- Donald Trump leading the Polymarket presidential election polls with a 66.1% chance of winning, while Kamala Harris stands at 33.8%.

- Standard Chartered bank analysts predict that Bitcoin (BTC) could climb to $125,000 if Trump wins the election.

The United States Presidential Election 2024, which is scheduled for November 5, is heating up the debate and the impact of a Donald Trump victory on the global crypto markets, particularly Bitcoin (BTC). As the presidential candidates Trump and Kamala Harris battle for triumph, prominent figures in the markets predict that if Trump wins the election, it could spark a bullish trend for Bitcoin and other cryptocurrencies, possibly pushing the “BTC price to $125,000.”

Donald Trump is currently leading the presidential election polls with a 66.7% chance of winning, while Kamala Harris holds a 33.4% chance, as per prediction market Polymarket.

(Presidential Election Prediction Poll Source: Polymarket)

Will Bitcoin Reach $125,000?

According to Geoff Kendrick, Head of Crypto Research at Standard Chartered, Bitcoin is eyeing to hit one more all-time high by the end of this year, regardless of whether Vice President Kamala Harris or former President Donald Trump emerges victorious in the upcoming presidential election.

Also, he highlighted that each presidential candidate brings unique regulations and opportunities for crypto. But “the risks associated with a Harris presidency might be overstated.” Further, Kendrick predicts that “Bitcoin may end 2024 at a new all-time high and says it could reach around $125,000 if Trump wins or approximately $75,000 if Harris takes office.”

Kendrick also suggests that on Election Day (Nov. 5), “Bitcoin price may possibly move to about $73,000, just 1% below its current all-time high of $73,750.”

Moreover, Kendrick noted that if Harris wins, initially it might cause Bitcoin prices to dip. However, he anticipates that the market will rebound as investors recognize the regulatory progress. Ultimately, he believes that positive developments will continue to support Bitcoin as a solid investment choice, regardless of the political view.

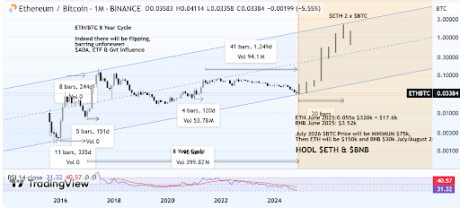

BTC Price Chart (Source: TradingView)

Last week, Bitcoin reached a three-month high of $69,051. But soon after, it was retraced and traded between $66.5K and $68.5K. However, today, the cryptocurrency recovered and recorded an intraday high of $68.5K. At the time of writing, BTC traded at $68,358 with a market capitalization of $1.35 trillion.

The current rally in the BTC price has been supported by optimism over the expected softer regulations for cryptocurrencies after the US Presidential Elections in 2024. The US presidential elections historically largely influenced the financial markets, and the crypto market is no exception.

According to the BTC price prediction, the asset expected to trade between $46,987 to $104,023 in 2025.

Donald Trump’s Stance on the Crypto Market

Trump, who once called crypto a scam, has recently fueled hope that he’d be good for the crypto industry. Earlier this year, Trump waved his open support for Bitcoin being referred to as a “Trump trade” due to his pro-crypto stance. Also, during his campaign, he promised to make America “the crypto capital of the planet.”

I promised to Make America Great Again, this time with crypto. @WorldLibertyFi is planning to help make America the crypto capital of the world! The whitelist for eligible persons is officially open – this is your chance to be part of this historic moment. Join:…

— Donald J. Trump (@realDonaldTrump) September 30, 2024

Moreover, Trump visited the Bitcoin 2024 crypto conference in Nashville in July, where he promised to fire SEC Commissioner Gary Gensler and keep all of the federal government’s bitcoin in a “strategic national bitcoin stockpile” if elected.

Most legal scholars agree the president does not have the power to fire the SEC chair outright. However, the president can replace the chair with another commissioner until the Senate confirms a permanent replacement.

Even Trump and his son introduced a new crypto project “World Liberty Finance (WLFI),” which went public on October 15. Additionally, WLFI aimed to raise $300 million, but it has raised around $12.72 million.

Further, since June, Trump’s political action committee has raised around $7.5 million in crypto donations.

In 2024, crypto corporations have donated over $119 million for political campaigns, mainly to a non-partisan super PAC focused on supporting pro-crypto candidates and opposing crypto skeptics. Remarkably, the crypto industry contributed nearly half (44%) of the total $274 million raised from corporate donors.

Harris has been relatively quiet about her stance on crypto. But in recent months, she has begun to express subtle support for the industry while campaigning. In September, during a Wall Street fundraiser, she mentioned that her administration would “encourage innovative technologies like AI and digital assets while safeguarding our consumers and investors.”

Finally, with strong support from the crypto community and Trump’s pro-crypto stance, his presidency could create a welcoming environment for Bitcoin and other digital assets.