According to Bitfinex, Bitcoin (BTC) volatility is set to intensify over the next week. A “potent mix” of geopolitical and macroeconomic factors has significantly influenced the flagship crypto’s performance, with anticipation for the outcome of the US election and Q4’s close setting a potential target of $80,000 by year-end.

Crypto exchange Bitfinex’s recent report shared that Bitcoin’s price could hit $80,000 by the end of the year due to a convergence of geopolitical uncertainty, macroeconomic factors, seasonality, and the increasing influence of the “Trump Trade.”

The report noted that, historically, global macroeconomic trends and geopolitics events influenced BTC’s price. As a result, the largest cryptocurrency by market capitalization has seen its price movements driven by the anticipated US Presidential elections.

The potential outcome of the elections, scheduled for next week, has affected Bitcoin’s performance throughout the year. Both presidential candidates have acknowledged the crypto industry, with the Republican candidate Donald Trump becoming the sector’s champion after fully embracing Bitcoin and crypto.

Trump’s pro-crypto stance increased the correlation between the Republican candidate’s winning odds and Bitcoin’s trajectory. Moreover, the “Trump Trade” narrative reflects “the market’s view of how BTC will fare dependent on the outcome of the election.”

Per the report, this narrative has fueled Bitcoin volatility, with the flagship crypto seeing sharp intra-week corrections before rebounding. Last week, BTC saw a 6.2% pullback toward the $65,000 support zone before reclaiming the $68,000 mark again.

Bitfinex analysts consider that this pullback might be the first of several “whipsaw price movements” ahead of the elections, affecting BTC’s short-term price as speculation and volatility increase.

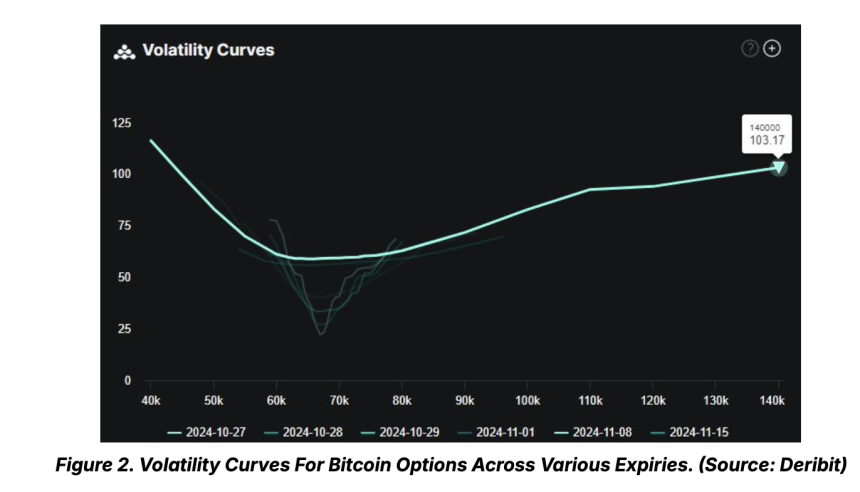

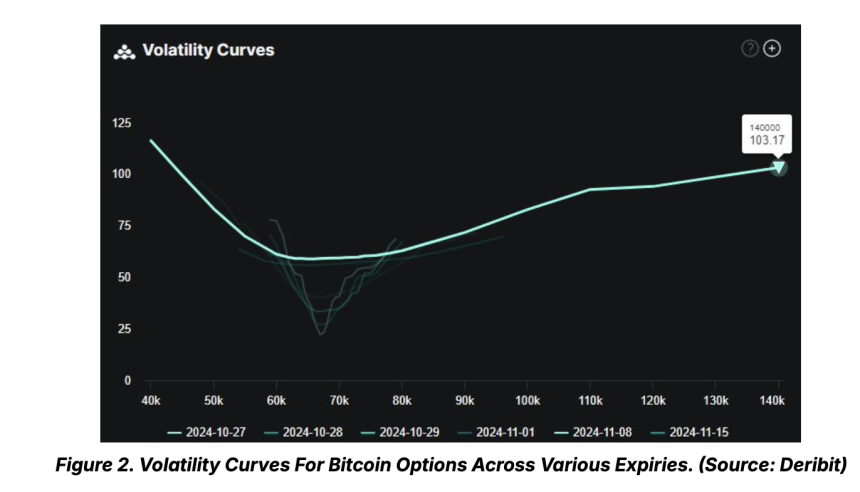

Additionally, option premiums and estimated daily volatility for the US stock market and Bitcoin are projected to rise significantly next week. The report noted that BTC volatility will peak between November 6 and November 8, when the Election results are expected to be delivered.

