Bitcoin had surged above $30,000 earlier during the past day but has since observed a retrace as profit-taking from traders has spiked.

Bitcoin showed some promising signs of breaking away from its stagnation earlier during the past 24-hour period, as the cryptocurrency’s price managed to make a sharp recovery towards the $30,000 mark. This surge, however, couldn’t last for too long, as the cryptocurrency has already slipped to the $29,700 level.

So far, Bitcoin has been able to retain a lot of the recovery despite this pullback, as the asset’s price is still significantly above the $29,000 level it had been consolidating at prior to this move.

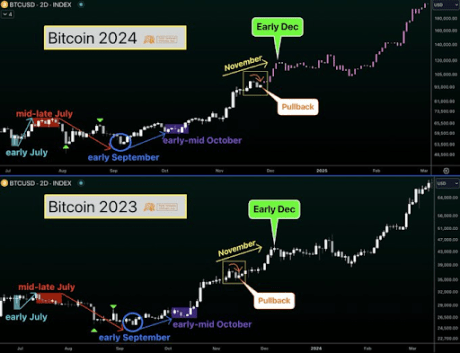

From the above chart, it’s visible that the current recovery surge looks quite similar to the one seen around the start of the month. This rally also died off at the $30,000 level and the price slid off, until it eventually ended up slumping back to sideways movement around the $29,000 mark.

It would appear that the $30,000 level was acting as a major source of resistance for the cryptocurrency back then, and it seems that its role hasn’t changed this time either.

