Here’s what the legendary Bitcoin Market Value to Realized Value (MRVRV) Ratio says about whether Bitcoin is currently overheated or not.

In a CryptoQuant Quicktake post, an analyst has discussed about the MVRV Ratio of Bitcoin. The “MVRV Ratio” is an on-chain metric that keeps track of the ratio between the Bitcoin market cap and realized cap. The market cap here is just the total valuation of BTC’s circulating supply at the current spot price. The other metric, the realized cap, is also a capitalization model for the asset, but it doesn’t work so simply.

Unlike the market cap, this model doesn’t put the same price on every coin in circulation; rather, it assumes that the last price at which a token was transacted represents its ‘true’ value.

The previous transaction of any coin is likely to represent the last point it switched hands, so the realized cap essentially takes the sum of the cost basis of all tokens in circulation.

One way to look at this model is as a measure of the amount of capital that the investors as a whole have put into the cryptocurrency. The market cap, in contrast, signifies the value that these holders are carrying in the present.

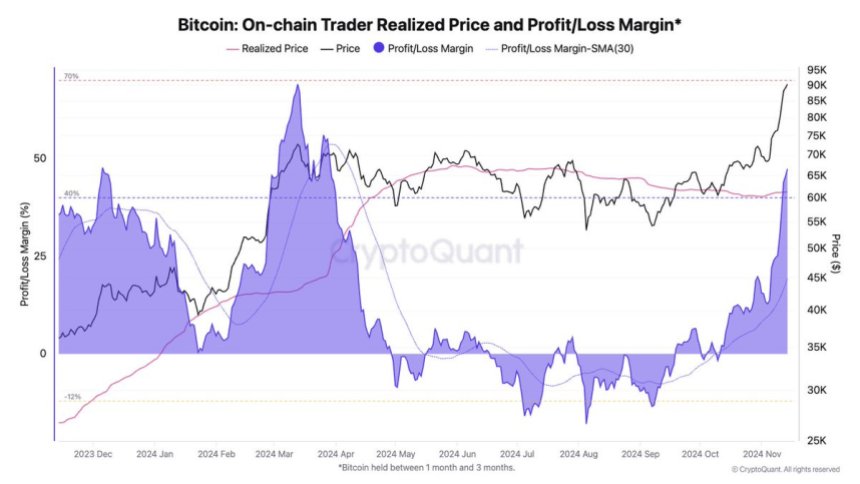

When the MVRV Ratio is greater than 1, it means that the market cap is above the realized cap right now. Such a trend suggests the investors as a whole are in a state of net profit.

On the other hand, the indicator being below this mark implies the average holder is currently underwater as they are holding their coins at a value below the price they bought them for.

As displayed in the above graph, the Bitcoin MVRV Ratio had surged to significant levels back when BTC had broken the November 2021 all-time high (ATH) in the first quarter of the year. An increase in the metric has also followed in the new ATH break, but the metric is clearly not near the same high as earlier in the year yet.

Historically, the cryptocurrency has made tops whenever the indicator has risen to high levels. As the quant has marked in the chart, however, how high is a ‘high’ MVRV level has been declining over the last few cycles.

If the trendline drawn by the analyst holds, then the current cycle should see a top around when the MVRV Ratio would hit a value of around 3. At present, the metric is at 2, so there may still be a while to go before Bitcoin becomes overheated.

As for why the asset tends to get overheated when the MVRV Ratio shoots up, the reason is that investors become increasingly likely to take part in profit-taking the larger their gains get.

At the time of writing, Bitcoin is trading around $74,100, up almost 8% over the last 24 hours.

Bitcoin MVRV Ratio Has Risen Alongside The Latest Rally

In a CryptoQuant Quicktake post, an analyst has discussed about the MVRV Ratio of Bitcoin. The “MVRV Ratio” is an on-chain metric that keeps track of the ratio between the Bitcoin market cap and realized cap. The market cap here is just the total valuation of BTC’s circulating supply at the current spot price. The other metric, the realized cap, is also a capitalization model for the asset, but it doesn’t work so simply.

Unlike the market cap, this model doesn’t put the same price on every coin in circulation; rather, it assumes that the last price at which a token was transacted represents its ‘true’ value.

The previous transaction of any coin is likely to represent the last point it switched hands, so the realized cap essentially takes the sum of the cost basis of all tokens in circulation.

One way to look at this model is as a measure of the amount of capital that the investors as a whole have put into the cryptocurrency. The market cap, in contrast, signifies the value that these holders are carrying in the present.

When the MVRV Ratio is greater than 1, it means that the market cap is above the realized cap right now. Such a trend suggests the investors as a whole are in a state of net profit.

On the other hand, the indicator being below this mark implies the average holder is currently underwater as they are holding their coins at a value below the price they bought them for.

As displayed in the above graph, the Bitcoin MVRV Ratio had surged to significant levels back when BTC had broken the November 2021 all-time high (ATH) in the first quarter of the year. An increase in the metric has also followed in the new ATH break, but the metric is clearly not near the same high as earlier in the year yet.

Historically, the cryptocurrency has made tops whenever the indicator has risen to high levels. As the quant has marked in the chart, however, how high is a ‘high’ MVRV level has been declining over the last few cycles.

If the trendline drawn by the analyst holds, then the current cycle should see a top around when the MVRV Ratio would hit a value of around 3. At present, the metric is at 2, so there may still be a while to go before Bitcoin becomes overheated.

As for why the asset tends to get overheated when the MVRV Ratio shoots up, the reason is that investors become increasingly likely to take part in profit-taking the larger their gains get.

BTC Price

At the time of writing, Bitcoin is trading around $74,100, up almost 8% over the last 24 hours.