- Bitwise has filed with the SEC for an ETF based on its 10 Crypto Index Fund, including Bitcoin and Ethereum.

- The SEC has acknowledged the filing but has not set a deadline for approval or rejection of the ETF.

Digital asset manager Bitwise has officially filed an application with the U.S. Securities and Exchange Commission (SEC) for an exchange-traded fund (ETF) based on its existing 10 Crypto Index Fund. The filing, submitted on Nov. 27, seeks approval for a new ETF created to provide investors with indirect exposure to a mix of ten cryptocurrencies, with the custodian handling the fund’s assets.

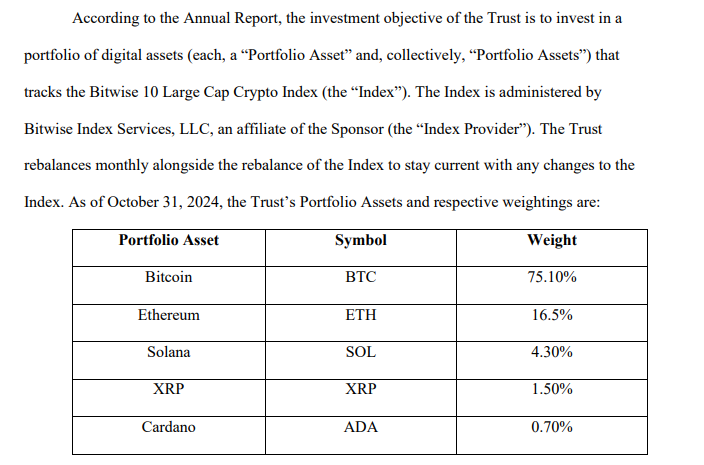

The Bitwise 10 Crypto Index Fund, launched in November 2017, currently has $1.4 billion in assets under management (AUM). However, the proposed Bitwise 10 Crypto Index Fund ETF will primarily consist of 75.14% Bitcoin, followed by Ethereum (ETH) at 16.42% of the portfolio. Other cryptocurrencies in the fund include Solana (SOL), Ripple (XRP), Avalanche (AVAX), Cardano (ADA), and Uniswap (UNI), among others.

(Source: SEC)

Bitwise’s Strategic Moves and SEC Decision Timeline

To ensure the security of its crypto assets, Bitwise has partnered with Coinbase Custody for custodial services, while BNY Mellon charges cash management and administrative duties. The daily valuations are provided by CF Benchmarks.

However, the SEC has not yet set a deadline for a decision. Further, Bitwise entered the Solana ETF race, joining VanEck and 21Shares in submitting regulatory filings for similar products earlier this week. Also, on Nov 27 Bitwise rebranded its European XRP ETF, initially launched in 2022, as the Bitwise Physical XRP ETP.

The expectation for crypto approval has risen following the announcement of SEC Chair Gary Gensler’s departure. Additionally, the impact of his resignation on crypto ETF approval could be enhanced by the crypto-friendly regulatory policies anticipated under Trump’s leadership.