BNB price (Binance coin) is attempting a recovery from $202 against the US Dollar. The price could start a strong increase if it clears the $215 resistance level.

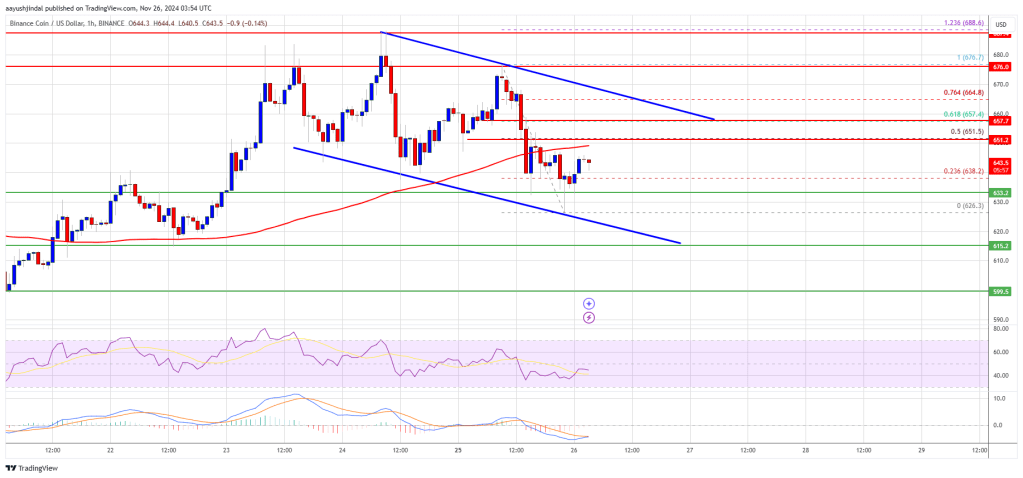

In the past few days, BNB price saw a major decline from well above the $235 level. The price declined below the $225 and $220 levels to enter a bearish zone, similar to Bitcoin and Ethereum.

It even spiked below the $212 support. It tested the $202 zone and recently started an upside correction. There was a move above the $210 level. Besides, there was a break above a key bearish trend line with resistance near $208 on the 4-hour chart of the BNB/USD pair.

However, BNB price is still trading well below $230 and the 100 simple moving average (4 hours). On the upside, it is facing resistance near the $214 level. It is close to the 23.6% Fib retracement level of the downward move from the $248 swing high to the $203 low.

Source: BNBUSD on TradingView.com

A clear move above the $214 zone could send the price further higher. The next major resistance is near $225 or the 50% Fib retracement level of the downward move from the $248 swing high to the $203 low. A close above the $225 resistance might increase the chances of a push above the $230 resistance.

If BNB fails to clear the $214 resistance, it could start another decline. Initial support on the downside is near the $208 level.

The next major support is near the $202 level. If there is a downside break below the $202 support, the price could drop toward the $200 support. Any more losses could send the price toward the $185 support.

Technical Indicators

4-Hours MACD – The MACD for BNB/USD is losing pace in the bearish zone.

4-Hours RSI (Relative Strength Index) – The RSI for BNB/USD is currently near the 50 level.

Major Support Levels – $208, $202, and $200.

Major Resistance Levels – $214, $225, and $230.

- Binance coin price is slowly moving higher from the $202 zone against the US Dollar.

- The price is now trading below $230 and the 100 simple moving average (4 hours).

- There was a break above a key bearish trend line with resistance near $208 on the 4-hour chart of the BNB/USD pair (data source from Binance).

- The pair might gain bullish momentum above $215 and $216.

Binance Coin Price Eyes Fresh Increase

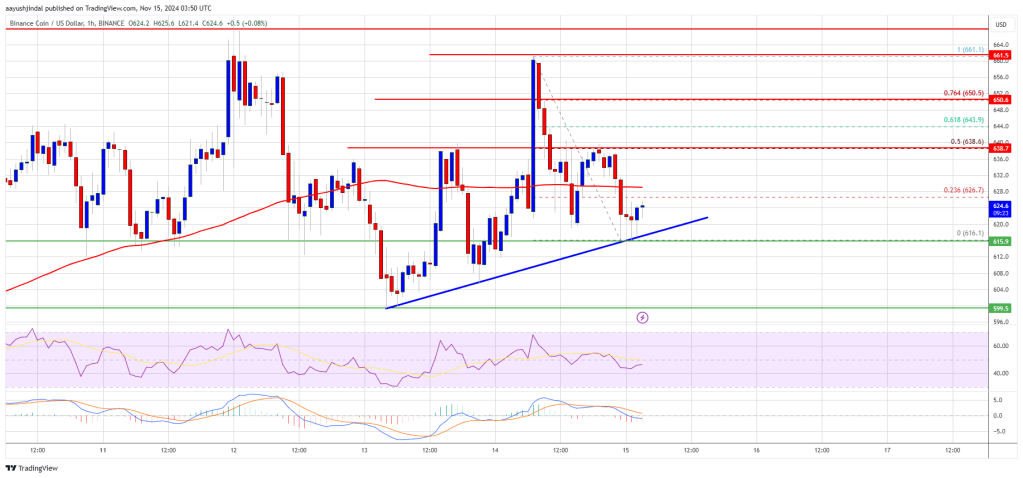

In the past few days, BNB price saw a major decline from well above the $235 level. The price declined below the $225 and $220 levels to enter a bearish zone, similar to Bitcoin and Ethereum.

It even spiked below the $212 support. It tested the $202 zone and recently started an upside correction. There was a move above the $210 level. Besides, there was a break above a key bearish trend line with resistance near $208 on the 4-hour chart of the BNB/USD pair.

However, BNB price is still trading well below $230 and the 100 simple moving average (4 hours). On the upside, it is facing resistance near the $214 level. It is close to the 23.6% Fib retracement level of the downward move from the $248 swing high to the $203 low.

Source: BNBUSD on TradingView.com

A clear move above the $214 zone could send the price further higher. The next major resistance is near $225 or the 50% Fib retracement level of the downward move from the $248 swing high to the $203 low. A close above the $225 resistance might increase the chances of a push above the $230 resistance.

Another Decline in BNB?

If BNB fails to clear the $214 resistance, it could start another decline. Initial support on the downside is near the $208 level.

The next major support is near the $202 level. If there is a downside break below the $202 support, the price could drop toward the $200 support. Any more losses could send the price toward the $185 support.

Technical Indicators

4-Hours MACD – The MACD for BNB/USD is losing pace in the bearish zone.

4-Hours RSI (Relative Strength Index) – The RSI for BNB/USD is currently near the 50 level.

Major Support Levels – $208, $202, and $200.

Major Resistance Levels – $214, $225, and $230.