After hitting the $100,000 milestone, Bitcoin suffered a sudden price crash on Friday resulting in an estimated price loss of 7%. During this decline, the asset’s perpetual funding rates in the derivative markets took a hit. However, traders may yet retain enough leverage to strongly influence price volatility.

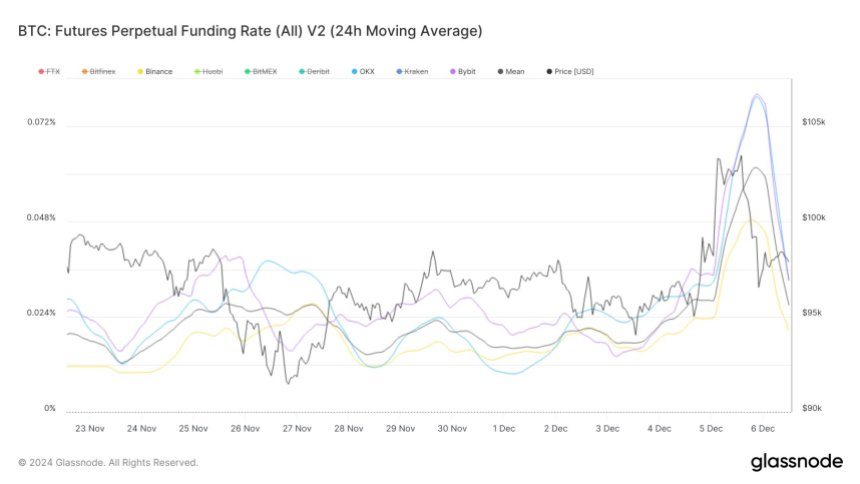

In an X post on December 6, blockchain analytics firm Glassnode expressed that Bitcoin’s perpetual funding rate may hold significant implications for the asset’s short-term price.

For context, perpetual funding rates are periodic payments made between traders in the perpetual futures market to ensure the contract price aligns with the spot price of Bitcoin. Positive funding rates indicate that long positions are paying shorts, which is bullish while negative funding rates represent the vice versa.

According to Glassnode, BTC’s perpetual funding rates initially showed signs of stabilization on its weekly frame amidst speculative demand. However, the asset’s surge to $100,000 on Thursday driven by increased market leverage saw these funding rates rise by 3.6x their weekly average.

Notably, Bitcoin’s perpetual funding rate hit a peak of 0.062, representing its highest value since April. Importantly, the analytics team at Glassnode notes that this rate spike suggests significant influence by the derivative market on Bitcoin’s ascent above $100,000.

However, Bitcoin’s flash price resulted in a major decline in its funding rates slightly above 0.024. Despite this fall, Glassnode states these rates are still relatively high compared to earlier this week, indicating the Bitcoin market still contains a significant level of leveraged positions.

This residual leverage in the market indicates a strong potential for increased price volatility. Therefore, Bitcoin’s price movement in the coming days appears unclear as a reversal on either side could trigger a significant level of liquidation, inducing a cascading effect.

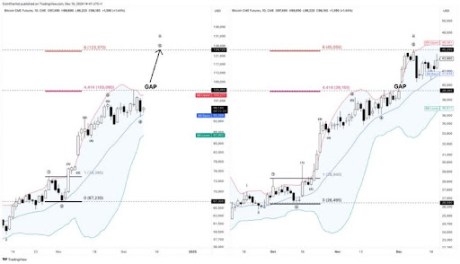

In other news, renowned analyst Ali Martinez has posted a Bitcoin price prediction based on the asset’s short-term holder (STH) cost basis i.e. the average price at which those who typically acquired BTC over the last 155 days. It indicates a break-even level for these investors.

According to Martinez, the STH behavior indicates that Bitcoin would reach a local top or $112,926 price based on a +1 standard deviation that adjusts the level of STH cost basis upward to account for price volatility and behavioral trends.

