- BNB price consolidates, but Chaikin Money Flow (CMF) shows bullish divergence.

- Long/Short ratio at 1.04 indicates positive sentiment among traders.

- Potential targets: $598 and $645.90 on bullish breakout, or $468.90 if bearish trend emerges.

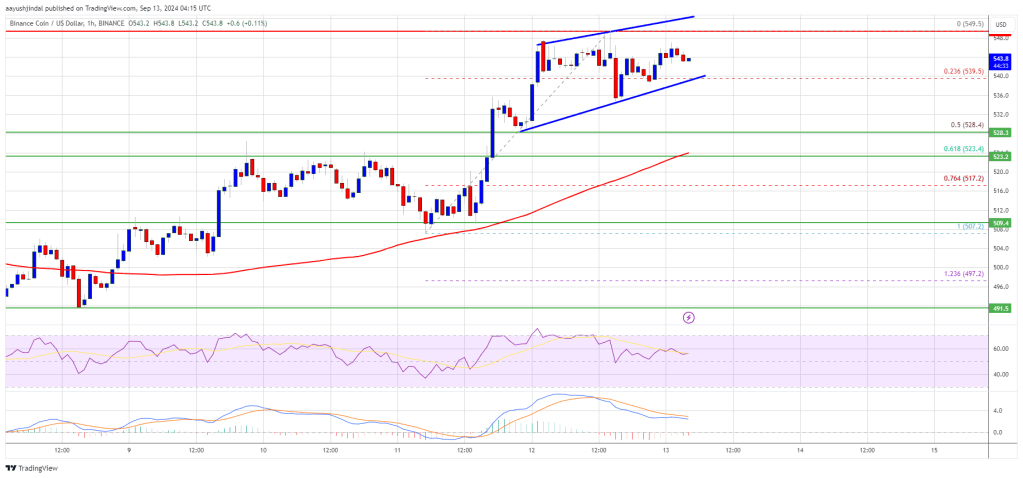

Binance Coin (BNB) finds itself in a state of market indecision, with recent price action characterized by sideways movement as neither bulls nor bears muster sufficient momentum to dictate a clear directional trend.

Despite this apparent stagnation, emerging technical indicators suggest the formation of a bullish divergence, prompting a segment of market participants to accumulate BNB in anticipation of a potential upward breakout.

The period between September 6 and 12 saw BNB’s price trend upward in an attempt to breach the long-standing support level at $560. However, this effort ultimately fell short, resulting in the current consolidation phase where the coin’s price oscillates without a definitive trend.

BNB’s CMF shows upward trajectory

Intriguingly, while BNB’s price consolidates, its Chaikin Money Flow (CMF) indicator has been on an upward trajectory, signaling a bullish divergence. This technical formation occurs when an asset’s price moves sideways or downward while its CMF rises, suggesting an increase in buying pressure that has yet to manifest in price action.

This divergence potentially indicates accumulation by “smart money” investors who foresee an upside breakout once the price consolidation phase reaches its conclusion.

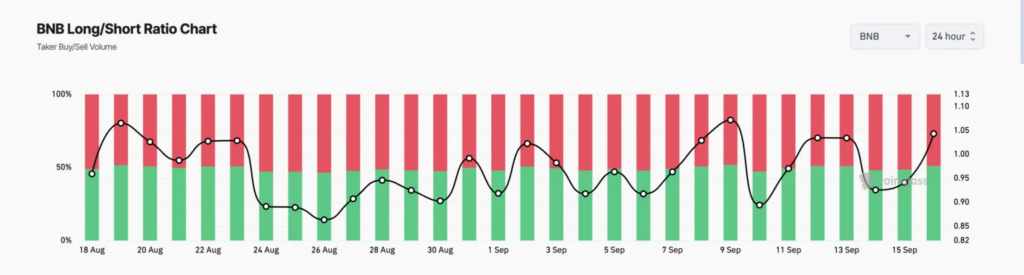

Source: Coinglass

Supporting this bullish narrative, BNB’s Long/Short ratio currently stands at 1.04, reflecting a slight preference for long positions among traders and suggesting positive sentiment regarding the coin’s future price movement.

Looking ahead, a successful bullish breakout could propel BNB beyond the $560 level, setting the stage for a challenge of the key resistance at $598. This price point has rebuffed BNB’s advances three times since July, making a potential breach particularly significant. Should this resistance fall, BNB could potentially rally to a three-month high of $645.90.