Binance Smart Chain (BNB) has seen significant growth in its daily active addresses and transactions in the second quarter of 2023, according to a report by blockchain analytics firm Messari.

The increase in activity was primarily driven by LayerZero, a cross-chain messaging protocol that enables lightweight and efficient communication between different networks.

However, BNB’s market cap declined by 25.2% after the US Securities and Exchange Commission (SEC) alleged that BNB is a security in its regulatory actions against Coinbase and Binance.

Despite this, the total cryptocurrency market cap increased by 2% quarter-over-quarter (QoQ), primarily driven by Bitcoin (BTC) and Ethereum (ETH).

Per the report, BNB’s revenue in BNB decreased by 6.1% QoQ as average transaction fees declined 25.5% after BSC validators voted to reduce gas fees from 5 to 3 Gwei.

Nevertheless, staking on the network remained stable. BNB Chain plans to increase the number of validators from 29 to 100 with a new validator reward model (balanced mining) and a validator reputation system.

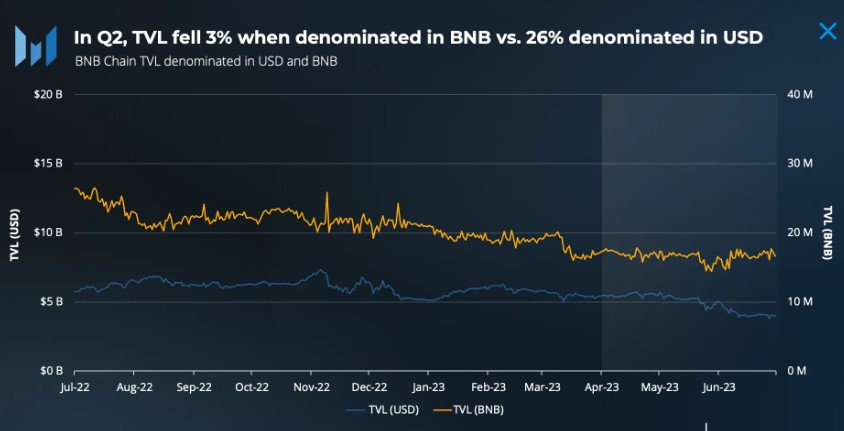

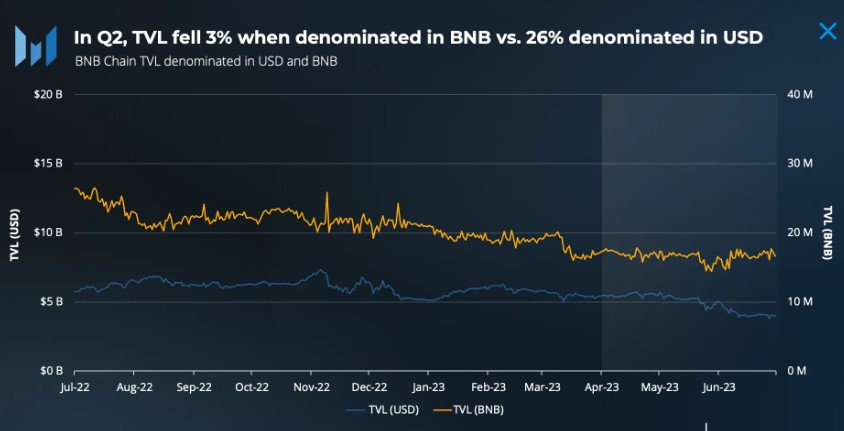

On the other hand, the Binance Smart Chain saw a decrease in total value locked (TVL) denominated in USD during Q2 2023, decreasing by 26.3%. However, TVL denominated in BNB was relatively flat at -2.8%.

While PancakeSwap remained the most prominent protocol by TVL on the BNB Chain, its dominance decreased from 45% to 37% during the quarter, indicating a shift in TVL concentration towards a more robust DeFi ecosystem.

In the stablecoin space, Binance Smart Chain has the third-highest total stablecoin market cap of approximately $5.7 billion, trailing behind Ethereum and TRON. The BUSD market lost some of its users after regulators forced Paxos to cease the issuance of BUSD, resulting in a decline of approximately 54% in the BUSD market cap on the BNB Chain during Q1.

Developer engagement also showed positive growth during Q2, with the number of unique contracts verified growing by 51.9% QoQ, and full-time developers on the BNB Chain increasing from 130 to 133 QoQ.

Despite the decline in TVL denominated in USD, the BNB Chain’s continued expansion of its DeFi ecosystem and the shift in TVL dominance towards a more diverse range of protocols signal a promising outlook for the ecosystem’s future.

