- Bitcoin has retreated to the $67K range after reaching a weekly high of $69,450 on Oct 21.

- Tesla now holds over 11,509 BTC, and MicroStrategy owns 252,220 BTC.

Bitcoin has slipped back to the $66K range after starting the week strong and reaching an intraday high of $69,450 on October 21. Currently, the cryptocurrency is attempting to recover, climbing back to $67K after hitting an intraday low of $66,612.

Earlier today, Bitcoin tested the $67,700 resistance zone but struggled to maintain that level. At the time of writing, the price saw a slight increase and traded at $67,176.

Meanwhile, institutional involvement in Bitcoin appears to be on the rise. Recent reports from intelligence firm Arkham reveal that Elon Musk’s Tesla currently holds over 11,509 Bitcoins ($772 million). In addition, MicroStrategy, led by Bitcoin advocate Michael Saylor, now holds a staggering 252,220 Bitcoins, valued at approximately $9.91 billion.

Further, on Monday Bitcoin’s 7-day moving average (7DMA) hashrate hit an all-time high of 703 EH/s, marking a 13% rise since April’s halving event. This surge indicates growing miner activity, which could influence future price movements.

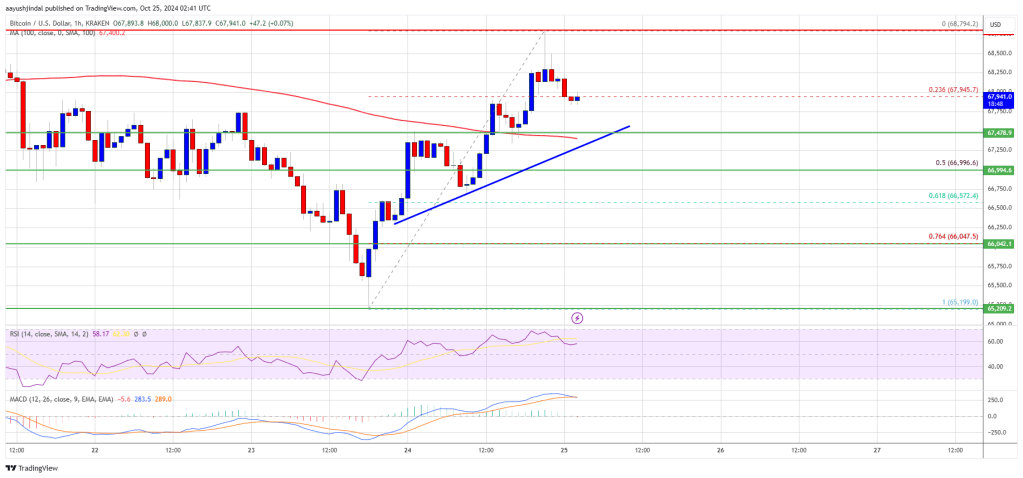

24-H Technical Analysis for Bitcoin

On the technical front, Bitcoin’s price is almost nearing the 23.6% Fibonacci retracement level from its recent swing low of $66,536 to its swing high of $69,875. However, it remains below $67,300 and the 9-day Exponential Moving Average (EMA), with a Relative Strength Index (RSI) of 47, signaling a neutral market stance. A contracting triangle is also forming on the 4-hour chart, with support at $66,677.

Looking ahead, if Bitcoin breaks the key resistance level at $67,250, it could target higher levels around $67,890 and $68,130. However, if the price loses momentum, support levels at $66,320, $65,760, and $65,100 may come into play. A break below these levels could push BTC down to $57,000.

Today BTC is expected to trade in the range between $66,580 support and $67,800 resistance.

Highlighted Crypto News Today

Worldcoin Moves $12M Worth WLD To 5 Market Makers