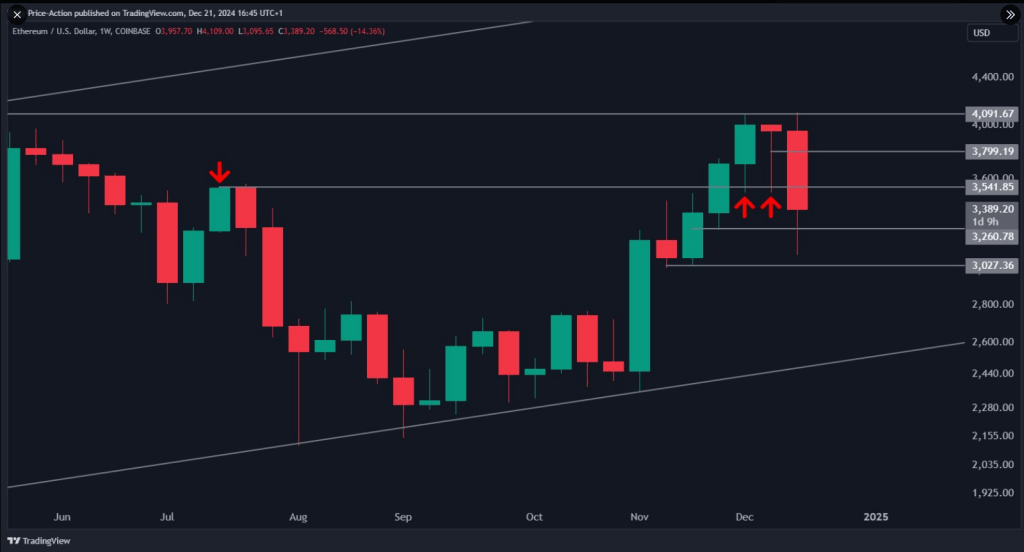

Ethereum (ETH) is trading at $3,323, registering a slight 0.10% dip alongside a 10% drop in trading volume over the past 24 hours. This follows a turbulent week where ETH hit a 29-day low of $3,101 and recorded a 16% weekly decline. The daily Relative Strength Index (RSI) now hovers at 39, nearing oversold territory.

Notably, Ethereum’s whale activity surged during the downturn. Over three days, whales accumulated 340,000 ETH worth over $1 billion, hinting at strategic bulk purchases during price dips. Historically, such patterns often signal a potential market rebound.

ETH Price Chart, Source: Sanbase

Meanwhile, on the technical front, Ethereum’s weekly chart shows signs of stabilization. The price has retested key levels within the Ichimoku Kinko Hyo indicator, including the Tenkan and Kijun lines, suggesting the correction phase may be concluding. Interaction with the Kumo Cloud’s Senkou Span A, now a support level, adds further evidence of resilience. However, a potential retest of Senkou Span B could serve as a litmus test for market sentiment.

Long-term trends also appear promising. Ethereum’s Long Term Trend Directions (LTTD) score is 0.82, indicating sustained buyer interest and a bullish year-end outlook. Despite mid-year dips, the score rebounded in October, reflecting renewed momentum.

Analysts Remain Bullish On Ethereum

Institutional dynamics reveal mixed sentiments. Ethereum ETFs saw significant outflows, with BlackRock’s ETHA losing $103.7 million amid market declines. However, BlackRock added 33.9K ETH worth $143.7 million, underscoring institutional confidence.

Moreover, On-chain metrics further bolster bullish projections. According to IntoTheBlock, Ethereum’s large transactions reached 2.83 million ETH, worth approximately $11 billion. Rising whale activity and positive weighted sentiment suggest a potential price rally.

Analysts predict Ethereum could break the $3,982 resistance. Broader bullish conditions could propel prices above $4,500, reaffirming its status as a leading altcoin.

Highlighted News Of The Day

FTT Tops Gainers List with 8% Surge While Crypto Market Declines