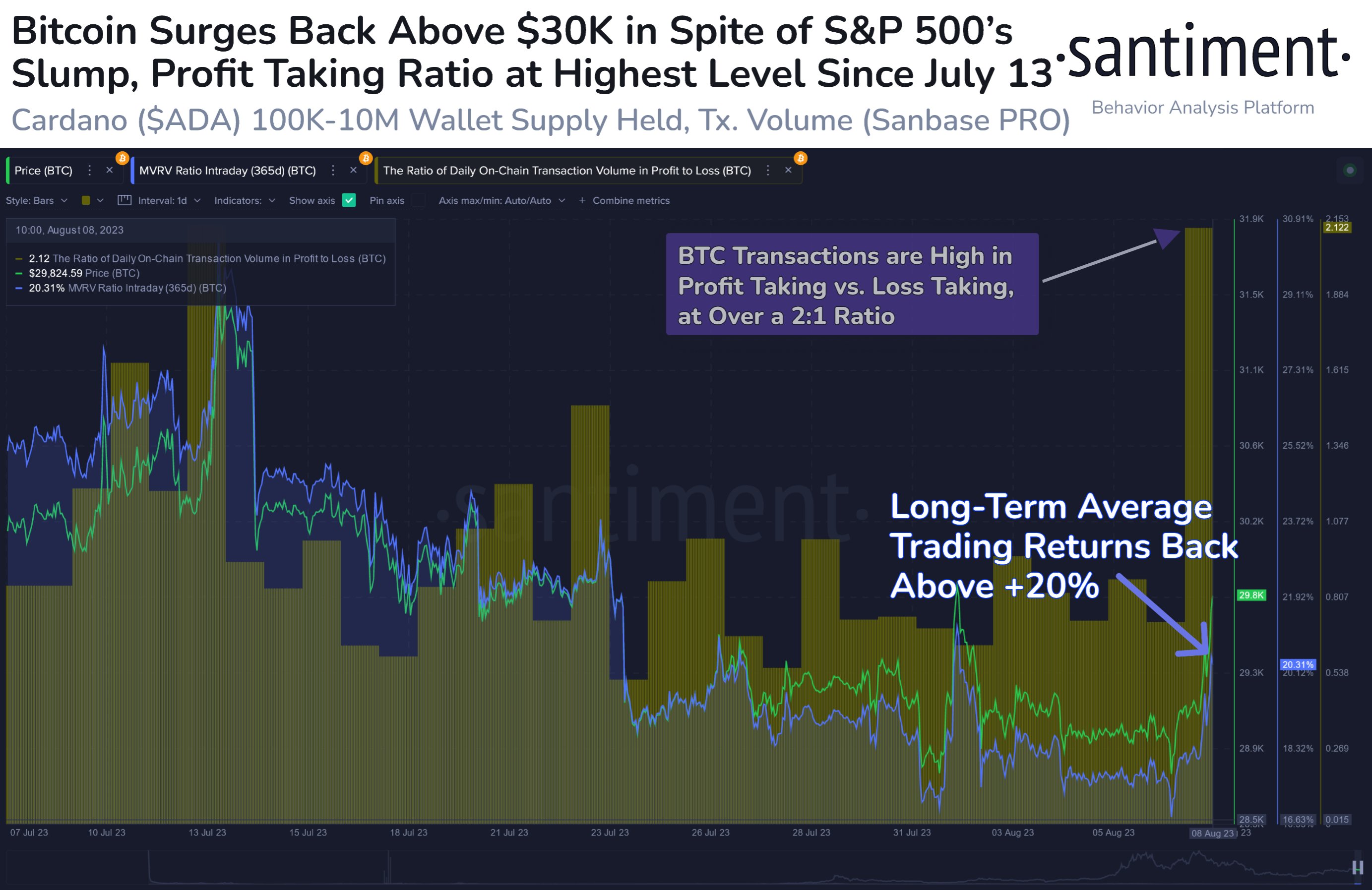

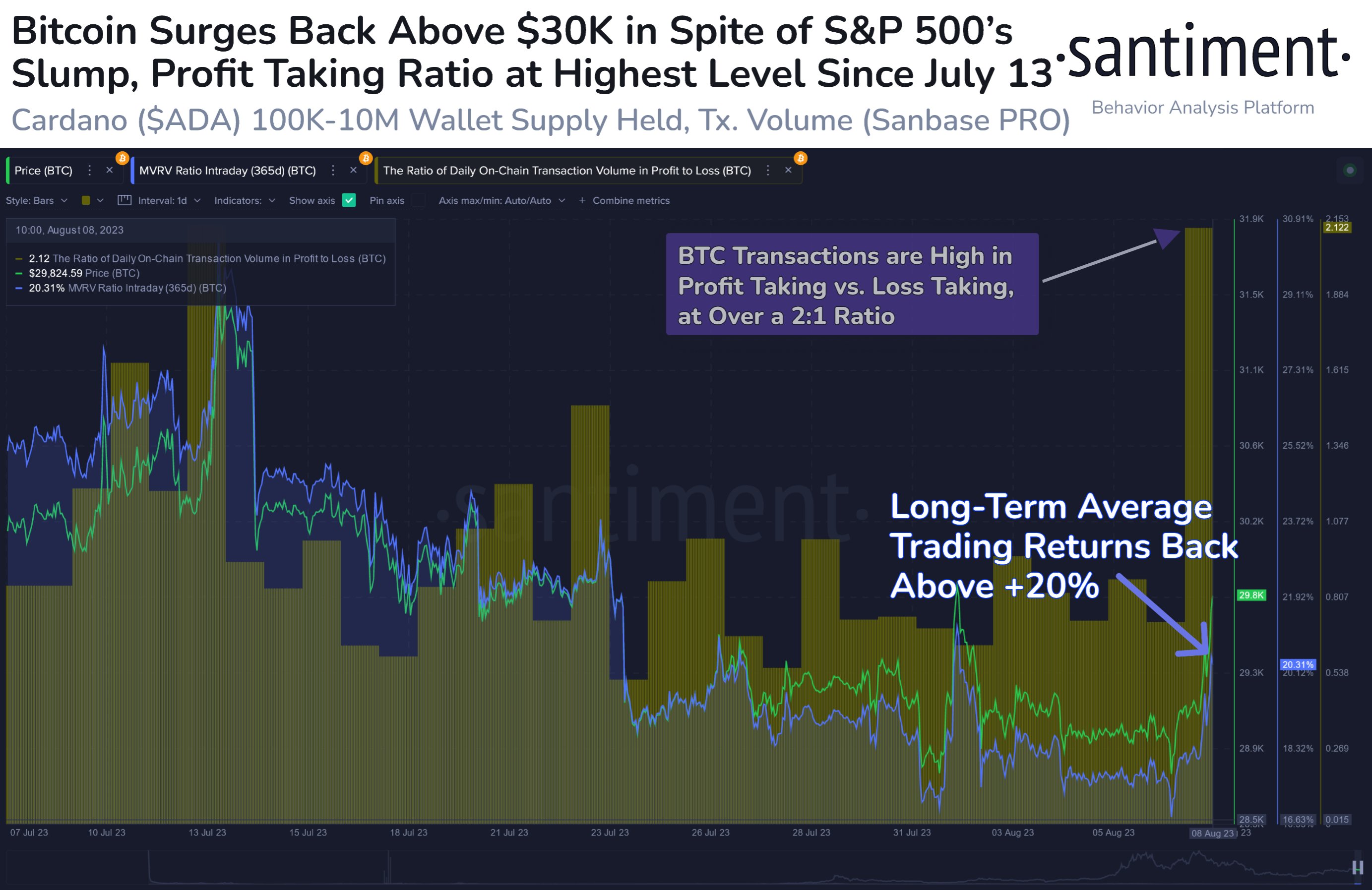

There is one thing different this time, however, and that is the level of profit-taking that the investors are displaying. According to data from the on-chain analytics firm Santiment, the profit-taking in the market has observed a sharp increase as this rally has occurred.

In the above graph, the data for the “ratio of daily on-chain transaction volume in profit to loss” metric is shown, which keeps track of how the profit-taking volume in the Bitcoin market compares with the loss-taking volume right now.

Clearly, this indicator has surged to some pretty high levels, meaning that the profit realization is far outweighing the loss realization at the moment. It’s not uncommon for this behavior to be seen during rallies, as some investors would want to quickly jump on the profitable opportunity while it’s still there.

This scale of the profit-taking, however, may be worrying. At the current level of the indicator, the profit-taking volume is more than double the loss-taking volume.

As can be seen from the graph, the metric had instead remained relatively muted when the aforementioned recovery rally of a similar scale had taken place earlier in the month.

This difference in behavior between the two Bitcoin price surges may be a reflection of how the investors have perceived each move. Earlier, they may have been more hopeful for further price rise, so they may not have been too keen on harvesting their profits just yet.

This time, however, the holders may be thinking that this rise will die out like the previous one as well, so they are using the opportunity to quickly exit from the market.

Bitcoin Profit-Taking Volume Is Currently More Than Twice The Loss-Taking One

Bitcoin showed some promising signs of breaking away from its stagnation earlier during the past 24-hour period, as the cryptocurrency’s price managed to make a sharp recovery towards the $30,000 mark. This surge, however, couldn’t last for too long, as the cryptocurrency has already slipped to the $29,700 level.

