- BlackRock’s iShares Bitcoin Trust ETF (IBIT) continued to receive record-breaking inflows.

- IBIT has seen substantial inflows totaling over $3.1 billion in the last 7 days.

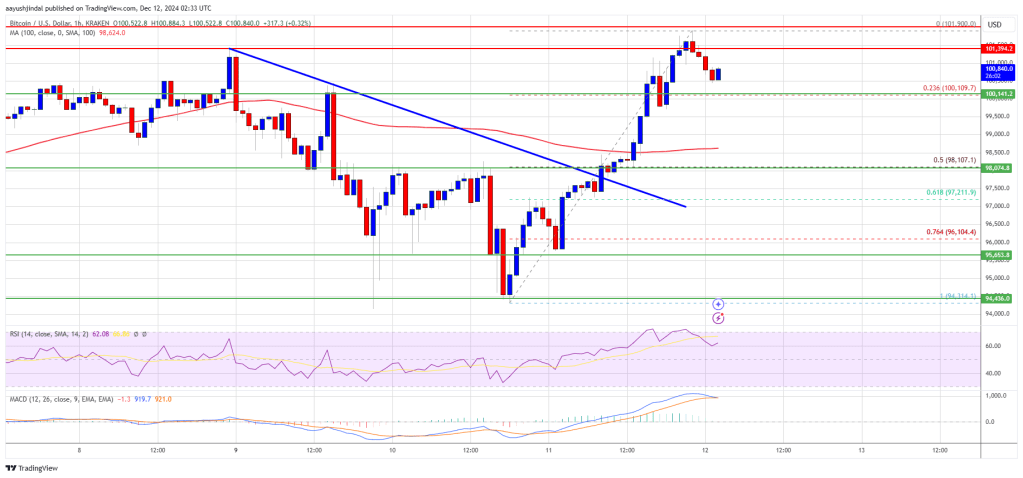

Despite the wild swings in the cryptocurrency market, the BlackRock Bitcoin ETF (IBIT) managed to attract $358 million in new investors on Monday. Even though the price of Bitcoin dropped below $94,000 yesterday, IBIT’s dominating inflows persisted. Bitcoin fell more than 5% after rejection at $100,000 levels, causing altcoins to fall as well and causing leveraged positions to be flushed out.

On Monday, December 9, according to statistics from Farside Investors, BlackRock’s iShares Bitcoin Trust ETF (IBIT) continued to receive record-breaking inflows, capturing over 4,000 Bitcoin, valued at $398 million. Institutional investors clearly have a lot of faith in IBIT, as the product’s daily trading volume jumped to $3 billion yesterday.

Substantial Inflows Recorded

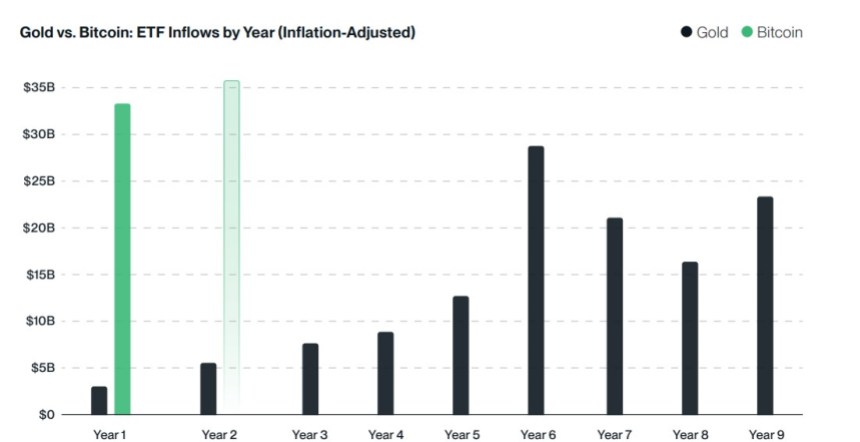

In only the previous seven trading days, the BlackRock Bitcoin ETF has seen substantial inflows totaling over $3.1 billion. Consequently, IBIT has amassed net inflows of almost $34.7 billion since its establishment.

Bets that Trump’s appreciation of the crypto sector presage a boom for the industry have prompted over $10 billion to stream into US exchange-traded funds investing directly in Bitcoin since he became president-elect.

Based on statistics collated by Bloomberg, the group’s total assets have increased to almost $113 billion from the $9.9 billion that the twelve funds from issuers received in the time after Election Day on November 5.

Trump has backed the concept of a national Bitcoin reserve and promised to replace the skeptical policies imposed by the Biden administration with regulations that are favorable of digital assets. After first being skeptical of the cryptocurrency sector, the Republican changed his mind after the sector spent heavily on electoral campaigns to further its interests.

Highlighted Crypto News Today:

Crypto Trader Turned $3K into $73M, Trading PEPE tokens