Reportedly, the highest implied volatility (IV) is for the November 8 strike price “reaching up to over 100 vol for strike prices over $100,000 for BTC.”

The report noted that Bitcoin has shown strength despite the increasing volatility. The flagship crypto “has remained resilient” and held its ground compared to the September lows, surging around 30% from last month’s drop.

Additionally, BTC closed September, which has historically been a challenging month for the cryptocurrency, with a 7.29% increase, the highest closing for the month on record. The crypto exchange’s report predicted that October’s close could be “less impressive” due to the volatility.

Nonetheless, Bitfinex analysts suggested that Q4’s historically bullish seasonality will still favor a positive rally for BTC. Market positioning shows that end-of-year options have seen a considerable rise in call open interest over the last few weeks.

BTC is expected to continue experiencing higher-than-average volatility and potentially see deep corrections in the coming days. But the market seems poised for a post-election surge above March’s $73,666 all-time high (ATH).

Lastly, call options with a December 27 expiry and an $80,000 strike price have seen a steady build-up, suggesting that this target could be in reach by year-end. As of this writing, BTC is trading at $71,197, a $3.4% increase in the daily timeframe.

Bitcoin Volatility About To Reach Its Peak

Crypto exchange Bitfinex’s recent report shared that Bitcoin’s price could hit $80,000 by the end of the year due to a convergence of geopolitical uncertainty, macroeconomic factors, seasonality, and the increasing influence of the “Trump Trade.”

The report noted that, historically, global macroeconomic trends and geopolitics events influenced BTC’s price. As a result, the largest cryptocurrency by market capitalization has seen its price movements driven by the anticipated US Presidential elections.

The potential outcome of the elections, scheduled for next week, has affected Bitcoin’s performance throughout the year. Both presidential candidates have acknowledged the crypto industry, with the Republican candidate Donald Trump becoming the sector’s champion after fully embracing Bitcoin and crypto.

Trump’s pro-crypto stance increased the correlation between the Republican candidate’s winning odds and Bitcoin’s trajectory. Moreover, the “Trump Trade” narrative reflects “the market’s view of how BTC will fare dependent on the outcome of the election.”

Per the report, this narrative has fueled Bitcoin volatility, with the flagship crypto seeing sharp intra-week corrections before rebounding. Last week, BTC saw a 6.2% pullback toward the $65,000 support zone before reclaiming the $68,000 mark again.

Bitfinex analysts consider that this pullback might be the first of several “whipsaw price movements” ahead of the elections, affecting BTC’s short-term price as speculation and volatility increase.

Additionally, option premiums and estimated daily volatility for the US stock market and Bitcoin are projected to rise significantly next week. The report noted that BTC volatility will peak between November 6 and November 8, when the Election results are expected to be delivered.

Reportedly, the highest implied volatility (IV) is for the November 8 strike price “reaching up to over 100 vol for strike prices over $100,000 for BTC.”

BTC Poised To Hit $80,000 In Late December

The report noted that Bitcoin has shown strength despite the increasing volatility. The flagship crypto “has remained resilient” and held its ground compared to the September lows, surging around 30% from last month’s drop.

Additionally, BTC closed September, which has historically been a challenging month for the cryptocurrency, with a 7.29% increase, the highest closing for the month on record. The crypto exchange’s report predicted that October’s close could be “less impressive” due to the volatility.

Nonetheless, Bitfinex analysts suggested that Q4’s historically bullish seasonality will still favor a positive rally for BTC. Market positioning shows that end-of-year options have seen a considerable rise in call open interest over the last few weeks.

BTC is expected to continue experiencing higher-than-average volatility and potentially see deep corrections in the coming days. But the market seems poised for a post-election surge above March’s $73,666 all-time high (ATH).

Lastly, call options with a December 27 expiry and an $80,000 strike price have seen a steady build-up, suggesting that this target could be in reach by year-end. As of this writing, BTC is trading at $71,197, a $3.4% increase in the daily timeframe.