- The exchange plans to provide cryptocurrency derivatives trading in Europe by 2024.

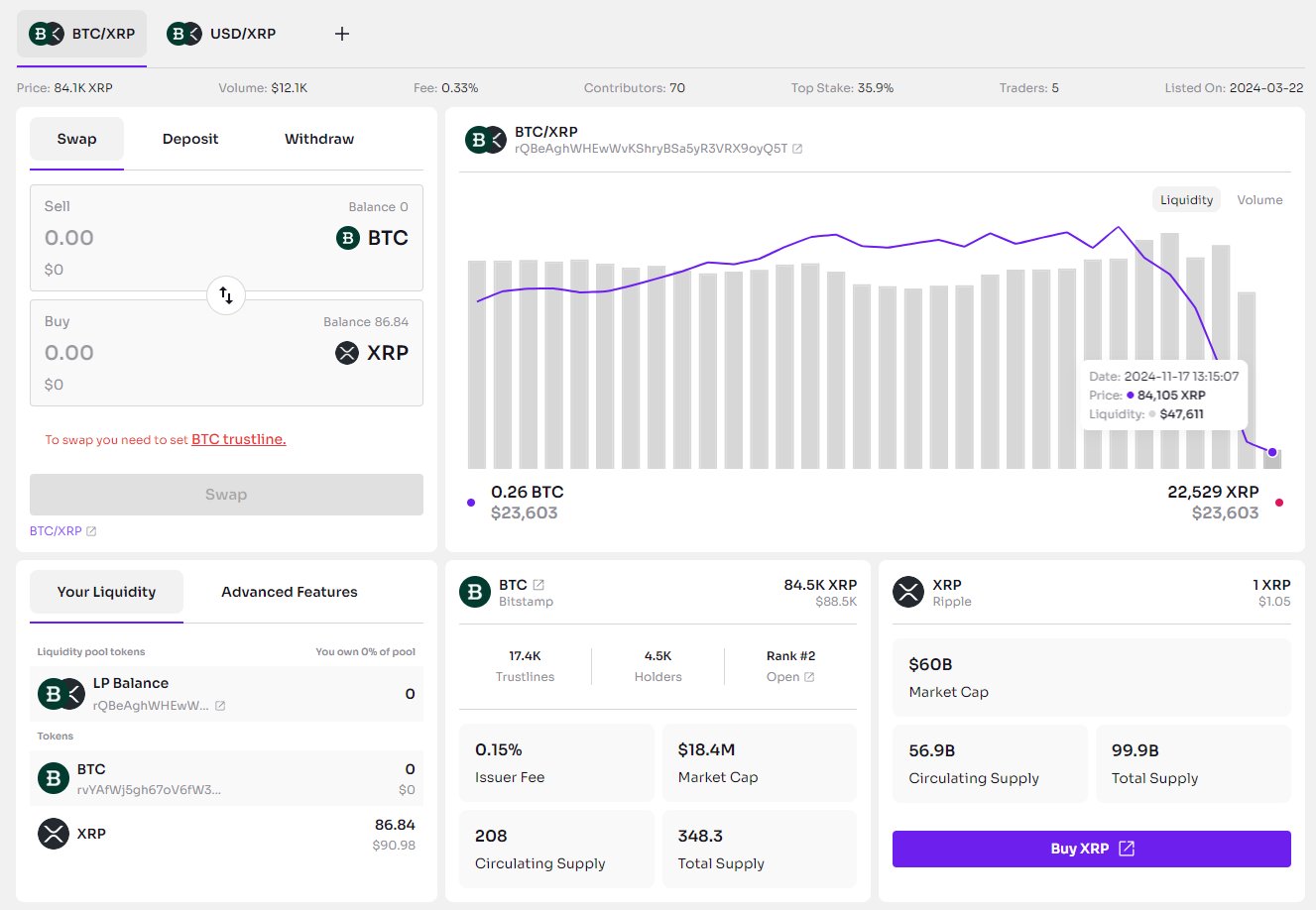

- Bitstamp is now the 7th biggest cryptocurrency exchange in the world.

Bitstamp, a cryptocurrency exchange, is in negotiations to acquire additional capital as the industry faces increasing regulatory scrutiny across the globe. The exchange’s global CEO, Jean-Baptiste Graftieaux, has said that the company began raising capital in late June, advised by Galaxy Digital Holdings and Mike Novogratz.

The money will be used by the exchange to increase its presence in both the European and Asian markets. Bitstamp is expanding to new Asian regions and plans to provide cryptocurrency derivatives trading in Europe by 2024.

In addition, it hopes to expand its presence in the United Kingdom. The Financial Conduct Authority (FCA) in the United Kingdom granted authorization to the crypto exchange Bitstamp earlier in June.

Graftieaux stated:

“Bitstamp is not for sale, and we are not actively looking to sell the company. Our current and exclusive priority is to raise money through strategic investors to accelerate Bitstamp’s growth by providing new products and services to retail and institutional crypto customers.”

Strategic Expansion

Bitstamp, a cryptocurrency exchange based in Luxembourg, commenced in 2011. According to statistics compiled by CMC, it is now the 7th biggest cryptocurrency exchange in the world, with a 24-hour trading volume of roughly $126 million. Bitstamp was purchased in 2018 by the European investment group NXHM.

Bitstamp’s American branch, Bitstamp USA, may legally do business in New York because of a significant license called BitLicense. This license has been crucial to its performance in the United States, where it has expanded its market share this year amid the decrease in market share of rival exchanges like Binance US. Amid rising regulatory scrutiny, crypto firms are actively looking to expand in Europe and other regions which offer a clear stance.

Highlighted Crypto News Today:

Brazil’s Central Bank Unveils CBDC ‘DREX’: Know More