Binance Smart Chain Outlines Ambitious Plans For 2023

Despite the regulatory challenges, BNB Chain has laid out robust plans for 2023, including increasing the network’s gas limit to boost throughput and reducing the data footprint through state offload.

BNB Chain also plans to further decentralize by introducing a new validator reward model and a validator reputation system to increase the number of validators from 29 to 100.

The roadmap highlights other initiatives, including increased scalability through modular architecture, creating a data storage network, and implementing consumer protections provided by blockchain security firms.

In Q2, BNB Chain validators and projects discussed the integration of miner extractable value (MEV) within the BSC network, with some validators piloting MEV in various formats. With its wide-reaching plans, BNB Chain aims to remain competitive for the rest of 2023.

While the regulatory challenges faced by Binance and Binance.US directly impact the entire crypto ecosystem, Binance and BNB Chain are separate entities. Binance, Binance Labs, and the Binance Launchpad help grow the BNB Chain ecosystem through asset listings, liquidity provision, investment, and project launches.

The outcomes of the ongoing lawsuits are unpredictable, and adverse outcomes could slow the advancement of the BNB Chain ecosystem and bring continued volatility to its native BNB token.

Featured image from Unsplash, chart from TradingView.com

The increase in activity was primarily driven by LayerZero, a cross-chain messaging protocol that enables lightweight and efficient communication between different networks.

However, BNB’s market cap declined by 25.2% after the US Securities and Exchange Commission (SEC) alleged that BNB is a security in its regulatory actions against Coinbase and Binance.

Despite this, the total cryptocurrency market cap increased by 2% quarter-over-quarter (QoQ), primarily driven by Bitcoin (BTC) and Ethereum (ETH).

BNB Q2 Revenue Declines

Per the report, BNB’s revenue in BNB decreased by 6.1% QoQ as average transaction fees declined 25.5% after BSC validators voted to reduce gas fees from 5 to 3 Gwei.

Nevertheless, staking on the network remained stable. BNB Chain plans to increase the number of validators from 29 to 100 with a new validator reward model (balanced mining) and a validator reputation system.

On the other hand, the Binance Smart Chain saw a decrease in total value locked (TVL) denominated in USD during Q2 2023, decreasing by 26.3%. However, TVL denominated in BNB was relatively flat at -2.8%.

While PancakeSwap remained the most prominent protocol by TVL on the BNB Chain, its dominance decreased from 45% to 37% during the quarter, indicating a shift in TVL concentration towards a more robust DeFi ecosystem.

In the stablecoin space, Binance Smart Chain has the third-highest total stablecoin market cap of approximately $5.7 billion, trailing behind Ethereum and TRON. The BUSD market lost some of its users after regulators forced Paxos to cease the issuance of BUSD, resulting in a decline of approximately 54% in the BUSD market cap on the BNB Chain during Q1.

Developer engagement also showed positive growth during Q2, with the number of unique contracts verified growing by 51.9% QoQ, and full-time developers on the BNB Chain increasing from 130 to 133 QoQ.

Despite the decline in TVL denominated in USD, the BNB Chain’s continued expansion of its DeFi ecosystem and the shift in TVL dominance towards a more diverse range of protocols signal a promising outlook for the ecosystem’s future.

Binance Smart Chain Outlines Ambitious Plans For 2023

Despite the regulatory challenges, BNB Chain has laid out robust plans for 2023, including increasing the network’s gas limit to boost throughput and reducing the data footprint through state offload.

BNB Chain also plans to further decentralize by introducing a new validator reward model and a validator reputation system to increase the number of validators from 29 to 100.

The roadmap highlights other initiatives, including increased scalability through modular architecture, creating a data storage network, and implementing consumer protections provided by blockchain security firms.

In Q2, BNB Chain validators and projects discussed the integration of miner extractable value (MEV) within the BSC network, with some validators piloting MEV in various formats. With its wide-reaching plans, BNB Chain aims to remain competitive for the rest of 2023.

While the regulatory challenges faced by Binance and Binance.US directly impact the entire crypto ecosystem, Binance and BNB Chain are separate entities. Binance, Binance Labs, and the Binance Launchpad help grow the BNB Chain ecosystem through asset listings, liquidity provision, investment, and project launches.

The outcomes of the ongoing lawsuits are unpredictable, and adverse outcomes could slow the advancement of the BNB Chain ecosystem and bring continued volatility to its native BNB token.

Featured image from Unsplash, chart from TradingView.com