So far, Bitcoin has been able to retain a lot of the recovery despite this pullback, as the asset’s price is still significantly above the $29,000 level it had been consolidating at prior to this move.

From the above chart, it’s visible that the current recovery surge looks quite similar to the one seen around the start of the month. This rally also died off at the $30,000 level and the price slid off, until it eventually ended up slumping back to sideways movement around the $29,000 mark.

It would appear that the $30,000 level was acting as a major source of resistance for the cryptocurrency back then, and it seems that its role hasn’t changed this time either.

There is one thing different this time, however, and that is the level of profit-taking that the investors are displaying. According to data from the on-chain analytics firm Santiment, the profit-taking in the market has observed a sharp increase as this rally has occurred.

In the above graph, the data for the “ratio of daily on-chain transaction volume in profit to loss” metric is shown, which keeps track of how the profit-taking volume in the Bitcoin market compares with the loss-taking volume right now.

Clearly, this indicator has surged to some pretty high levels, meaning that the profit realization is far outweighing the loss realization at the moment. It’s not uncommon for this behavior to be seen during rallies, as some investors would want to quickly jump on the profitable opportunity while it’s still there.

This scale of the profit-taking, however, may be worrying. At the current level of the indicator, the profit-taking volume is more than double the loss-taking volume.

As can be seen from the graph, the metric had instead remained relatively muted when the aforementioned recovery rally of a similar scale had taken place earlier in the month.

This difference in behavior between the two Bitcoin price surges may be a reflection of how the investors have perceived each move. Earlier, they may have been more hopeful for further price rise, so they may not have been too keen on harvesting their profits just yet.

This time, however, the holders may be thinking that this rise will die out like the previous one as well, so they are using the opportunity to quickly exit from the market.