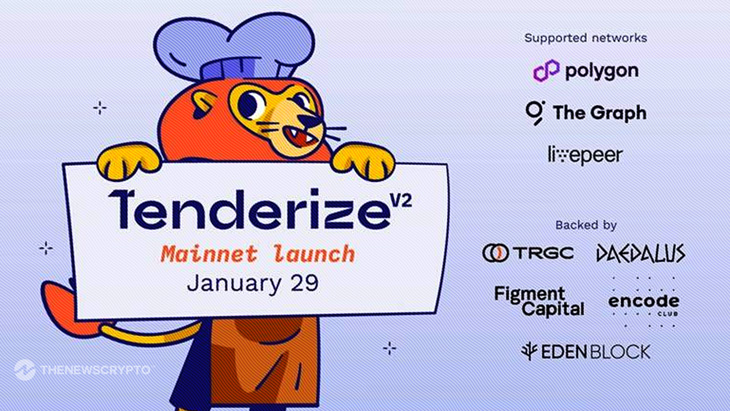

Tenderize Labs proudly announces the launch of Tenderize v2 Mainnet, a significant advancement in the decentralized finance (DeFi) and liquid staking landscape. This platform is the culmination of two years of dedicated research and development, signifying a major leap in the DeFi and Liquid Staking ecosystem. The launch of Tenderize v2 marks a new era in liquid staking, known as ‘Liquid Staking 2.0’, introducing a groundbreaking model with validator-specific liquid staked tokens (LSTs) and a shared liquidity pool.

Tenderize v2: Ushering in Liquid Staking 2.0

With the backing of industry giants like Figment, Eden Block, and TRGC, Tenderize introduces ‘Liquid Staking 2.0‘, an innovative approach featuring unique validator-specific liquid staked tokens (LSTs) and a shared liquidity pool model. This new standard ensures non-custodial, permissionless access for all validators and delegators, thereby maintaining the decentralization and censorship resistance of the underlying networks.

Barriers To Entry In Liquid Staking 1.0

To service demand for liquid staking, without centralizing the underlying validator set, a totally permissionless liquid staking protocol must exist. Such a system allows more validators to participate in the liquid staking ecosystem, re-decentralizing the underlying crypto network. The question at hand is, why aren’t more validators and solo-stakers using the liquid staking protocols of today?

- Validator Whitelists: Popular protocols today only work with select validator sets, requiring new validators to go through a rigorous interview process. This results in a massive stake being managed by a cartel of selected validators.

- Socialized Risk: Companies running validator businesses have to control risk. When LST protocols use a shared token, the yield of that token depends on the group of validators. If one of the many validators is slashed, all users are punished.

- Expensive, Fragmented, On-Chain Liquidity: Projects have successfully launched new liquid staked tokens in the past, such as cbETH and stETH. The liquidity of these assets often runs thin due to the value of incentive tokens decreasing, especially in bear markets. The thin liquidity causes problems during the borrowing and lending process.

Addressing the Challenges in Liquid Staking

Historically, liquid staking faced several barriers that hindered its widespread adoption and threatened the decentralization of blockchain networks. One major issue was the reliance on select validator sets, which led to a centralization of control and massive stakes being managed by a cartel of selected validators. Additionally, the shared token model in existing LST protocols meant that all users bore the risks associated with any one validator’s performance. This centralized risk and the fragmented, often expensive on-chain liquidity have been critical concerns, especially in bear markets.

The Cookout: Kickstarting the Tenderize v2 Experience

The launch of Tenderize v2 unfolds in two distinct phases, with the first phase, “The Cookout,” set to commence at the end of January 2024. This phase is focused on enhancing the Total Value Locked (TVL) of tTokens and bolstering TenderSwap liquidity. Users can participate by staking or providing liquidity for MATIC, LPT, and GRT, earning unique rewards and points on top of their native staking yields.

The Feast: WAGYU Token Generation Event

Following “The Cookout ” is “The Feast,” which marks the Token Generation Event (TGE) for WAGYU, the native governance and utility token of Tenderize. WAGYU will be distributed to users based on their accumulated points, a novel approach in the realm of token distribution.

Significance for the DeFi Community

This launch is particularly significant for those keen on the evolution of DeFi and Liquid Staking. Tenderize v2 offers a unique platform that allows for greater interaction and benefits from Liquid Staking, fostering a more decentralized network environment. By covering this story, media outlets can provide their audiences with invaluable insights into the future of Liquid Staking and Validator Decentralization.

Maximizing Participation in The Cookout

To ensure users get the most out of “The Cookout,” a variety of activities are available, including an onboarding quest, a Tenderize V1 airdrop, the creation of invite codes, and opportunities for token staking. This engagement prepares users for the Mainnet Launch on the Arbitrum and Ethereum networks, where they can stake their tokens and earn rewards in a novel and efficient manner.

Empowering Users with WAGYU

The conclusion of “The Cookout” leads to “The Feast” and the exciting WAGYU TGE, a pivotal event where users transition into key stakeholders within the Tenderize ecosystem. WAGYU serves as a crucial element in aligning the interests of validators, delegators, and token holders, ensuring a cohesive and mutually beneficial ecosystem.

Invitation to Join The Cookout Journey

We extend an invitation to all to share and engage with this groundbreaking development in DeFi and Liquid Staking. By doing so, you are not only keeping your audience informed about the latest developments but also helping them understand the vast opportunities that Tenderize v2 presents.

For further information and updates on Tenderize v2, please explore the comprehensive Whitepaper , visit the Website, and follow Tenderize v2 on Twitter for real-time updates.

Contact Information

- Name: Nicholas Resendez

- Email: [email protected]

- Organization: Tenderize Labs

- Phone: (310) 935-1854

- Website