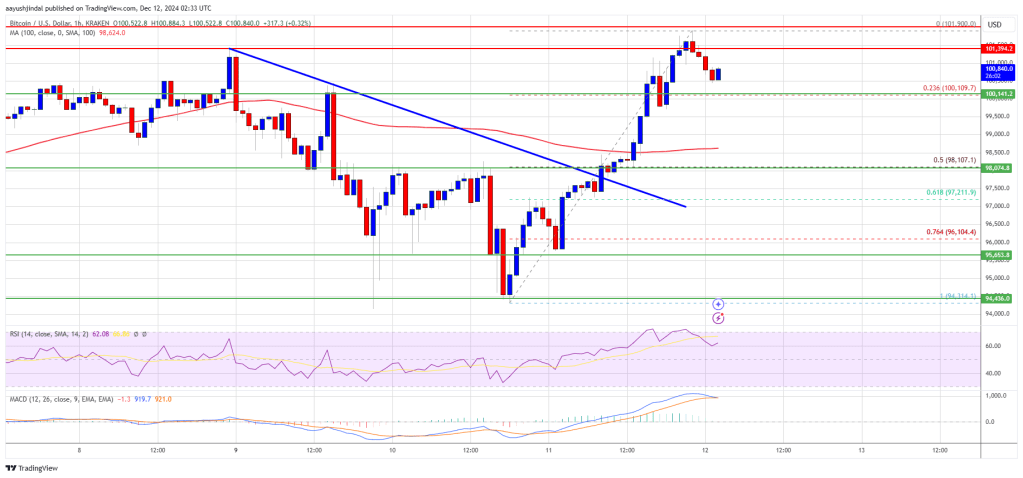

At press time, Bitcoin trades at $100,137 after its recovery from Friday’s crash faced a rejection at $102,000. Meanwhile, the asset’s trading volume is down by 42.46% and valued at $89.12 billion.

Bitcoin Short-Term Outlook Uncertain Due To Heightened Leverage

In an X post on December 6, blockchain analytics firm Glassnode expressed that Bitcoin’s perpetual funding rate may hold significant implications for the asset’s short-term price.

For context, perpetual funding rates are periodic payments made between traders in the perpetual futures market to ensure the contract price aligns with the spot price of Bitcoin. Positive funding rates indicate that long positions are paying shorts, which is bullish while negative funding rates represent the vice versa.

According to Glassnode, BTC’s perpetual funding rates initially showed signs of stabilization on its weekly frame amidst speculative demand. However, the asset’s surge to $100,000 on Thursday driven by increased market leverage saw these funding rates rise by 3.6x their weekly average.

Notably, Bitcoin’s perpetual funding rate hit a peak of 0.062, representing its highest value since April. Importantly, the analytics team at Glassnode notes that this rate spike suggests significant influence by the derivative market on Bitcoin’s ascent above $100,000.

However, Bitcoin’s flash price resulted in a major decline in its funding rates slightly above 0.024. Despite this fall, Glassnode states these rates are still relatively high compared to earlier this week, indicating the Bitcoin market still contains a significant level of leveraged positions.

This residual leverage in the market indicates a strong potential for increased price volatility. Therefore, Bitcoin’s price movement in the coming days appears unclear as a reversal on either side could trigger a significant level of liquidation, inducing a cascading effect.

STH Cost Basis Points To $112,000 Price Target

In other news, renowned analyst Ali Martinez has posted a Bitcoin price prediction based on the asset’s short-term holder (STH) cost basis i.e. the average price at which those who typically acquired BTC over the last 155 days. It indicates a break-even level for these investors.

According to Martinez, the STH behavior indicates that Bitcoin would reach a local top or $112,926 price based on a +1 standard deviation that adjusts the level of STH cost basis upward to account for price volatility and behavioral trends.

At press time, Bitcoin trades at $100,137 after its recovery from Friday’s crash faced a rejection at $102,000. Meanwhile, the asset’s trading volume is down by 42.46% and valued at $89.12 billion.